While compulsory contributions and default MySuper products are important features of the Australian superannuation system, Australians can also choose their super fund and the investment option within that fund. In the retirement phase, there are no default super products, and all retired members must make choices about their product and investments. To make a choice that is appropriate for their financial situation, needs and objectives, members need to select options with expected returns and volatility that align with their individual risk profile. Such choices can have lasting impacts on their retirement income, so the disclosures made by trustees about their investment options are very important.

The investment option label is the highest level of disclosure about an option. It is the name by which the investment option is identified and to which all other meaning imparted by more detailed disclosures is attached. Option labels feature in product disclosure statements, member communications, on fund websites, and in tables of product information published by APRA and private ratings agencies. A label represents a short-hand description of the option. To be helpful to consumers, it is critical that a label aligns with the relevant option’s underlying asset allocation and associated risks.

ASIC recently examined investment option labelling by superannuation trustees as part of a broader focus on investment product labelling practices. Over the last two years, ASIC has been undertaking a series of surveillances on the product labelling and marketing practices of responsible entities of managed funds. As a result, 13 responsible entities rectified inappropriate labelling practices. ASIC also took enforcement action against the Mayfair 101 Group, La Trobe Financial Asset Management and Skyring Fixed Income Fund for misleading or deceptive conduct.

In keeping with our communications in recent years, ASIC is asking superannuation trustees to carefully consider whether their investment options are ‘true to label’, and consistent with common use market usage, noting that superannuation investment options are not offered in a vacuum. Investment option labels should contribute to consumers’ understanding of an option’s key features and risks, and be useful when comparing an option to others offered by the trustee, as well as other options in the market.

Analysis of investment option labels

ASIC’s analysis was prompted by recently introduced policies and regulatory initiatives focusing on Choice options and products, such as the design and distribution obligations, APRA’s Choice Heatmap and APRA’s Super Data Transformation initiatives.

Investment option labels are used for both Choice options and MySuper products. MySuper products are separately authorised by APRA, but they are also typically presented as investment options within accumulation product investment menus. For this analysis, ASIC looked at data relating to both Choice and My Super options.

ASIC analysed unpublished data collected by APRA under SRF 550.0 (Asset Allocation)1, SRF 605.0 (RSE Structure) and SRF 001.0 (Profile and Structure), to compare the label of an option to its asset allocation. The full dataset contains over 2,000 investment options, which is itself a subset of all options available to members within super.

Our analysis focused mainly on multi-asset class options. The full dataset was reduced to 898 options after excluding defined benefit products, options with single-asset class labels, options labelled only as MySuper products or MySuper lifecycle stages, options designed by third parties, and other options without an explicit or implicit risk profile. We have outlined our observations and the main areas to focus on here.

Observations

Meaningful components in labels: We observed that most option labels have at least one, and sometimes two, meaningful components. These components relate to:

1. Asset allocation, framed in terms of either:

a. risk profile (for example Balanced, Growth, Conservative); or

b. asset class (such as Equities, Fixed interest, Property); and (optionally)

2. Portfolio management style (such as Passive, ESG, Hedged, Leveraged)

Asset allocation – Risk profile labels

Risk profile labels describe an option’s strategic weighting towards either growing or protecting the portfolio’s value over time. They are commonly used on multi-asset class options – those that invest in a mix of asset classes. In a near universal practice, the assets which make up such options are categorised by trustees, asset consultants and fund managers, as either ‘Growth’ or ‘Defensive’.

Investment options with a higher allocation to growth assets are expected to deliver higher returns and are exposed to higher risk (volatility in returns) than those with lower allocation to growth assets.

It is notable that while APRA applies a ‘Growth/Defensive’ categorisation at the asset class level in its heat map publications, there is no standard method for trustees to apply the ‘Growth/Defensive’ categorisation to their investment options to facilitate consistent reporting in product disclosures. ASIC notes and sees benefit in the efforts of think-tank Conexus to promote a consistent industry approach to growth/defensive asset categorisation.

