Tax considerations are set to become an even larger focus for trustees as they look to address key issues raised by the Royal Commission into Banking, Superannuation and Financial Services and the Productivity Commission into Superannuation.

A key area called into question by the Royal Commission was whether trustees were performing their duties in the best interests of members. From an investment governance perspective, trustees have a fiduciary obligation to take tax considerations into account as part of their investment strategy under APRA’s prudential standard on investment governance (SPS530). Embracing tax considerations more fully would give trustees an opportunity to appease regulatory concern and maintain their fiduciary duties.

The Productivity Commission has also made it clear that it considers tax management to be an important aspect of looking after members’ best interests, stating “Maximising net returns (after fees and taxes) is the most important way in which the superannuation system contributes to adequate and sustainable retirement outcomes”. It did seek to review superannuation funds’ after-tax investing practices but found it difficult to obtain related data. This suggests that the industry still has a way to go in relation to after-tax measurement and reporting

The importance of having an after-tax focus

The most important reason to manage for after-tax returns is that members receive their returns after tax.

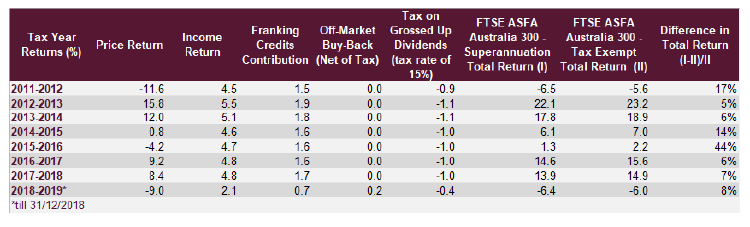

Tax is also a significant cost that can have a major impact on returns. The extent of that impact can be seen by comparing returns of the FTSE ASFA Australia 300—Superannuation Index (which takes tax into account) with the FTSE ASFA Australia 300—Tax Exempt Index. As the last column in the table below shows, the impact of tax has ranged between 5 per cent and 44 per cent over the past 7 years. It is also interesting to note that the smaller the total return, the more significant the tax impact.

This simple example highlights that tax can, and does, have an impact on returns. Numerous studies into tax aware investing have also clearly demonstrated that value can be added to members’ returns by taking tax considerations into account.

Trustees clearly have a huge opportunity to improve members’ after-tax returns by giving tax due consideration as part of the investment process.

After-tax measurement and benchmarking

Given members receive after-tax returns, it makes sense for investment performance to be measured on an after-tax basis. However, not all superannuation funds measure after-tax returns.

A key obstacle impeding trustees’ adoption of after-tax benchmarks is the widespread use of pre-tax indices as benchmarks, which is what superannuation funds have traditionally used to measure and assess fund managers.

This traditional method of benchmarking can create a misalignment between superannuation funds and their fund managers as some investment decisions, that are attractive on a pre-tax basis, may harm after-tax performance. For example, if a fund manager’s performance is measured on a pre-tax basis, the fund manager has no incentive to wait those few extra days when selling the fund’s shares to get a discount on the capital gain that the sale might have generated if the shares had been held for more than 12 months. Thus, capital gains tax may not be managed as efficiently as it could be. Likewise, when a fund manager is benchmarked to an index that does not contain franking credits, the fund manager might sell its holdings in a company before fulfilling the 45-day rule. Thus, the fund does not benefit from franking credits as part of the dividend distribution and the value of the franking credits is overlooked.

This misalignment is potentially hazardous from a governance perspective, so why haven’t more superannuation funds adopted an after-tax benchmark? The ingrained use of pre-tax indices as benchmarks is one factor, but other factors include complexity and cost.

To help make the transition to after-tax performance measurement and reporting less complex and costly, FTSE and ASFA launched the first industry standard after-tax benchmark in 2009 – the FTSE ASFA Australia Index Series.

Exhibit 1: Return Attribution: FTSE ASFA Australia 300 – Superannuation Index vs. FTSE ASFA Australia 300 – Tax Exempt Index

Source: FTSE Russell, data as at 31 December 2018.

A clearer picture for all investors

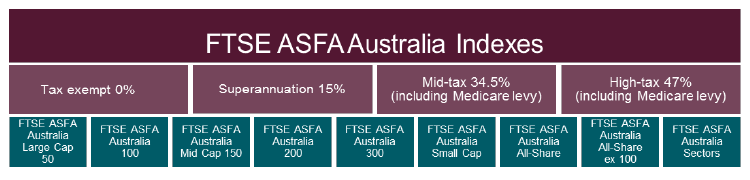

The FTSE ASFA Australia Indexes offer broad, investable coverage of the Australian Equity market in addition to tax-adjusted indices for superannuation funds and other types of Australian investors. It combines unique tax features with FTSE Russell’s rules-based methodologies and global standards.

FTSE Russell uses varying tax rates to calculate a franking credit and buy-back adjusted versions of the FTSE ASFA Australia Indexes for tax exempt investors, superannuation funds, investors in the mid-tax bracket and investors in the high-tax bracket, as outlined in exhibit 2.

