Looking forward to 2050

The imperative of moving to a net zero world means the economy of 2050 will look very different to the economy of today. It will result in the emergence of new sectors, significant modifications to existing infrastructure, new forms of energy and innovative transport solutions. We can expect the carbon intensive industries of the past to be replaced by cleaner, greener ways of producing and consuming goods and services.

The change from the emission intensive economy of today to a net zero economy won’t happen overnight, and it won’t happen by accident. For investors, an active and considered approach to portfolio and asset management will be required.

Infrastructure portfolios have a number of important roles to play in decarbonisation of the real economy. Of course, the operations of infrastructure assets need to decarbonise. But beyond this, infrastructure assets are critical enablers of the decarbonisation of other sectors. Fulfilling this enabling role will require not only change to existing infrastructure assets, but a significant amount of new infrastructure to provide goods and services—especially energy—in new ways.

Whilst the transition to net zero will take time, we believe investors must start positioning their infrastructure exposure with a view to the future.

Whilst the transition to net zero will take time, we believe investors must start positioning their infrastructure exposure with a view to the future.

For investors, an infrastructure portfolio focused on managing climate risk and opportunity has two key components:

- Investment in existing critical infrastructure assets that are being proactively managed to (a) transition to net zero operations, and (b) make the necessary operational investments to support the decarbonisation of adjacent sectors (for example, as the technology and supply chains mature airports must upgrade their fuel delivery to facilitate the introduction of low carbon fuels). These assets will often have high current emissions and be exposed to transition risk.

- Investment in the new infrastructure needed to facilitate the net zero economy of the future. This includes categories such as green hydrogen production, transport and storage; and enhanced electricity networks. These assets will often have low, if any, ongoing emissions across scopes 1, 2, and 3, and face relatively low transition risk. We refer to this as “clean” economy infrastructure.

Both transitioning infrastructure and “clean” economy infrastructure could be expected to generate attractive, stable, long-term returns, and both have a systemic risk mitigation role to play. Clean economy infrastructure also has a portfolio risk mitigation role.

This paper outlines how investors can use their infrastructure asset allocation to help manage their total portfolio climate risk, whilst also channelling capital into greener projects that will assist in the mitigation of systemic (global) climate risks.

The nature of investment-related climate change risks

Our climate is changing rapidly due to greenhouse gas emissions generated by economic activity. These changes, and the efforts to limit them, create a unique set of risks that are subject to significant uncertainty over the medium term, yet yield broadly foreseeable long-term impacts depending on near term action to mitigate and manage them.

The changing climate’s effects on economic and financial outcomes occur through a range of channels. These include deteriorating public health, labour productivity and agricultural yields, failing public infrastructure, rising mortality rates, and weather-related property destruction, among other impacts. Such adverse effects can result in direct financial risks, prompting a reassessment of asset values, changing the cost or availability of credit, or affecting the timing or reliability of cash flows. They can also create risks to economic activity, which can themselves create or amplify financial risks. Economic and financial risks can also amplify one another – for example, weather-related property destruction can lead to bank losses that lead to less lending, then reduced investment, and so on.

Importantly, while most financial risks can be managed on a company-by-company basis, and diversified at a portfolio level, the investment risks arising from climate change can be overwhelmingly systemic. For example, even if an investor divested all of its portfolio companies involved in upstream fossil fuel production, and thereby reduced the portfolio’s transition risk, the remaining portfolio companies would still be exposed to the impacts of global heating if global greenhouse gas emissions do not decline.

As a result, the ability of investors to mitigate the climate change risks to their portfolios will involve not only decisions about which assets to add and remove from the portfolio, but also:

- taking all reasonable steps to encourage portfolio companies to decarbonise their operations and supply chains, and

- increasing investment in clean economy infrastructure to accelerate economy-wide decarbonisation.

The only real way to mitigate climate change risk for long-term investors is an orderly, rapid decarbonisation to a net zero economy that achieves the international community’s temperature goal of no more than 1.5°C of warming relative to pre-industrial levels.

The only real way to mitigate climate change risk for long-term investors is an orderly, rapid decarbonisation to a net zero economy that achieves the international community’s temperature goal of no more than 1.5°C of warming relative to pre-industrial levels.

Types of infrastructure portfolios – traditional, transition and clean economy

As the investment industry continues to evolve to address climate change risks, the universe of infrastructure funds is being fragmented into three broad groupings. These broad groups include:

- Traditional funds – existing core infrastructure portfolios with no net zero aspirations

- Transition funds – existing core infrastructure portfolios that have net zero aspirations and are actively working with portfolio assets to decarbonise their operations and supply chains

- Clean economy funds – products that invest solely in assets that (i) already have net zero or very low emissions profiles, and (ii) help catalyse or enable a net zero economy. In particular, they focus on investing in infrastructure-related climate solutions that will help scale up decarbonisation efforts and contribute to sustainable, climate-resilient economic growth (such as renewables, electrification, alternative fuels).

We believe both transition funds and clean economy funds have a role to play in global decarbonisation and make important contributions to asset owners’ portfolio composition.

Transition funds will assist existing infrastructure assets to successfully transition to a low carbon world. This should result in lower global emissions and help other sectors that use the infrastructure to decarbonise their operations.

