The importance of the environmental, social and governance (ESG) impacts in a portfolio is increasing. More and more, investors expect that any robust investment process will also include ESG characteristics – not at the expense of investment returns, but rather as a driver of long-term investment performance.

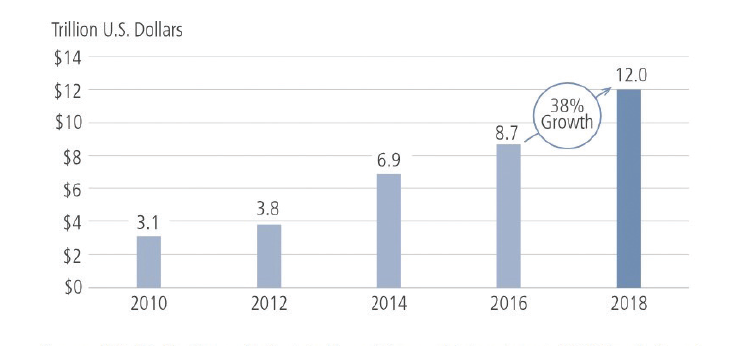

Corresponding with this thematic, inflows into ESG strategies—both by investors and institutions—have risen in recent years, as shown in figure 1. Indeed, in 2018, $1 out of every $4 of US assets under management was invested in sustainable strategies.

At the same time as this increasing focus on ESG, passive investments—including index funds and ETFs—have grown dramatically. For investors, they provide a low-cost exposure to market beta, at a time when their performance has been strong.

Unsurprisingly, there has also been a spike in the number of passive ESG options. In the last two years alone, the number of ESG ETFs has more than doubled, from 25 in 2016 to 69 in 2018, according to the US SIF 2018 Trends report.

Figure 1: Demand for ESG-Related Investments Continues to Grow in the U.S.

U.S. SIF, The Forum for Sustainable and Responsible Investments 2018 Trends Report

Weighing up the benefits

For investors, then, the question of how to define, measure and enhance the ESG component of their investments must also include an analysis of the benefit of an active or a passive approach to ESG integration.

Passive ESG strategies—particularly those that use third party data or ratings to implement an ESG overlay—can be a cost-effective way of undertaking ESG. It can provide efficient fund selection and potential cost savings.

However, in passive ESG investing, there are also limitations to the analysis that can be undertaken, as well as the performance outcomes.

From a risk and opportunity perspective, active ESG integration is a more robust option, for some of the following reasons:

A holistic approach – ESG issues tend to be strongly linked with business and financial issues. As a result, a single source of ESG data (such as that used by passive strategies) is usually not enough to allow a comprehensive decision to be made on the investment risks and merits of these issues.

Active ESG strategies, on the other hand, can take advantage of multiple sources of research and data to qualitatively and quantitatively evaluate material and relevant ESG considerations as part of the holistic investment process.

Flexibility and focus – Utilising data can be valuable as a starting point but limited in its absolute use. Passive strategies tend to use third-party ESG data that rely heavily on voluntary company disclosure. In addition, this can be backward-looking and limited in scope. Because of the limitations in the quality, disclosure and other biases inherent with ESG data today, investors relying solely on this information to make investment decisions may miss a comprehensive risk-reward analysis.

However, using multiple sources of data allows for a broader analysis and the ability to focus on the issues most relevant and material to the investment thesis.

Engagement – Active managers believe that engagement beyond the formal data is more meaningful than the data itself. No one data provider has a monopoly on the most pertinent data. Information comes from a variety of sources, meaning that judgment and prioritisation in the context of each investment decision is required.

Active investment benefits – Due to their deep knowledge of companies, their business practices and industries, active managers can play an important role in engaging with companies on material ESG issues, and positively influence corporate behaviors as well as drive sustainable long-term value for investors.

This view is supported by the numbers. Over rolling one- and three-year periods since 1999, active ESG strategies beat their passive counterparts after fees more than 60 per cent of the time across capitalisations and geographies. The success of active management was particularly pronounced in global and non-US equity portfolios, as active outperformed passive at least 70 per cent of the time.

Active strategies can therefore be seen to offer a more effective way to gain exposure to equity markets, both in terms of investment performance and impact. Active managers can achieve this by:

- using fundamental analysis based on multiple sources of research and data to incorporate ESG criteria into their investment process. The research undertaken by active managers can home in on issues and considerations, allowing them to identify emerging ESG trends within companies—both positive and negative—and assess the impact they may have on valuations

- reacting to changing ESG dynamics in a timely manner which also assists in uncovering potential opportunities and risks that might be missed by passive ESG strategies – something that is becoming increasingly relevant as companies seek to meet changing investor expectations across a range of issues

- incorporating a range of sustainability issues, including climate change, diversity and corporate governance, while passive strategies tend to focus on a single theme, such as carbon emissions

- delving deeper into the long-term impact of issues. For instance, while both active and passive managers can screen for companies with a good gender diversity on the board, only active managers can also research the company’s commitment to gender diversity by looking whether its business practices are also encouraging women in their professional development to reach senior roles.

Another consideration with ESG investing is that the issues which are material to performance are constantly evolving. As a result, the approach to engaging with companies and analysing these issues must evolve as well.

Climate change is a good example. For many years, the industry focused on carbon emissions measurement and reporting. Then, engagement with company managements evolved to consider the use of renewable sources of energy and the establishment of energy efficiency initiatives. Today, the conversation has developed to considering implications on business growth from scenario analysis around science-based targets.

To understand the implications of these complex and continuing changing issues for investors requires a deep understanding of business fundamentals and ongoing engagement with management.

Active managers are therefore well-positioned to consider new information as soon as it is available. Passive strategies can struggle to be nimble because they may be rigid methodologically and backward-looking.

It’s not surprising that some investors would consider passive strategies as a way to access ESG-driven portfolios at a low cost. However, the structural limitations—in data and research, portfolio integration and corporate engagement—make passive ESG strategies a suboptimal way to gain exposure to markets, both in terms of investment performance and impact.

Active ESG strategies have delivered compelling relative performance, even in the beta-driven bull market that followed the 2008 financial crisis, while providing investors greater control over the impact of their portfolio. The ongoing normalisation of central bank policy and its impact on financial market dynamics may further support the relative performance of active strategies, ESG-focused or otherwise.