Conservative investing and the fear of money running out

When examining account-based pensions, the traditional approach at retirement has been to transition investments from balanced or more aggressive assets into defensive assets such as cash and fixed income. Super fund members approaching retirement tend to focus on income generating, lower risk assets avoiding investments that are likely to fluctuate too adversely.

The lack of capital growth of these options over the long term further restricts the amount retirees take out to enjoy retirement. This is exacerbated by uncertainty of how long they’ll need income, which results in reduced spending in retirement and living more frugally than is necessary[1].

To address the uncertainty and in response to the regulatory changes in recent years (including the introduction of the Retirement Income Covenant), there has been a recent emergence of investment linked lifetime annuities in the Australian market.

Investment linked lifetime annuities provide a longevity guarantee that payments will be made for life. The investment linked component of these offerings enable members to actively choose how much investment risk they take on, which impacts the level of annuity payments they receive (that is, higher potential for more cumulative income over the long term, in exchange of income volatility).

Encouragingly, members can also switch between investment options if their attitude to risk changes or market conditions change. This contrasts against traditional lifetime annuities where once money is invested, the investment outcome cannot be changed even if members’ risk appetite or market conditions change.

Product layering in super

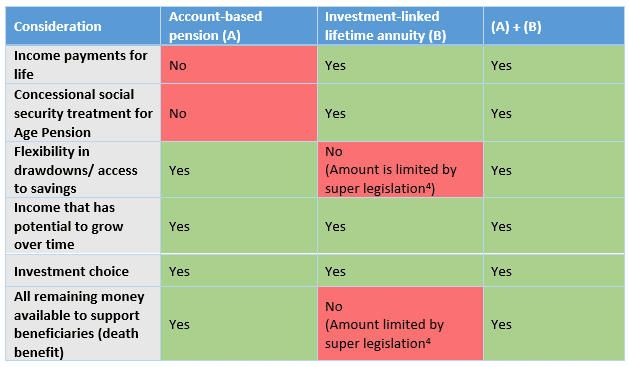

Product layering strategies can address the shortfalls of account-based pensions and offer a holistic retirement portfolio. This is where proportions of retirement savings are allocated between account-based pensions and annuities. Combining products recognises the desire of members to have the financial security of knowing they will have a guaranteed income stream, while having personal choice and flexibility.[2]

Concessional social security treatment of these types of annuities[3] also mean Age Pension entitlements can increase as a third income stream for retired members, where relevant eligibility requirements are met.

Investment choice when layering products

There are a range of investment strategies that a trustee can make available to their members, consistent with their retirement income strategy. We look at two strategies as an indication of how layering can impact financial outcomes over the long term.

- A “default” pathway:

Under a “default” pathway, the trustee either defaults members into an investment strategy across both products at a certain age when no investment choice is made, or provides nudges in terms of a recommended investment option.

To reduce complexity and adopt a strategy that has a measure of long-term capital growth, default investment options made available under both products can be identical. They could have the same level of low investment risk but nevertheless offering some exposure to growth assets to achieve a measure of capital growth.

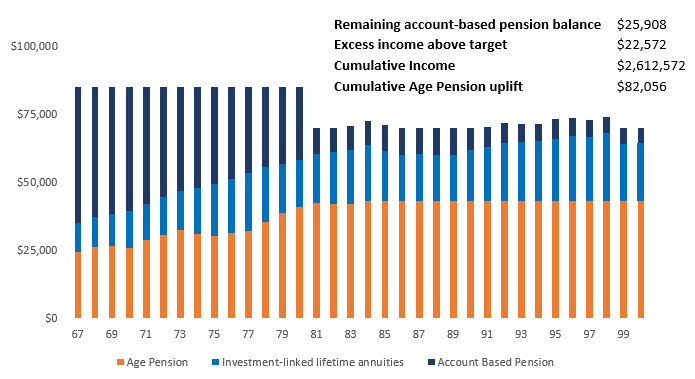

The graph below sets out an example of long-term outcomes where a consistent approach is used across both products. In this example, we examine potential outcomes for a couple aged 67 with a combined super balance of $600,000 who are nudged into a joint level of income of $80,000 in the early retirement years (dropping to $70,000 in the later years).

