Currently, nearly all Australians are left to manage their superannuation risks in retirement. An example of this is the uncertainty people face around how long their money needs to last. Typically, retirees have little idea of whether they will be someone who survives into their late 90’s or if they might be one of the ones who die before they reach age 70. This uncertainty means nobody can accurately determine how much to safely withdraw from their super each year and be confident it will last.

The only option most superannuation funds offer to provide a retirement income is an account-based pension. With this pension, you make withdrawals from your balance as your ‘income’. Take out too much, and it could mean running out.

Studies referenced in the Actuaries Institute submission the Retirement Income Review indicated that most pensioners err on the side of caution and spend less than their assets can theoretically sustain, that is they are self-insuring their longevity risk. This cautious behaviour may mean a poorer retirement outcome. It also means significant death in retirement benefits are being paid to their children/estate. But that is not what superannuation tax concessions are designed to achieve.

Sharing the risk

Better retirement outcomes can be delivered by sharing risks amongst groups of retirees and helping each other. For example, pooling investments to gain more diversity or pooling longevity risk to deal with the uncertainty each retiree faces about their lifespan. Modelling by the Australian Government Actuary for the Financial System Enquiry Final Report shows that pooling longevity risk can result in a more stable lifetime retirement income that is 15 per cent to 30 per cent higher than merely drawing down from an account-based pension.

The account-based pension is perhaps misnamed. It is not a pension in the traditional sense. It is an investment account that requires a minimum level of annual withdrawals. The minimum level is a percentage of the balance which varies by age. For retirees under age 65, it is 4 per cent and increases at 75, 80, 85, 90 and 95 years when it reaches 14 per cent, although these rates have been halved by the Government for the short term as a response to the COVID-19 pandemic. There is no guarantee that the level of income paid will last for any specified length of time, let alone for life. Both the investment risk and the longevity risk are placed entirely on the individual.

A pension for life

The Government is currently reviewing the need for superannuation funds to offer better options for their retired members to turn super into income that will last for life. By providing an opportunity where longevity risk is insured will allow a pension to be paid for life.

The mathematics of insurance is based on pooling risk. People use insurance to insure their home and contents, cars and so on. They pay premiums which are pooled together with premiums of other people and when a claim is made the pool’s resources are there to pay the claimant. Why not use the same approach to insure the uncertainty of longevity risk?

When longevity risk is insured, it means payments for each retiree will last for life. It provides better security and, depending on how it is set up, can still allow retirees to have investment choice and an opportunity to have exposure to growth assets. Investment in higher-growth assets provides the opportunity to achieve higher returns and can be more likely to produce an income that can keep pace with long term inflation.

Extending purchasing power

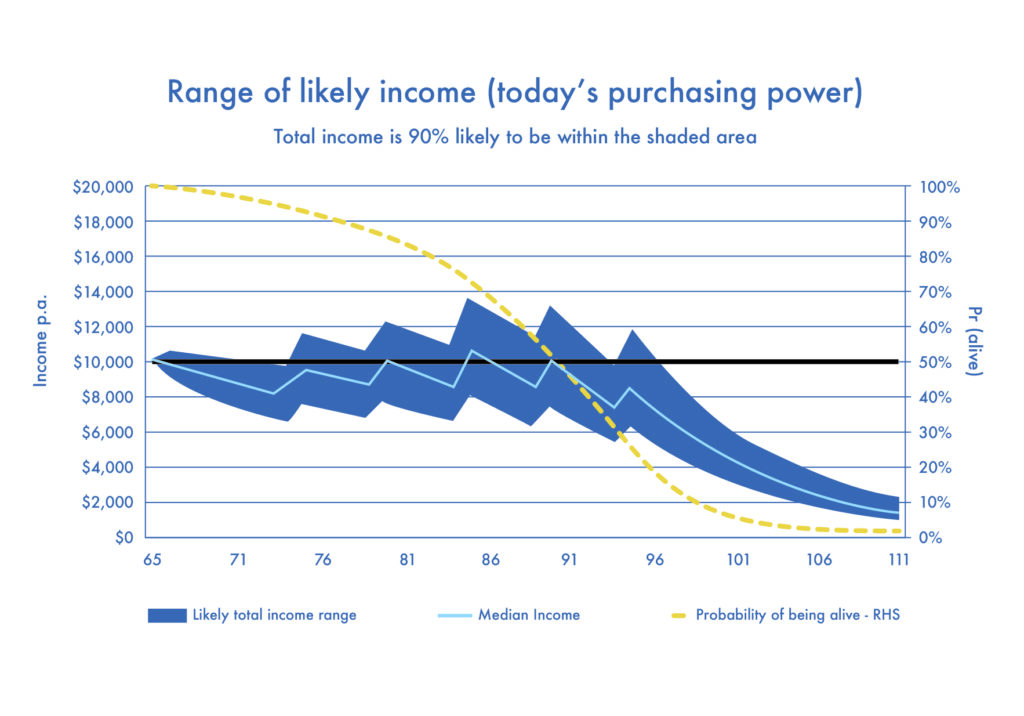

The following range of likely income charts, produced by Optimum Pensions, show the benefits of investing in a (pooled) investment-linked lifetime pension versus a standard account-based pension product (drawing the minimum age-based percentage).

The charts show the results of 1,000 simulated projections of investment returns (above CPI) over the next 50 years and assume a 66-year old female who is in good health with $200,000 in a conservative-balanced superannuation option (50 per cent allocation to growth assets). There is an estimated 90 per cent chance that her retirement income will be somewhere within the green shaded area each year of her life with a 5 per cent chance it will fall below or 5 per cent above the green shaded area. The red line in the middle of the shaded area shows the median. The dotted line is the probability of being alive and any given age.

Projected income from an account-based pension

Projected income from a pooled longevity product (investment-linked)

The pooled product is based on the design being considered by some of Australia’s largest superannuation funds. The rates used assume the same administration and investment management fee assumptions for both charts, with an additional fee of 0.5 per cent per annum of assets for the longevity insurance provided by a global reinsurer.

Pooling investments have been used for a long time by the superannuation industry. Members’ investments are pooled together, and many funds also use pooled investment vehicles. This has been done to minimise risk by gaining greater diversification and achieving higher returns. Funds also use pooled arrangements for providing insurance benefits for their accumulation members. In retirement, pooling continues to be used for investments. More importantly, pooling can also be used to provide longevity protection for a retiree. This will ensure retirees will have an income for life and higher returns by delivering investments in growth assets without the fear of the retirees running out of money.