The ASFA annual Conference provides an opportunity to reflect back on the year that’s been.

There is no doubt it has been a difficult, challenging and, in many ways, a confronting year.

But I want to step away for the moment from the immediate challenges presented by the Productivity Commission, the Royal Commission, and the various superannuation Bills such as Protecting Your Super and Member Outcomes, and reflect more broadly on retirement in Australia.

A grand bargain that has already started to deliver

Retirement in Australia, and superannuation is at the centre of it, is ultimately a grand bargain between the present and the future that has already started to deliver.

Despite the protestations of those who should know better, superannuation is working. It may not be perfect, but it is world class, and as we work to improve it even further we should keep in mind what our primary objective is: A dignified retirement for as many Australians as possible.

Born out of the heat of an inflationary 1980s the grand bargain of deferred wages that is superannuation has become an outstanding piece of public policy.

What makes it outstanding?

- The first thing that makes it outstanding is that it rejects the idea of two Australias, two separate retirement experiences. We used to have an Australia where those who were well-off could become members of defined benefit public sector and corporate schemes and enjoy a dignified retirement and those who remained, were left to exist on the Aged Pension.

- Instead we now aspire to something greater; a dignified retirement for as many Australians as possible.

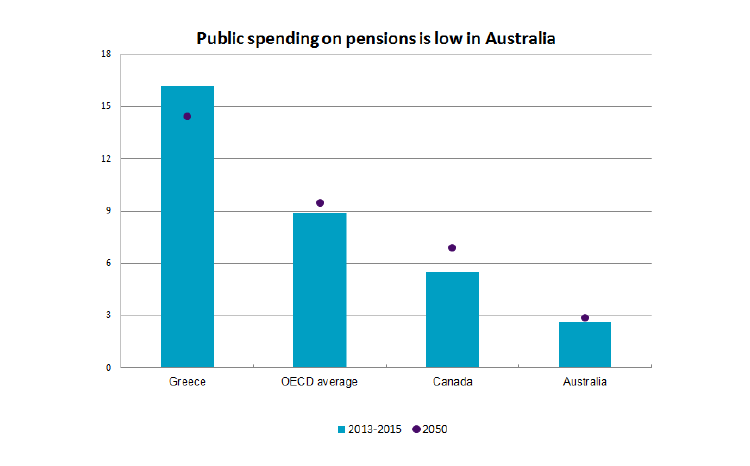

- It also rejects the notion of saddling future generations with an unmanageable fiscal burden. Instead of the 7, 9 and 11 per cent that the German, UK or Greek tax payer must pay to fund the burden of their Aged Pension schemes, ours sits strongly and reliably at 2-3 per cent of GDP. See figure 1.

- It also rejects the ideological purity of a solution either wholly free market or of unfettered collectivism, and instead combines the best of these into a powerhouse of investment returns. It stands unique in the world in its ability to reconcile members’ best interests with the animal spirits of the market. Of course in such system there will be ups and downs. But as we’ve seen, in the last five years we’ve managed to have outstanding returns reflected in the numbers in figure 2.

- But what really makes it outstanding is the everyday and mundane world of superannuation. A world in which on a single standard day:

- $307 million in total benefits is paid to members

- $566 million in investment income is received by superannuation funds

- 52 life insurance claims are paid

- 57 TPD and 124 Income Protection claims are paid

- 900 lump sum retirement payments are made and 140 new pension benefits are established

Figure 1

Figure 2

Super is good for the economy

It’s important to understand that the fundamental business of superannuation is retirement.

We’re not in the infrastructure business, we’re not in the listed equities business. The business we’re in is retirement.

But that doesn’t mean superannuation doesn’t support businesses or the economy generally.

Ultimately, 14 cents in every mortgage in this country emanates from the superannuation system. 4.5 per cent of the funds under management are invested in infrastructure – each day people go to work, they go to airports, they work in office blocks funded by super.

Funds have to give primacy to member returns and members’ best interest but what we need to remember is that at the same time what’s good for superannuation is ultimately good for Australia.

A new era of superannuation

As we pass through what future generations will no doubt see as the Golden Age of growth, not just in superannuation but in Australia generally we need to be cognisant of the responsibility that comes with size and scale. We must temper hubris, rein in excess and remain humble – $2.7 trillion if nothing else, is a reason to be civil.

The age of optimism

In difficult times like these we need to remain optimistic and cheerful about the future of superannuation, even when so many people want to remove compulsion or whittle away at the system.

But we have every reason to be optimistic. Our compulsory superannuation system means that a dignified retirement is within reach of the majority of Australians.

In order to do deliver this, we must address a number of things:

- We have to address the failings the Productivity Commission and the Royal Commission have revealed in the course of this year

- We need to restate our commitment to moving to a 12 per cent SG rate

- We need to take steps to address the post-retirement policy settings

Most of all, we need to make a renewed commitment to civility in the public sphere as we engage the market with ideas and public policy choices that will define an outstanding future and a better retirement for the people of Australia.