Exhibit 2: A clearer picture of performance for all types of investors

Superannuation funds can choose from a range of benchmarks that take the effects of franking credits into account. The standard index allows for franking credits to be reinvested on ex-dividend dates. As an alternative, investors can opt for accumulating franking credits on a daily basis and reinvesting those credits at the end of the financial year or on a specific date.

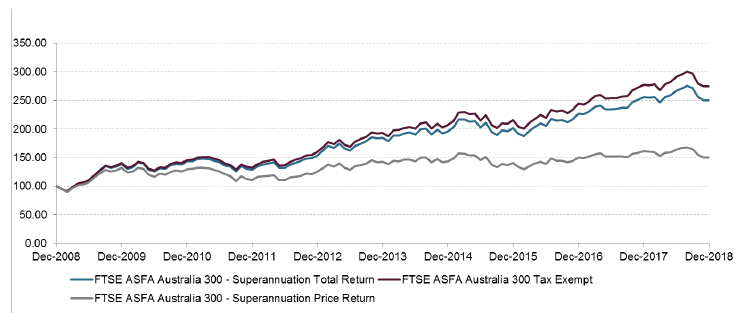

The importance of taking franking credits and income tax into the return calculation can be seen by looking at the performance of the FTSE ASFA Australia 300 Index, shown in exhibit 3.

Exhibit 3: FTSE ASFA Australia 300 Index performance

The grey line represents the price return, which is around 50 per cent over a decade, at 4.1 per cent p.a. The blue line represents the price return plus dividends minus income tax, which is 150 per cent return over a decade, at 9.6 per cent p.a. The red line represents the price return plus dividends, which is 174 per cent return over a decade, at 10.6 per cent p.a. The main takeaway is that the annual total return is more than twice the size of the annual price return.

A step in the right direction

Adopting an after-tax benchmark is a positive step towards improving after-tax returns because, as the old proverbs goes, ‘you can’t manage what you don’t measure’.

That said, there is a lot to consider when it comes to maximising net returns, after fees and taxes, for members. By working closely with their fund managers, custodians and other stakeholders, trustees are taking a step closer to improving after-tax outcomes from members.

Collaborating for improved after-tax returns

Superannuation trustees have a huge opportunity to improve after-tax outcomes for their members by working closely with fund managers, custodians, and other stakeholders to fully understand the tax consequences of their investment strategies.

To help trustees down this path, PwC produced the paper in 2016 called ‘Ten questions to ask your investment manager and custodian on tax’.

By asking the

se questions, which are briefly summarised below, trustees will be able to gain a better understanding of their fund manager’s capabilities, as well as identify areas for improved interaction and collaboration.

Ten questions to ask your fund manager about tax:

- Do you have a strategy to maximise after-tax returns?

Check whether the manager considers costs, such as capital gain tax liabilities, the loss of franking credits, or higher execution costs, as part of the decision to make a trade. - What impact does your style of investing and portfolio turnover have on the fund’s after-tax returns?

Understanding the manager’s style, and how it manages tax costs, allows trustees to assess the expected after-tax and after-fee outperformance. - Does the custodian efficiently allocate tax parcels, and on what basis?

The various approaches to selecting tax parcels, such as First In First Out (FIFO), impacts how the fund manager manages the timing around realised gains and losses. - Do you consider tax implications before trading?

In order to maximise after-tax returns, a fund manager needs to have a system in place to calculate tax impacts. This invariably requires information from the custodian, so it’s good to know how a fund manager interacts with the custodian. - Would you delay or bring forward an investment decision because of the tax implications?

If the answer to this question is a resounding no, this may indicate that an after-tax performance measurement and benchmarking process should be implemented. - Do you participate in off market buy-backs?

Fund managers face a difficult choice when it comes to participating in off market buy-backs because it may be detrimental to their pre-tax performance published in surveys, and the benefit for investors depends on their individual tax rate. Generally speaking, it is beneficial for pension assets and other tax-exempt investors to participate in off market buy-backs. - Do you manage the portfolio specifically for my tax status (individual, super, tax-exempt, pension)?

If superannuation funds segregate pension and accumulation assets, investment mandates can be tailored and managers can be appointed to optimally manage the after-tax return for the underlying client. - Is after-tax performance systematically measured?

Funds should be asking their fund managers how they manage tax costs and whether they can demonstrate after-tax returns are being maximised. The easiest way to accomplish this is for funds to start measuring managers on an after-tax basis against an after-tax benchmark. - Is the existing measurement of after-tax portfolio and benchmark returns conducted in a robust and meaningful methodology?

A key issue in after-tax return calculations is whether the calculation is done on a pre-liquidation or a post liquidation basis. - Can you operate under a Centralised Portfolio Management (CPM) approach?

There are many issues to be carefully considered and analysed before adopting CPM, but super funds should consider the role they can play in tax efficiency when they are large enough to use individual mandates rather than unit trusts.