Historically collateral management has been seen as secondary to the trading, risk, or financing functions. Although it has always been the case that some derivative trades required collateral to be moved, there was not typically concern over the availability of collateral as a whole – despite the collateral workflow being complex.

However, this has been changing in recent years due to increasing regulations affecting different parts of the industry. For example, the Prudential Standard CPS 226 requires an Australian Prudential Regulation Authority (APRA)-covered entity to have appropriate margining practices in relation to non-centrally cleared derivatives which means firms must have the capabilities to exchange variation margin (VM) and post and collect initial margin (IM) with a covered counterparty, subject to certain criteria, as well as collect eligible collateral to satisfy margin requirements and apply appropriate risk-sensitive haircuts to collateral collected.

The rollout of the Uncleared Margin Rules (UMR) has also broadened the amount of the portfolio that has to be collateralised, which has created even more stress on collateral demands and meeting counterparty obligations.

With the UMR rules having rolled out to phase 5 firms—and phase 6 coming into force in September 2022—many more firms are now having to move IM on uncleared trades: adding to the demand for collateral.

In addition, volatility across the markets has been responsible for sudden and very significant spikes in margin requirements as dynamic risk-based margin models adapt to short-term market stress.

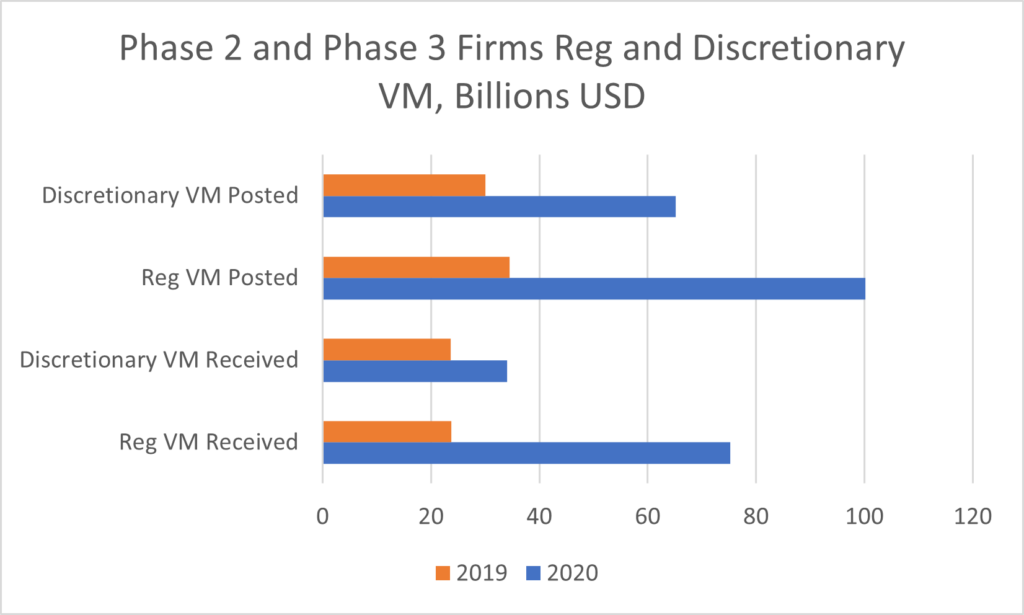

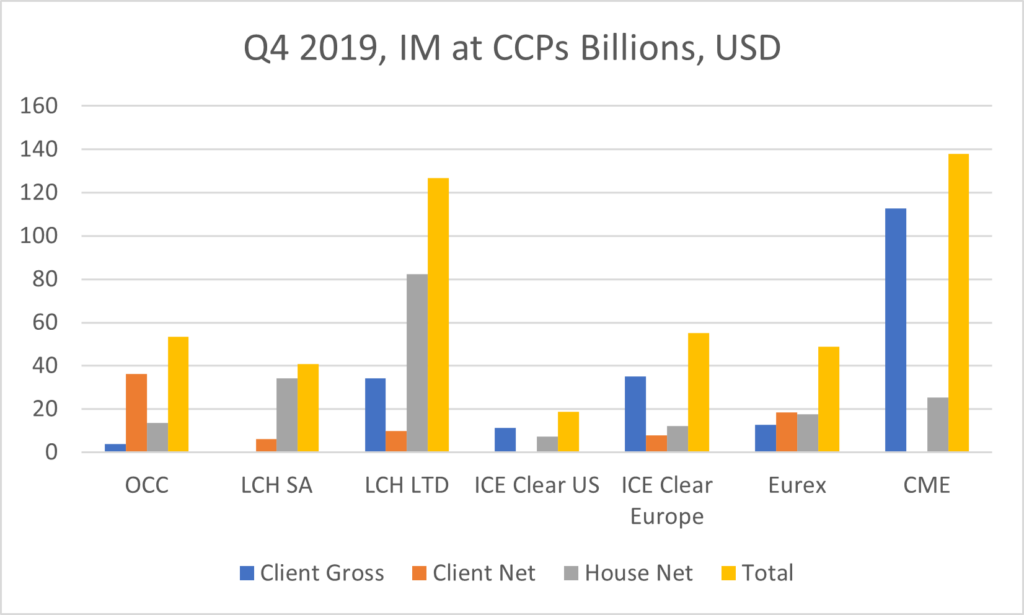

The below charts illustrate some of the changes in IM and VM requirements over the last two years. Some highlights are:

- Among the major banks, Reg VM has roughly tripled from 2019 levels.

