The Australian Government’s privatisation of Telstra in the 1990s led to the establishment of what was then the ‘Telecom Superannuation Scheme’. The proceeds of the sale of Telstra assets were the basis for converting an unfunded commonwealth pension scheme into the original defined benefit scheme that was eventually closed to new members in 1999, but still has over 3,000 active defined benefit members and has grown to be Australia’s largest corporate superannuation fund.

The fund opened a profit-to-members accumulation plan in 1997 with a comprehensive service offering to Telstra Group employees and ex-employees. Today, members enjoy a dedicated range of investments and services from accumulation to retirement.

Modernising the member experience

Like the technology industry the fund was originally formed to represent, the fund has gone through many changes in the past 30 years. As an internally administered fund, technology— whether for business processes and systems, or digital capabilities—has been the key to delivering quality products and benefits to members.

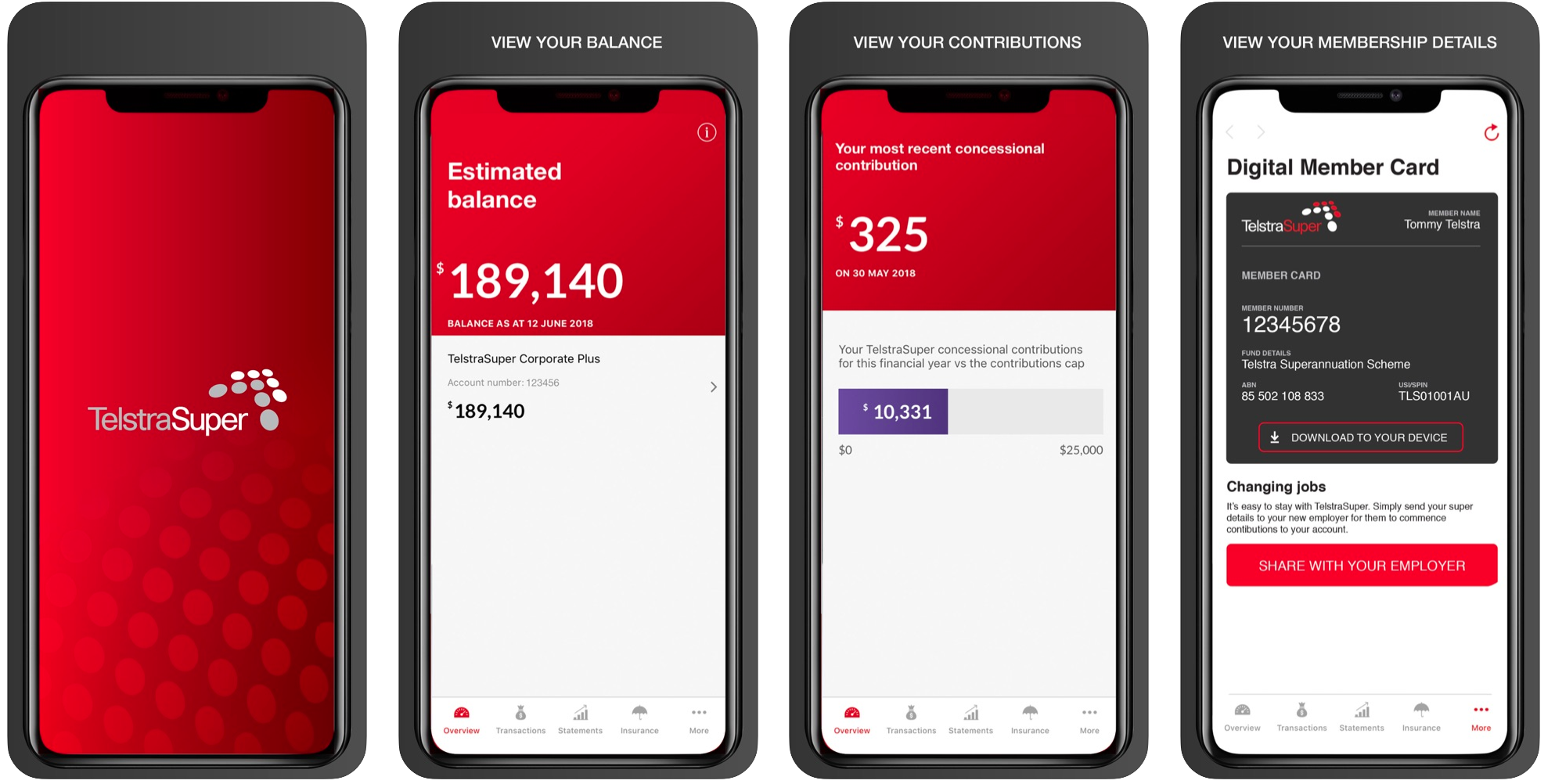

The digitalisation of the member experience continues to be the fund’s major focus and its recognised strength. Over the past five years TelstraSuper has successfully continued its program of digital transformation to deliver the best possible outcomes to members.

The fund’s digital transformation strategy has included a new web platform and member app delivering personalised relevant information, stimulus to act, and education to empower members. The success of this approach is reflected in TelstraSuper’s member satisfaction rates and NPS scores as well as changes in member behaviour, with higher login rates and substantially above-average open rates on communications.

Investment management and product development innovation

Historically, TelstraSuper has been a strong performer. The team successfully maintained portfolio strength throughout the challenges of the GFC and has also remained strong during the current COVID-led market volatility.

