Today more than ever, in this uncertain world we find ourselves in, one thing becoming increasingly clear is the important role our superannuation industry plays in the well-being of Australians and the economy. Not only are superannuation funds providing their members with more cost-effective life insurance than retail insurance, but without insurance in super over three-quarters of those who have life insurance may not have any.

Background

Recently, there has been an increasing focus on the superannuation industry and the value provided to its members. We have seen a number of regulatory changes come into effect that are aimed at improving retirement outcomes including:

- Protecting your superannuation package – ensuring members aren’t paying for insurance they don’t want or don’t need

- Putting members’ interests first – inactive low-balance super accounts being transferred to the ATO and consolidated where possible, and

- Member outcomes assessments – to annually assess the outcomes provided to members (outcomes assessment) and determine whether these outcomes can be improved into the future.

There is no doubt that these regulatory changes have encouraged very necessary, and in some cases long overdue, dialogue between Trustees and their service providers to find ways of providing better outcomes to members. In exploring areas where members could improve their retirement outcomes, there has been increasing discussion around the affordability and sustainability of insurances through super and whether the members’ funds that are used to pay for these insurances could rather be allocated towards achieving a better retirement outcome.

Through our research at Deloitte, what is evident is that many Australians benefit from insurance through super and this is a crucial vehicle through which they gain access to cost effective cover which, in many cases, they would otherwise not have in place.

Typically the cost of insurance is deducted from the contributions to super rather than being funded by a separate (or additional) contribution, and this results in a trade-off between what is allocated to insurance and retirement benefits. This trade-off means that default benefits may be selected based on price rather than need. However, on the other hand, when members join a super fund, particularly those offered through their employer, they and their families have an expectation that the benefits provided will be enough to meet their needs.

This creates a dilemma for Trustees in determining the default level of cover provided to members due to the differences in members’ individual circumstances and hence their needs. While the sufficiency of insurance provided to members is not explored in this article, we do consider the other benefits Australians get through their super.

The breadth of insurance in super

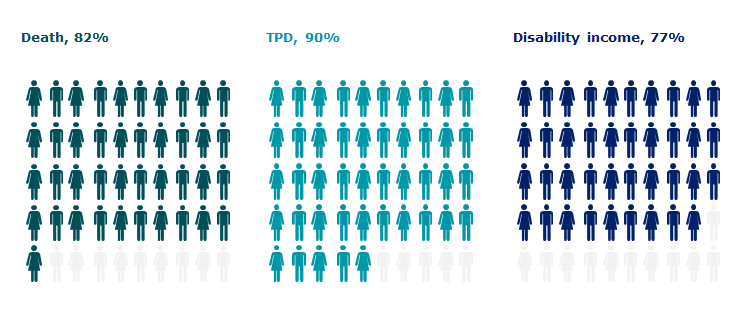

It is estimated that some 94 per cent of working Australians have some form of life insurance and, by the end of 2019, the majority of this was held through their super.

Figure 1: Proportion of number of lives insured in Australia held through group super as opposed to non-super policies

The significance of this is that without the insurance through super, over three-quarters of Australians who currently have life insurance would no longer have any cover. Even if we assumed a proportion with cover through super took out a non-super policy it is still reasonable to assume the majority of Australians would not have cover, which would be similar to the experience in most other countries where life cover is not embedded in their pension fund system.

Compared to other countries such as the UK, Canada, Germany or the USA, where insurance cannot be provided through their pension funds, we see there is a greater proportion of working Australians who are covered by some form of life insurance. This emphasises the pivotal role super plays in providing financial protection to Australians and their families.

Not only is super ensuring Australians have life insurance, it is also providing them with better value for money than if they were to purchase individual retail policies.

Comparison of group super insurance against individual policies

In considering whether members are receiving value for money, there are a whole host of factors that need to be balanced. Of these, two that can be reasonably and simply compared are the price paid and level of claims paid (or conversely, proportion of claims declined) and are discussed further below. It is worth bearing in mind this is not a balanced view across the whole range of factors that ought to be considered.