Graph 1. Product layering – Account Based Pension (Balanced) and Immediate Lifetime Annuity (Balanced)

Through investing both products into a default investment option, the members gain from the benefits of keeping their super assets invested throughout retirement while also preserving the balance of their account-based pension to leave a legacy to the next generation.

- A “choice” pathway:

The alternate “choice” pathway instead puts control in the hands of the member.

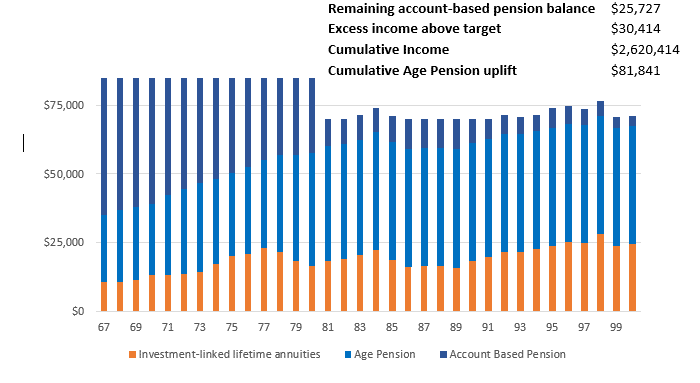

Under the “choice” pathway, investment allocations across the account-based pension component and investment-linked annuity component can vary recognising the differing utility of the product offerings.

For a retiree couple adopting a product layering strategy, the account-based pension ensures access to capital. Therefore, a member can select a balanced portfolio with greater downside protection.

For their investment-linked lifetime annuity, as there is greater emphasis on an income stream and less on access to capital, the member selects a growth portfolio as indicated in the graph below.

Graph 2. Product layering – Account Based Pension (Balanced) and Immediate Lifetime Annuity (Growth)

Once a member’s lifetime income stream reaches above a target income level, they can also switch out of the growth portfolio into a conservative one which will deliver a more stable income stream with a lower income growth profile.

Though the strategy and engagement methodology are different, both pathways highlight ways in which members may be able to achieve their desired retirement outcomes, enabling members to have greater control over their retirement income over time.

Disclaimers for Graphs 1 & 2:

Illustrating a 67-year-old couple purchasing investment linked lifetime annuity, allocating 35% of their $600,000 combined superannuation balance and selecting a 2.5% accelerated payment option. Administration fee of 0.92% p.a.

The remaining superannuation balance is rolled over into an account-based-pension. Administration fee of 0.30% p.a. Balance drawn out of account-based pension is to meet target income. Minimum drawdowns apply.

In terms of investment strategy:

- For Graph 1: Both products are invested into the same balanced portfolio which consists of 30% MSCI World Ex Australia, 20% S&P/ASX All Ordinaries, 35% Bloomberg Global Aggregate, 15% Bloomberg Ausbond Composite. Commencing 1st July 1990. Assumed Franking Credit Refund 0.29%.

- For Graph 2: the investment linked lifetime annuity is Invested into a growth portfolio which consists of 42% MSCI World Ex Australia, 28% S&P/ASX All Ordinaries, 21% Bloomberg Global Aggregate, 9% Bloomberg Ausbond Composite. Account-based pension is invested into a balanced portfolio which consists of 30% MSCI World Ex Australia, 20% S&P/ASX All Ordinaries, 35% Bloomberg Global Aggregate, 15% Bloomberg Ausbond Composite. Assumed Franking Credit Refund 0.29%. Commencing 1st July 1990.

Age Pension rates and thresholds effective 20/09/2023. Income projection CPI adjusted.

[1] Retirement Income Review, Final Report, published July 2020 pg. 19 and pg. 56

[2] Professor Michael Hiscox, Dr Elizabeth Hobman, Mr Michael Daffey, Dr Andrew Reeson, Supporting retirees in retirement income planning, Behavoural Economics Team of the Australian Government (October 2017)

[3] Those annuities that meet the definition of “asset-tested income stream (lifetime)” – sections 1099DAB and 1120AB Social Security Act 1991 (Cth)

[4] Regulation 1.06B of the Superannuation Industry (Supervision) Regulations 1994 (Cth) sets out the maximum commutation value of “Innovative income streams” offered under the Regulation 1.06A pathway.