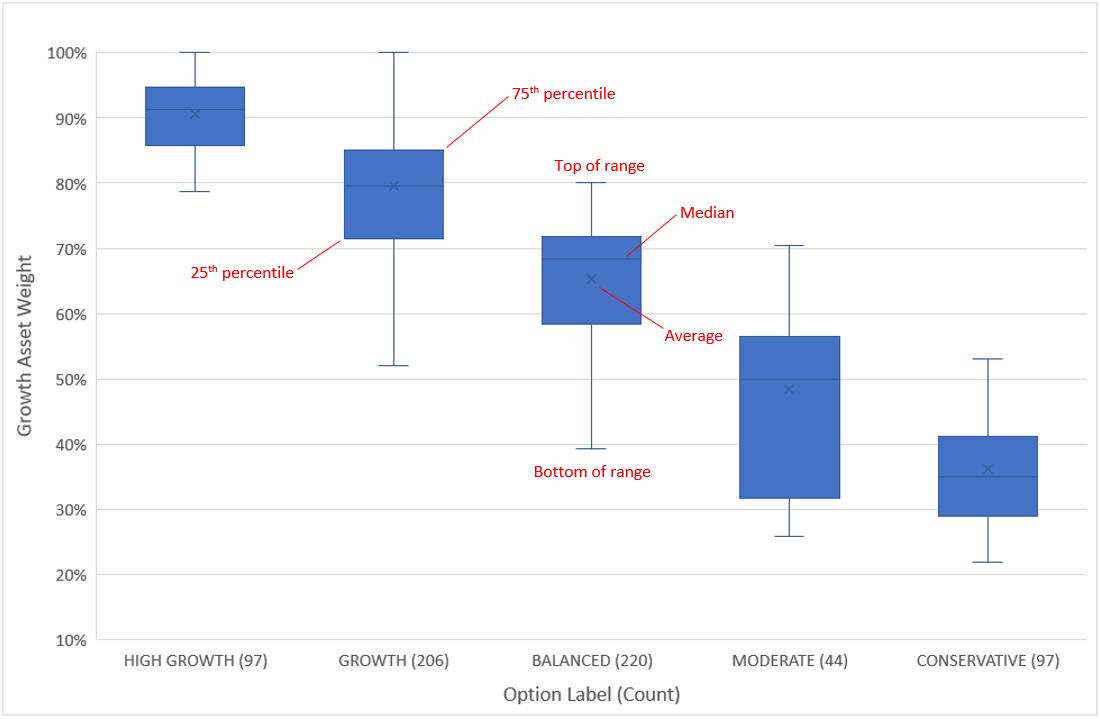

Our review of risk profile labels used in multi-asset Choice options found that the terms ‘High Growth’, ‘Growth’, ‘Balanced’, ‘Moderate’ and ‘Conservative’ are the most common labels used by trustees. Nearly 75 per cent of options with risk profile labels use labels that include these terms. To understand how these labels are used by trustees to communicate the option’s level of investment risk, we also compared each label against its calculated growth asset weight (GAW)2 in its strategic asset allocation. GAW indicates the portion of the portfolio that is invested in growth assets.

Each of these five labels (and the other less common labels we observed) had a range of GAWs in the market. Chart 1 captures the range (excluding outliers), mean and median GAW for all those labels that appeared three or more times in the dataset. We found that among the five most common risk-profile labels, High Growth has the highest average GAW followed by Growth, then Balanced, Moderate and Conservative with the lowest GAW.

While there are clear overlaps in the GAW ranges between these five labels (most obviously between options labelled ‘Moderate’ and ‘Conservative’), the general order in which they are used indicate some commonality of use of the terms.3 This is important because it provides a foundation on which super trustees can build to improve the consistency of investment option labels used in the market.

Issues to focus on

We found a number of issues with risk profile labels that warrant trustee attention.

Misalignment with level of risk: We found examples of options that use common risk profile labels, but in a manner inconsistent with the level of risk typical for that label. An example is an option labelled as ‘Defensive’ but with a GAW that is more akin to the median Balanced option. While these terms are not defined in any official regulation or industry standards, the use of labels in stark contrast to general industry practice does risk being misleading.

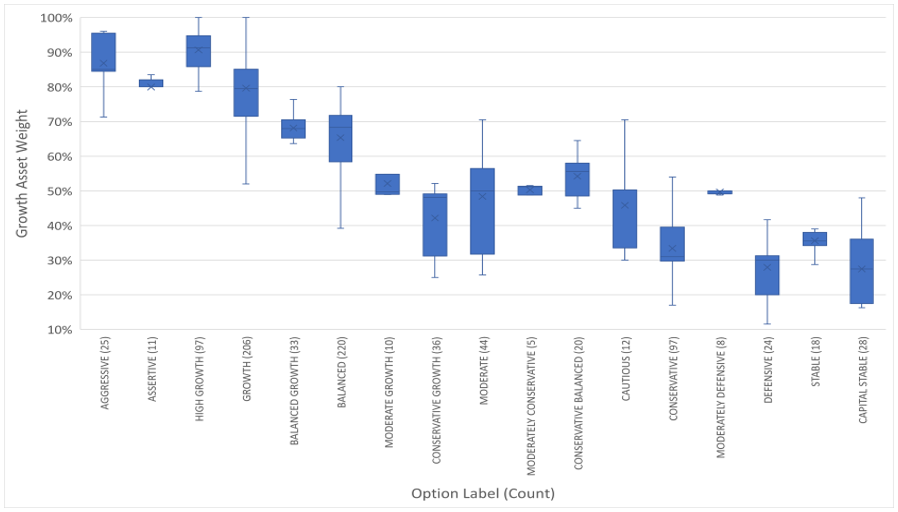

Too many uncommon labels: There is a proliferation of less common, even unique, risk profile labels. These make comparing options more difficult for consumers. Besides the five most common labels identified, we found more than 20 other risk profile labels for multi-asset class options. Most of these categories have GAW that overlap with one of the five most common. One of many such examples is that the GAW range of options labelled ‘Cautious’ overlaps entirely with that of options labelled ‘Moderate’.

Confusing or complex labels: We also

found some confusing combinations of terms in investment option labels, with some combining terms that, if given their standard meaning, are contradictory, such as ‘Conservative Growth’, ‘Moderately Conservative’.