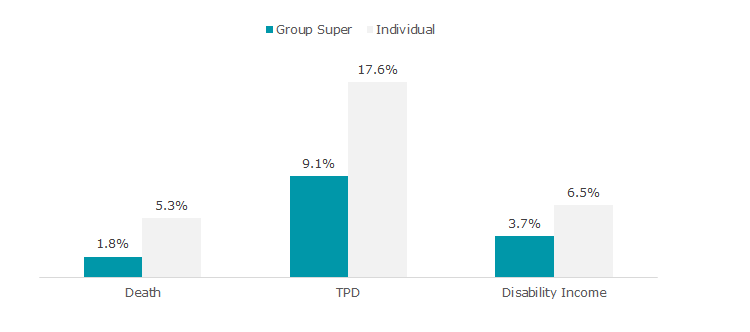

One way to compare the price of the insurance is to look at the loss ratio of group super versus individual advised policies as this provides an indication of how much of the premium is used to pay claims. Using the claims paid ratio for death benefits as a rough proxy for the loss ratio (importantly, noting this should not be interpreted as a measure of consumer value or product profitability), group super and individual advised policies can be compared as follows:

Figure 2: Claims paid ratio of death benefits for group super versus individual advised policies

This demonstrates individual advised policies attract far greater costs than for group super policies due to the fact that individual advised policies require a greater degree of initial underwriting, acquisition costs, broker commissions, administration costs, etc.

As a result, a bigger portion of premiums are available to pay claims under a group super policy compared to an individual advised policy.

Other factors affecting the relatively lower cost of Death benefits through group super may include (among others) members opting for default cover up to the automatic acceptance limits while individual policies may provide higher levels of cover than what is provided through group super.

However, we would expect that given the economies of scale superannuation funds have when purchasing insurance, the cost of Death, TPD and Disability Income benefits would generally be lower on a like-for-like basis between group super and individual policies.

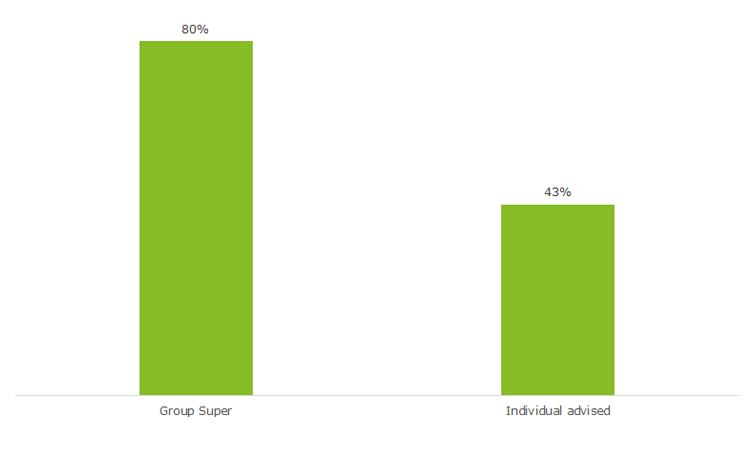

In addition to a lower cost of insurance, there is a growing expectation by members, regulators and the community more broadly that insurance products provided to individuals should be appropriate to their needs and in the event they need to claim against their insurance few barriers to receiving those benefits exist. This has been intensified following negative findings from the Royal Commission, as well as through ASIC’s review of TPD insurance and claims handling processes, that poor governance and processes have led to poor outcomes for a host of individuals.

We have seen the superannuation and life insurance industry transform themselves to ensure transparent and effective processes and simple products that are easy to understand and meet the needs of their customers. Arguably, through improved processes and more hands-on involvement of Trustees and their delegates, a considerably lower number of insurance claims are declined in super compared to individual policies (advised + non-advised).

Figure 3: Proportion of claims declined

Conclusion

Insurance through super provides value for money to the majority of Australians who have life insurance. With employers keen to promote financial well-being and flexible benefits packages, group insurance is a growing area of protection globally. In Australia we are fortunate to have it included within our superannuation system rather than, as is the case with most other developed countries with the exception of New Zealand, there be a reliance on the employer to provide cover on a discretionary basis.

It’s important to help people understand when and why they might need to take out life or income protection insurance. Your role, our role, is to ensure members have the right information and tools available to make informed decisions.