- As highlighted in the ISDA margin survey 2020, the amount of IM for cleared derivatives, including IRD and CDS, significantly increased in 2020.

- Total IM for IRD and CDS products reached $330.6 billion at the end of the fourth quarter of 2020, compared with $269.1 billion at the end of the fourth quarter of 2019.

Figure 1 – increase in VM posting by the largest firms in phase 2 and 3. Indicative of the effect phase 5 will have on the broader market.

Figure 2 – year on year increase in IM at Clearing houses

Overall, this means that firms actively using derivatives now have to manage daily VM and IM movements as well as post significant amounts of collateral against IM. They also have to ensure they have a sufficient supply of eligible collateral, whether that is cash or non-cash assets.

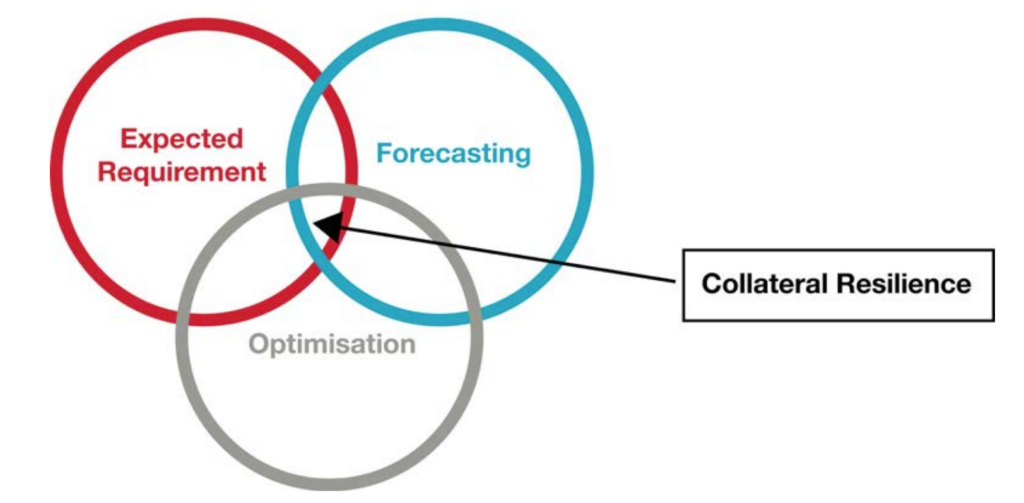

Collateral resilience

If a firm is in a position where they have insufficient assets available to meet a margin call, then they have no option but to address this with urgency. This can be via a range of tools such as freeing up cash, reassigning assets, or entering into collateral transform trades in order to meet the requirement. Handling a collateral shortfall in this way is expensive, operationally difficult and creates trading risk as it can mean a forced close out of trades causing losses on the portfolio. This is where collateral resilience comes into play.

Collateral resilience is an operational model that aims to ensure there is always sufficient collateral to meet any demand in any market.

To achieve true collateral resilience requires several elements:

EOD Requirement

The first step in building resilience is knowing what you are going to be required to post out as collateral. This means having the tools in-house to calculate your T+1 IM and VM exposures across all business lines and external counterparties.

