Almost a year on from the Royal Commission, consumers have not forgotten the shortcomings of the financial services sector, with new research finding Australians’ trust in super funds is almost as low as their trust in banks.

According to the latest Qantas Super CSBA Retirement Confidence Index (the RCI), only six in 10 Australians trust their super funds to act in their best interest, only just slightly ahead of the 54 percent who trust in their banks.

Michael Clancy, CEO of Qantas Super, said, “It’s both a worry and a wake up call to the industry that only six in 10 Australians trust their super funds to act in their best interest.”

Around 13 percent of respondents believe that super funds are profit-driven organisations who only consider their own interests.

Management fees, minimal knowledge or engagement with the fund, the impact of the Royal Commission, and their view of government rules and regulations were cited as factors leading to a lack of trust.

The survey identified a slight gap in trust between younger Australians and older Australians. Perhaps because they have reached retirement age—and their super fund has, in theory, served its main function by helping them save for retirement—Australians aged 60 and above have more trust in their main super fund than those aged 40-59, with scores of 3.7 and 3.5 out of 5, respectively.

Meanwhile, Australians aged 18-39 have more trust in their bank than those aged 40-59, with scores of 3.6 vs 3.3 out of 5 respectively.

Main reason you gave that score for trust in your super fund |

||

| Respondents who indicated a high degree of trust Rating (4-5) |

Respondents who indicated a low degree of trust Rating (1-3) |

|

| They have given me no reason not to trust them | 36% | 18% |

| Fund reputation | 36% | 11% |

| I’m a long time-member and trust has been built over time | 27% | 9% |

| Fund type (e.g. industry fund) | 26% | 9% |

| Customer service | 18% | 12% |

| Communication (type, frequency, content) | 14% | 12% |

| Fund is better than others | 13% | 5% |

| Personalised contact | 10% | 7% |

| Information about Super | 9% | 10% |

| None of the above best describes my response | 8% | 43% |

| Specific experience(s) with the fund | 7% | 5% |

| Sample sizes | 603 | 397 |

Overall retirement confidence remains low

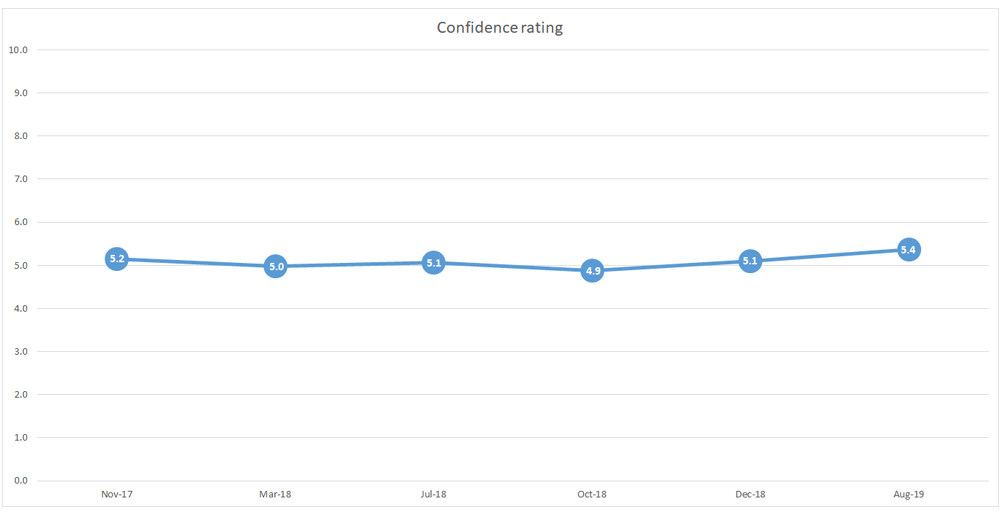

Even though there has been some modest improvement over the past year, confidence in a financially comfortable retirement is also low for most Australians.

Overall, the RCI measured confidence at an average of 5.4 out of 10. While up from last year’s average of 5.1, the continued lack of confidence from the same cohorts from year to year is concerning.

Qantas Super CSBA Retirement Confidence Index over time

Despite a greater focus from a number of funds on the super gap facing women, for example, men continue to be more confident in a financially comfortable retirement than women.

The most common reason given for those feeling confident is ‘I feel I will have enough money’, while 56 per cent of respondents who feel confident also have other investments, beyond their super, to support their retirement.

Factors leading to a low degree of confidence include the high cost of living, that respondents are not currently working, that they feel they won’t have enough money, and that they don’t know how much they will need to retire.

According to the RCI, Australians with a low degree of confidence in their retirement outcomes also tend to have a lower level of active involvement in making decisions about their super. Overall, just 48 per cent of Australians say they are actively involved in decision-making.

While Clancy welcomed the uptick in the RCI from 5.1 to 5.4 out of 10, he is worried that so many Australian adults still aren’t confident that they’ll be able to enjoy a comfortable retirement.

“The 2019 Melbourne Mercer Global Pensions Index has rated the Australian retirement system as the third best in the world, so there is a disconnect between the performance of the industry and how members feel,” he said.

