We’ve spent decades helping Australians build their super. Now comes the hard part: helping them spend it.

Australia’s superannuation system has done a remarkable job helping many people accumulate for retirement. But that success hasn’t yet translated into the retirement phase, turning those savings into reliable income for retirees. With more Australians retiring every year, this is both the next opportunity and pressing challenge for the sector, writes Aaron Minney, Head of Retirement Income Research at Challenger.

Supporting stronger member pathways

The introduction of Retirement Income Covenant in 2022 recognised that super doesn’t stop at retirement. It also brought sharper focus to the role funds can play in helping members navigate the decumulation phase.

While the focus is often on having a retirement income product, delivering strong member outcomes in retirement are best met through a combination of three components:

- Know your member: Understanding their composition, preferences and needs of the member base is essential for tailoring retirement solutions.

- Building a range of solutions: Funds should build and offer products to that reflect the needs of their members, recognising it’s not a one-size fits all solution.

- Providing clear guidance: Supporting members with relevant advice, education and tools helps retirees choose the solution that is right for their needs.

A range of pathways to support members

Super funds have many options to help their members generate income in retirement. A key part of this is providing education so members can have the right information when deciding how to convert their savings to an income stream. While education helps members understand their choices, many will need some form of advice at the critical point – at retirement. The question is: How will a member access the advice that suits their needs? Given diverse member preferences, funds should consider offering a variety of options.

Currently, a range of advice models operate within super funds. Some super funds follow a traditional advice model while others use scaled or digital solutions to assist with the large number of members in and approaching retirement that need help. The Conexus Institute has looked at a range of pathways for funds to offer retirement solutions. This discussion focuses on the advice and guidance elements, rather than retirement products.

Comprehensive personal advice

The traditional approach to supporting retirees has been through personal advice provided by a licenced financial adviser. This model considers a member’s full financial picture – including assets, liabilities and household circumstances – to create a tailored retirement income strategy. Advisers may be employed by the fund or operate independently on referral.

While comprehensive advice remains the gold standard for managing complexity and personalisation, it isn’t always practical or accessible.

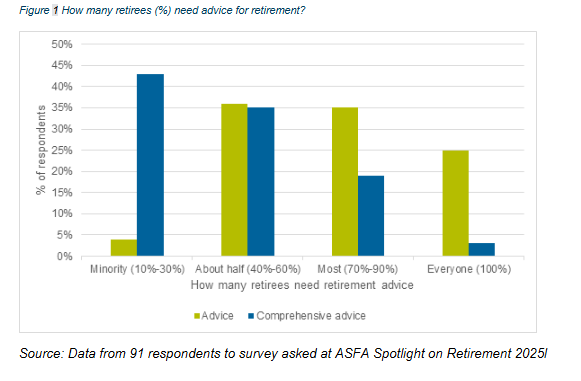

In recent years, the number of financial advisers has fallen to less than 16,000 on the ASIC register. This falls well short of what’s needed to service the 250,000 people approaching retirement every year – on top of those already receiving ongoing advice. Cost is also a barrier, with fees of up to $5,000 or more. This challenge was echoed in a live survey at ASFA’s Spotlight on Retirement event, where attendees acknowledged the importance of advice in retirement – but note that only a minority need full comprehensive advice. The challenge, and opportunity, lies in alternative advice, guidance and education pathways.

Hybrid and digital advice models

One promising solution to bridge the gap is hybrid advice. This model blends digital tools with human advice to lower cost and increase accessibility. Some super funds have begun to implement different forms of digital advice solutions for members, some with an annual fee, other tools provided as a service, and some consider one-off payments for the advice.

Success in implementing hybrid advice strategies will come from the ability to meet the need to advise members at scale. Digital solutions can be efficient and processing the information and allocating solutions, but people often prefer human advice. A hybrid advice approach can support this by enabling the member to engage with the digital elements, for as far as they are comfortable, and have the opportunity to engage with a human adviser before the final decision. The outcome is a large increase in productivity enabling the same adviser base to service a larger number of members.

General advice with member choice

Another approach that can generate scale benefits for a super fund is to provide enough information and guidance that members are equipped to make an informed decision on their own retirement solution. This is a very effective solution for members without complex retirement needs. While historically, this might have been used to help members start an account-based pension, funds have been helping members to implement broader solutions that meet the fund’s obligations under the Retirement Income Covenant.

Tools such as “cameos” and member profiles allow people to see how different solutions might apply to them. These can be paired with clear, general advice prompts encouraging members to seek further support when needed.

Take mortgage debt, for example. Rather than referring every member with a mortgage to an adviser, a fund might offer a general guidance statement like:

Many members who start retirement with a mortgage use a lump sum from their super to pay off the rest of their mortgage

Members with similar circumstances can recognise themselves in this and take confident, informed action – without needing to navigate the advice process unless their situation is more complex.

Better member outcomes

While the right retirement income products are critical, when paired with advice and guidance it delivers better outcomes for Australians in or approaching retirement.

Whether through comprehensive advice, hybrid models or general pathways, the common goal is the same: helping members make confident, informed decisions that support their lifestyle in retirement.

Stronger support at retirement also supports the fund itself – building trust, boosting retention, and delivering on the promise of super as a source of income in retirement.