Asset allocation – Single asset class labels

ASIC also considered options with labels that indicate assets are held in single asset classes, such as ‘Cash’, ‘Equities’, ‘Shares’, ‘Bonds’ or ‘Property’. In general, the asset allocations of such options were found to match the labels, though there were exceptions. It goes without saying that an option labelled ‘Cash’ that does not overwhelmingly contain cash or cash equivalents risks being misleading, even if detail about a more complicated asset allocation is published in the fine print of product disclosures. Trustees should note the relevant accounting standards and APRA reporting instructions and other guidance4 when categorising certain assets as either ‘cash’ or ‘cash equivalents’. ASIC is engaging with industry on such matters where necessary to seek corrective disclosures.

Portfolio management style

We noticed some option labels had a component related not to asset allocation but to portfolio management style. Here, we refer to terms such as ‘Passive’ or ‘Index’ to communicate an option where fund managers aim to match an index rather than select individual assets to outperform the market. We also saw the use of terms such as ‘Sustainable’ or ‘ESG’ to communicate a sustainable orientation to investment.

We observed that in most cases, the absence of terms relating to portfolio management style implied certain investment option features. For example, the absence of a term like ‘Passive’ or ‘Index’ generally implied that the option includes asset classes with active management.

It was also not uncommon for options labelled ‘Sustainable’ or similar, or ‘Passive’ or similar, to have no part of the label relating to risk profile. For options of this type, we found a GAW range that overlaps with the ‘Balanced’ range.

Marketing language: In our analysis, we noticed some labels contained extraneous marketing language or brand names. The use of product or brand names in labels for options that are not offered through investment platforms seem to add complexity without providing useful information. Some trustees also included terms that complicate labels without adding any useful information – for example, terms like ‘pooled’, ‘managed’ and ‘diversified’, all of which may be used to describe any superannuation investment option. These appear to be unnecessary marketing terms designed to impress, not inform, the consumer.

We note that investment option labels may include terms that signal a sustainable or ethical focus. However, the marketing of sustainable options, including any related misrepresentation (greenwashing), was not the focus of this work.

Looking ahead

Our analysis found a base of fairly consistent label usage by a range of trustees in the market, leading to a number of common terms having reasonably well-established meanings in standard practice. This includes use of the five most common labels – ‘High Growth’, ‘Growth’, ‘Balanced’, ‘Moderate’ and ‘Defensive’ – for a range of multi-asset class investment options.

However, we also saw some divergent behaviour and practices that may make it more difficult for consumers to understand and compare superannuation fund and option choices. Beyond misuse of labels for single-asset class options where the assets are not within the class, which is potentially misleading and deceptive, trustees should avoid:

• use of unusual or unique labels

• using common labels in a manner inconsistent with general market practice, and

• using common terms in odd or contradictory combinations or mixed with marketing language.

Trustees risk confusing consumers if their investment option labels use terms that are not meaningful, or worse, meaningful but misleading, such as by making the options appear more or less risky than they really are.

In the absence of explicit regulatory rules or industry standards about the use of investment option labels, ASIC expects trustees to give thought to their use of labels in investment menus, and whether the labels contribute to clear consumer understanding and sound decision making.

We strongly encourage trustees to use common terms that are consistent with market practice to provide clarity to consumers and to help direct them to investment options that match their investment and risk appetite. For the main menu of multi-asset class investment options, it would be clearer for consumers if trustees adhered to the most common labels for options in the central range of GAW, as captured in Chart 1.

When making an investment choice, members generally consider detailed disclosures, such as product disclosure statements, in addition to relying on their understanding of option labels. However, trustees should bear in mind that disclosure alone is insufficient. Investment option labels should be consistent with the key features and risks, and align with more detailed disclosures.

The design and distribution obligation, which took effect on 5 October 2021, go a step further. Trustees are required to prepare a target market determination (TMD) for each of their products as part of these obligations. For most trustees, their TMDs are due for a review this calendar year. We encourage trustees to consider the appropriateness of their investment option labels as part of this review.

Trustees undertaking their annual member outcomes assessment will also benefit from considering their option labels to determine whether the labels help consumers to make an informed investment choice about their superannuation.

- The dataset contains all investment options for which data was reported on SRF 550.0 Asset Allocation Table 1 by 1 June 2021. Due to staged implementation under SRS 550.0 Asset Allocation, RSE licensees were only required to submit data in respect of MySuper products and Trustee Directed Products as at 1 June. Reporting for other investments options was not mandatory until later in 2022.

- Growth Asset Weighting has been determined using the strategic sector of each asset allocation reported to APRA. The calculation uses the ‘Growth/Defensive’ classification used in APRA’s Superannuation heatmaps, details of which can be found at https://www.apra.gov.au/superannuation-heatmaps.

- One notable overlap is between the ‘Moderate’ and ‘Conservative’ categories, attributable in our view to the ‘Moderate’ label being used for options with a very broad range of GAW.

- See AASB 107 Statement of cashflows (especially paragraphs 6 and 7), Reporting Standard SRS 550 Asset Allocation and APRA’s June 2018 letter to trustees.