While some of the factors behind how members feel are structural, with potential solutions going beyond what a super fund alone can do to improve member confidence in retirement outcomes, Clancy believes the results indicate there is an opportunity to better engage members.

“The recent Productivity Commission and Royal Commission reports included recommendations about how the superannuation system can be improved, and the government’s retirement income review may produce more again. By better educating members on the improvements they’ve implemented and the relative strength of the Australian super system, funds could improve their members’ retirement confidence,” he said.

Opportunities for better member engagement

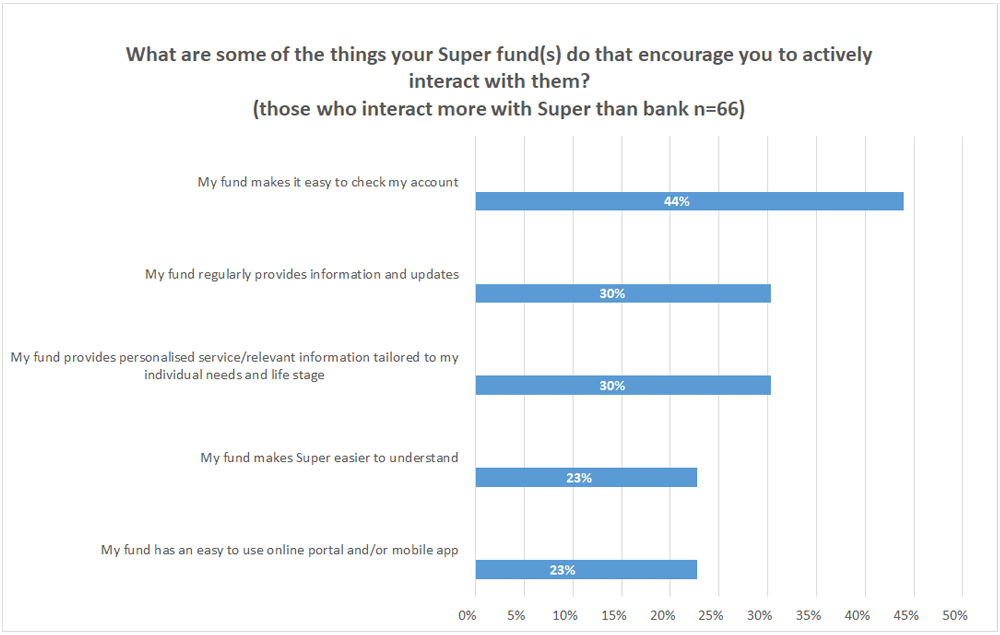

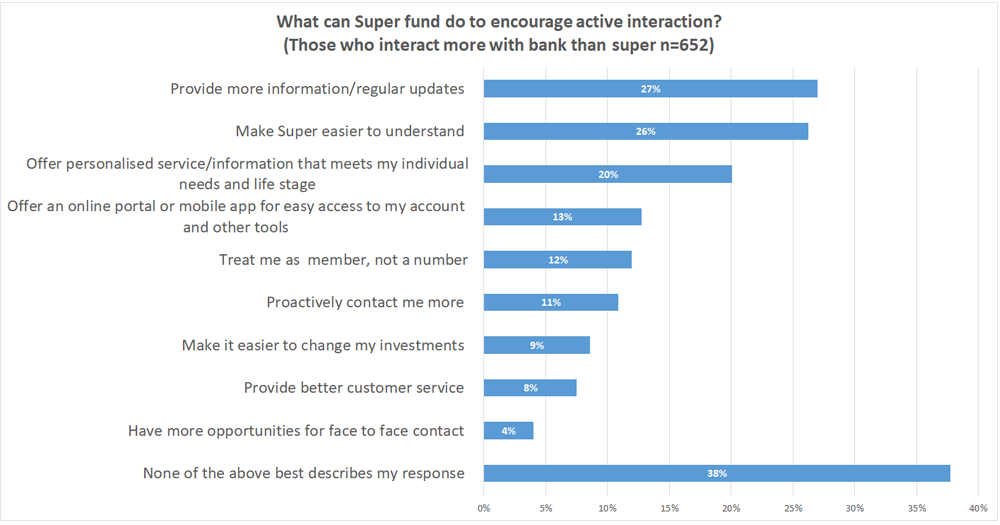

According to the RCI, Australians interact with their main super fund just over once a month, compared to more than once a week with their main bank.

Asked why their active interaction is less frequent with their super fund than with their bank, just over 50 per cent of respondents stated that banking is part of their day to day needs, while 45 per cent indicated they don’t feel the need to interact more often with their super fund. Twelve percent believe they’re too young to think about their super frequently, and 8 per cent stated they don’t understand much about their super.

However, that’s not to say Australians wouldn’t be open to more interaction with their super.

In fact, 27 per cent of respondents who currently interact more with their bank stated that they would be open to more information and regular updates from their super. In particular, almost half the 18 to 29-year olds surveyed stated that making super easier to understand would encourage more active interaction.

You can explore the topic of trust at this year’s ASFA Conference.

Parallel session 5A: Building trust in a post truth world – 4.00-5.10pm Thursday 14 November