For some years now, we have seen an increasing focus on fees within the superannuation system. The Royal Commission and the Productivity Commission looked closely at fees, and ASIC’s implementation of RG 97 and the recent release of APRA’s MySuper heatmaps ensures that this enhanced focus will continue into the future. While there is no doubt that fees have an impact on member outcomes and the right level of focus needs to be maintained, have we missed a trick on the other side of the ledger?

Early last year, APRA, in a letter to the industry, set out eight main areas of focus for 2019 and beyond, which ranged from trustee board capabilities to data and remuneration. APRA’s number one focus was on assessing and improving member outcomes, with an expectation that funds clearly articulate and measure their performance across a range of areas including but not limited to investment performance.

In APRA’s words: “Trustees should take a holistic approach to assessing the overall outcomes provided to members based on the products, options and services offered, including how they meet the needs of members in terms of performance, risk, diversification, fees and costs.” There is an opportunity for superannuation funds to add some additional streams of revenue to their bottom line, at little or no cost or risk, by undertaking a number of strategies that focus on leakages through their operational processes. Might these initiatives add to the “holistic approach…to overall outcomes” that APRA is referring to?

Add to the above the fact that we have been operating in a low return environment, a situation that is likely to continue for some time. The structure of a fund and/or governance with respect to operational leakage can have a material impact on investment returns when the economic environment is experiencing low growth. Is there an opportunity to review leakage within fund structures and the potential impact of such leakage on member outcomes?

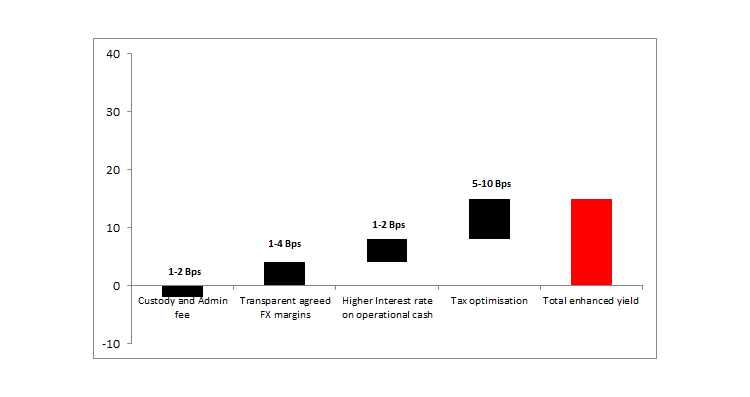

Our initial studies indicate that effective governance of operational efficiency can improve returns at a quantum significantly more than the administration fee levied by a custodian. Removing these inefficiencies is achievable but requires a better understanding of the hidden/indirect components of costs which are not directly reported against in annual reports, regulatory reporting to APRA and other documents.

So, what initiatives can your fund undertake to stem operational leakage and, in doing so, improve your net of fee outcomes? We have identified three key areas that should be front of mind for Trustees and their management teams:

- Interest income on operational cash

- Foreign exchange execution and margins

- Tax outflows with respect to Capital Gains.

Interest income on operational cash

Global cash rates are at an all-time low and the RBA has cut the official cash rate by 50 bps in the last few months. It’s also common place for global currencies to have a negative yield as custodians discourage holding cash on their balance sheets.

Looking at the interest rate earned on the frictional, or operational, cash you leave with your custodian as an example. A $20 billion fund with 3 per cent operational cash of $600 million could add up to 25 bps on this cash, yielding an additional $1.5 million p.a. Compounding this rate over many years in conjunction with underlying asset growth would produce a considerable amount of leakage from a fund’s returns.

Tax outflows with respect to Capital Gains

Tax is embedded in member account balances, therefore understanding and dealing with tax, in accordance with applicable tax law, is an important part of a trustee’s duties. While it is harder to quantify the overall tax effect there is certainly a case to be made that there is an opportunity to better manage the impact of Capital Gains Tax (CGT) in a fund’s investment decisions. It is likely that a superannuation fund’s single biggest potential saving resides in a greater focus on CGT, whether through optimising tax positions across portfolios or analysing tax outcomes pre-trade. Ensuring that your fund is structured appropriately, applying a tax outcome focus to manager selection including an understanding and awareness of the fund level tax implication of a proposed trade and providing your appointed managers access to pre-trade selection capability can provide a tangible impact to your underlying capital gains. Keeping with our example of a $20 billion fund, market experience indicates that management of these tax aspects could deliver a benefit to your members of anywhere between 7 to 16 bps a year. In fact in one example where a fund implemented a tax managed centralised portfolio management platform average savings of up to 38 bps were noted in the first few years of operation*.

Foreign exchange execution and margins

Historically, funds for the most part allowed their custodians to execute FX on their behalf on a “standing instruction” basis. Generally, these trades were done on a standalone basis with little or no netting taking place. Quite often there has been opaqueness to the rate at which such trades were executed consequent upon a lack of transparency around the timing of the trade. The result being that funds may be paying more than they need to for their FX trading.

So how can you mitigate against this uncertainty and “plug the leak” in FX transactional costs? Custodians have started undertaking an automated netting process across all trades undertaken by a fund on a daily basis. In fact, the netting process can occur a number of times throughout the day ensuring best execution. Further, we have seen that some custodians are willing to provide clients with set agreed margins, on a trade size basis and provide regular, independent reporting, to ensure total transparency across the trades undertaken.

Remaining with our $20 billion fund example above and applying an allocation to overseas assets of 40 per cent with a modest 50 per cent turnover, we encounter a situation where a fund’s notional FX volume per annum sits at $4 billion. Savings in transactional costs, through netting and/or fixed margins, is going to have a reasonable knock on effect to member outcomes. A 2bps saving in the above instance would yield an annual saving of $8 million.

Our example demonstrates that incremental changes to the operational governance of a fund have a quantum impact as the benefit is increased and materialised on a daily basis. A yearly benefit between $20-$25 million may be achievable – savings which are significantly greater than the average direct custody and administration fee for a fund of this size.

I’m not sure Italian economist Vilfredo Pareto ever envisioned that his theories on distribution of outputs and inputs would have been applied to the financial services sector in Australia more than a century later, the application of his principles are a worthwhile lesson for financial service providers today.