Transition funds are crucial because core infrastructure is relied upon by countless businesses and individuals – it cannot easily be shut down or substituted. Also, core infrastructure is very long-lived, and will remain in use for decades. Existing core infrastructure assets require long-term stewardship to support them to achieve net zero outcomes. Decarbonisation cannot be achieved by only investing in new “green” infrastructure projects.

However, existing infrastructure assets, such as ports and airports, often are carbon intensive or serve carbon intensive sectors. Effective im

plementation of climate change strategies by these assets is a potential driver of excess returns, but it does involve taking on transition risk at the asset and portfolio level.

One way asset owners can balance this transition risk at the portfolio level is through investment in clean economy infrastructure portfolios. These are relatively new and aim to provide attractive investment opportunities in existing and emerging “green” sectors. We believe their risk mitigation role arises from:

- reducing emissions intensity for the investor at the asset class level and fund level

- channelling capital into “green” assets/projects that can assist in reducing the systemic risks of climate change.

These risk management themes are discussed in more detail below.

Clean economy infrastructure can assist in the management of overall portfolio risk

Diversified investment portfolios, such as those managed by pension funds, are exposed to climate change risks across all asset classes – equities, bonds, property, infrastructure, private equity and so on. The climate risks associated with each asset class can vary, due to differences in the seniority of financial instruments in the capital structure of companies, duration, quality of disclosure, and other factors. In addition, asset classes vary in terms of the ease (or difficulty) with which climate risk mitigation can be achieved. Some financial instruments are liquid, and easily divested.

Others have few, if any, governance rights, meaning the investor has relatively little ability to influence and support climate change risk mitigation at the company level after the investment has been made.

We think clean economy infrastructure investments are well-suited to reducing climate risk at the asset class and whole-of-fund level. In addition to potentially providing attractive, long-term returns, clean economy infrastructure investments will generally have very low emissions profiles and will be conceived of with a net zero future in mind, so they should be resilient to long-term transition risk. This means they can help reduce an investor’s portfolio level emissions intensity, enabling investors to start moving towards net zero across their overall investment portfolios.

The reduction of portfolio-level emissions intensity also can help investors to meet their own net zero targets, and address increasing beneficiary or member demand for investors to help play a positive role in the global push to limit climate change.

Net zero portfolios can help mitigate systemic climate risk

Achieving a net zero economy will require significant changes to behaviours and public attitudes in relation to energy production and consumption and will require trillions of dollars of capital.

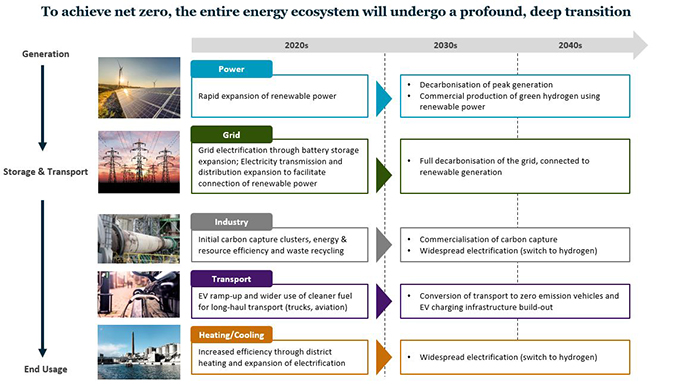

Figure 1 below shows that the entire energy ecosystem will need to undergo a profound and deep transition to achieve net zero. This investment is only part of the picture, and funding will also be required to reform food, forestry and land use, and to help capture and store carbon dioxide.

Source: IFM Investors

The transition task is immense and covers many different sectors of the economy. Industry experts have estimated the required investment for the energy transition and green infrastructure is between $92 trillion and $173 trillion over the next three decades. Achieving this would require the current annual investment to more than double, from around $1.7 trillion per year today, to somewhere between $3.1 trillion and $5.8 trillion per year on average over the next three decades.

To finance the global net zero transition, significant public investment will be needed, alongside unprecedented deployment of private capital. In recent years, we have seen an acceleration of private capital raising for climate solutions, as well as increased collaboration across mainstream finance and governments, such as through the Glasgow Financial Alliance for Net Zero. Such collaborations are aiming to get the settings in place to help mobilise private finance to support the re- engineering of our economies for net zero.

Clean economy infrastructure allocations can help fill the financing need to achieve a net zero economy rapidly enough to prevent the worst climate change impacts globally. For pension fund investors, clean economy investments, by design, channel retirement savings into new, green developments/projects and technologies that have zero or very low emissions.

For pension fund investors, clean economy investments, by design, channel retirement savings into new, green developments/projects and technologies that have zero

or very low emissions.

It is important to remember that clean economy infrastructure investments are still infrastructure and should enjoy the well-understood benefits of this asset class, including portfolio diversification arising from low correlation to other asset classes, low volatility, and the capacity to generate stable long-term cash flows, with downside protection often provided by the high barriers to entry and essential community role these assets play.

The net zero opportunity

No investor on their own can achieve the Paris Agreement temperate goals and prevent the worst impacts of climate change. But each investor will need to do their fair share – especially universal owners like pension funds, who will not be able to fully diversify away all climate-related financial risks.

The best way for pension funds and like-minded long-term institutional investors to protect their beneficiaries from the financial risks of climate change is to take all reasonable steps to support an orderly transition to a net zero world, because this is the lowest cost and lowest risk pathway. Investing in this way can also help an investor participate in the anticipated future growth of clean economy industries.