A big part of TelstraSuper’s success has been the growth of its high-performing investment team that utilises a combination of internal and external expertise to manage members’ savings. The fund has been a leader in bringing investment management in-house, with more than two decades of practical experience in the management of a variety of assets including Australian equities, fixed income and property. From TelstraSuper’s perspective, the key advantages of having had some form of internal investment management over the past two decades include:

- improved ability to customise portfolios to meet specific needs

- significant cost savings for members

- enhanced returns through the adoption of innovative ideas and approaches

- heightened ability to manage and monitor external fund managers.

Today, TelstraSuper has moved well beyond its beginnings as a Defined Benefit (DB) scheme and now offers members multiple investment options. It has spearheaded a range of new product development initiatives, the most recent being the Retirement Bonus.

With the Retirement Bonus, a bonus of up to a maximum of $8,000 is paid to eligible members when they transfer from the accumulation phase into a RetireAccess retirement income stream. When members start a retirement income stream the tax paid by TelstraSuper is reduced. The Retirement Bonus is funded from this tax saving and if members meet the eligibility requirements, this tax savings is paid to members as a bonus payment.

One of the pioneer funds for financial advice

TelstraSuper was one of the very first funds in Australia to offer financial advice, and its financial planning service has been consistently recognised as a finalist in super industry awards over a number of years.

It launched Telstra Super Financial Planning (TSFP) in 2002 to provide fund members and their partners with guidance around retirement planning and navigating the many super regulatory changes.

In 2015, the financial planning offer was broadened to meet the growing needs of members at all levels. A phone advice channel was added to meet growing demand from accumulation members. Additionally, the face-to-face channels broadened their advice scope to include advice on insurances, annuities, estate planning, non-super investments, and a range of other areas.

TSFP’s financial planners are salaried-only employees and have a range of external super funds and other products on their approved list – ensuring the advice is always provided in the best interests of the client.

Financial planning has always been a much-valued service amongst TelstraSuper’s pre-retiree and retiree members, with the vast majority of retired members (over 90 per cent) having had some advice interaction with TSFP. The key to this satisfaction, according to TelstraSuper, is the fact that their financial planners are highly qualified and experienced, and that their members can choose to speak with advisers over the phone or face-to-face in Melbourne, Adelaide, Brisbane and Sydney.

Key relationships make all the difference

The close relationship TelstraSuper has with Telstra Corp and related companies Foxtel and Sensis and their employees has been, and continues to be, its number one priority and point of differentiation.

As the fund prepares to move to a new office in Melbourne later this year, CEO Chris Davies sees this as the start of a new era as he looks towards the future and the ever-changing horizon in super, saying “Our close relationship with Telstra, Foxtel and Sensis will remain a key driver for the fund. Continuing to be the fund of choice for an iconic Australian company like Telstra is important for the fund. As technology continues to change so do members’ needs as they head into retirement. We remain focused on providing outstanding services and products to help our members reach their financial goals.”

Working at TelstraSuper for 30 years – Marelle Gerdes shares her story

Marelle Gerdes has been with TelstraSuper since the beginning and has lived through all the changes, both at the fund and in the super landscape.

I started working with the Benefits Payments team at our first offices in Southbank in 1990, and thirty years later, I’m still here! I’ve seen enormous changes in the fund over this time. When we started, we weren’t called TelstraSuper, of course, and we were about 25 employees. The focus in the beginning was simply on paying out members’ benefits as they transferred out of the Commonwealth Super Scheme into a fund that allowed lump sum payments. Whereas now the focus is much broader, including helping members to build those benefits throughout their lifetimes and to improve their financial wellbeing over the long term. Some of the biggest and most beneficial changes the fund has introduced during the last 30 years is the Financial Planning arm and the ability for family members to join. This has meant not only current and former Telstra Group employees can benefit from being in the fund, but their family members too.

In those 30 years the fund has gone though many different economic conditions. Managing a defined benefit (DB) fund through the GFC was challenging. The economic downturn hit the funding of the DB scheme hard and we had to work closely with our employers during this time. Now with fewer DB members, similar conditions in COVID-19 aren’t impacting the scheme the same way but it’s now our accumulation members we need to

support through these turbulent times.

When I joined the fund, we were like a big family – with so few employees, we all knew each other well. Although we’ve grown in size, TelstraSuper retains a friendly, open culture where everyone still knows each other’s names and we have regular company-wide catch ups. One of the reasons I’ve stayed so long is that I still enjoy coming into work. I also enjoy the member focus and working at a profit-to-members organisation where the members’ best interests are at the core of all that we do.

I’ve held many roles over the years, from Customer Service to Business Analyst, from Project Manager to Website Manager though to Marketing analysis and strategy along with managing research and most recently my current role as Manager Strategy & Planning. This has given me a wonderful understanding of so many aspects of superannuation. I’ve always found it possible to take on a new challenge at TelstraSuper and have loved the variety and learning opportunities this has given me. Not only have my roles changed but my work patterns have too. TelstraSuper has always been a flexible workplace and this has meant I’ve been able to maintain my lifestyle living on a large block of land with my beloved horses and dogs.

The superannuation industry has faced so many challenges and changes over the past few years and the rate of change has accelerated. There are roles and requirements in superannuation that couldn’t have even been imagined 30 years ago. It remains a very dynamic industry and I’m proud to work at a fund where the members’ best interests have always come first and members can feel truly supported, through financial planning advice, to educational seminars, great service and a wonderful digital platform of communications. While the industry as a whole face many challenges, I think TelstraSuper is well positioned to continue to serve our members needs into the future.