Calculating your expected IM or VM requirement in advance of the daily collateral management process allows you to determine if you will have sufficient eligible collateral before you receive margin calls from your brokers or counterparties. This also gives you the added benefit of being able to validate broker statements and margin calls.

Consistency across all business lines is key in this process, as being able to predict T+1 requirements on only some agreements gives a partial picture and doesn’t provide the ability to guarantee collateral coverage.

Forecasting

The next step is putting in place the ability to forecast potential future needs for collateral on short- and medium-term horizons.

VM Forecasting provides a view of the maximum amount of Variation Margin that may be called over a defined time horizon, for example, the next five business days, and in a certain confidence level. This is used by firms to ensure they have the right amount held in cash buffers to meet calls while freeing up excess cash for trading activities.

Forecasting of IM is also a powerful tool. For example, forward projecting portfolio growth or drift over time, or defining stress scenarios of extreme market conditions provides a set of metrics of possible IM requirement levels which can then be analysed against inventory to determine where collateral shortfalls could occur in the future.

Another extension of this concept is, where a firm can test the impact of changes to collateral eligibility haircuts or availability. This scenario is looking at situations where the overall margin requirements may not change but changes to the eligibility collateral what-if analysis or rating of collateral assets mean that there is no longer sufficient collateral available, and a shortfall can occur.

Optimisation

The third leg of the Collateral Resilience solution is Optimisation, and this applies to both margin and collateral.

Margin Optimisation

Using techniques to optimise and reduce your margin requirement clearly improves collateral resilience because less collateral is needed. There are multiple ways to do this, starting with pre-trade checks to identify the clearing house or counterparty that has the lowest margin impact and then moving towards post-trade analytics to identify trades that can be replaced or novated. These optimisation techniques allow for the same portfolio risk to be expressed while maximising portfolio offsets by counterparties. Some examples of this we see with clients are trades being novated among FCMs or futures contracts being rebooked with risk-equivalent trades on a competing exchange.

Collateral Optimisation

The last piece of the jigsaw when ensuring collateral resilience is implementing a fully-featured collateral optimisation engine. Rather than the waterfall allocation models commonly used by collateral systems a true collateral optimisation allows you to ensure that collateral is deployed in the most efficient way depending on each organisation’s individual constraints and that the maximum amount of liquid assets is retained to provide a buffer for any unforeseen margin calls. A complete collateral optimiser will support substitution and rebalancing and allow for configuration defining what inventory can be used and when.

Data Requirements

The above tools require robust data across all business lines including:

Visibility on CSA terms – All collateral agreements, eligibili

ty terms and constraints

Accurate Inventory – Knowing accurately what available as collateral inventory across the organisation is essential, and this includes data on asset reference data and holding location, as well as trading constraints that may restrict the ability to pledge certain assets.

Good trade data – Calculating the initial and variation margin in various scenarios needs full portfolio and trade economics.

This data is not always easy for firms to access – often the information is being managed by an outsourcing service provider, or else held in house systems that can’t integrate into the front or middle office.

Challenges

So how easy is it to put these tools and processes in place? Naturally, it is not straightforward, or everyone would have done it already.

There are three areas that commonly create hurdles to implementing a true collateral resilience strategy: Systems, Data, and Organisation.

The systems that need to be linked for all the above to be possible are often separate and siloed and not designed for integration and bringing back-office information into the front and middle office.

Additionally, data is represented differently between the front and back-office systems with neither having the full picture, so this has to be combined and harmonised. The agreement and funding data may not even be in a system or may be managed externally by an outsourcing service provider. All the usual issues of mismatched identifiers, and patchy trade economics come into play.

Sitting across all of these are the organisational barriers. Implementing the strategies described above requires collaboration between front and back-office teams and of course, that creates challenges in aligning priorities, allocating budgets, and so forth.

Outcomes

While none of the above is simple, it is well worth the investment and focus for any firm that has significant collateral exposure. Investing in systems and workflows to put in place the various tools and transparency on collateral information produces great rewards including:

- reduction of locked up cash buffers, resulting in P/L gains

- deeper pool of eligible collateral on hand for a rainy day

- reduction of Collateral Risk

- lowered cost of carry for derivative trades.