The introduction of the Retirement Income Covenant requiring trustees of super funds to develop a retirement income strategy for beneficiaries who are retired or are approaching retirement, has forced funds to comprehensively assess and take action to best support their members as they retire. In conjunction with the superannuation system continuing to mature, we are observing a shift in focus for super funds from the accumulation phase to the retirement phase.

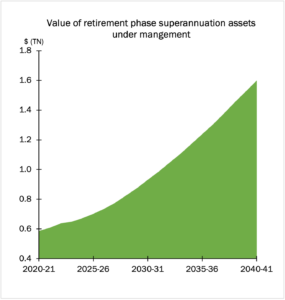

Figures from the Federal Government’s 2021 Intergenerational Report project that larger proportions of Australians can expect to receive higher balances at retirement age in the future. But the ever present and increasingly critical question for members is ‘will it be enough?’

Derived from Treasury’s 2021 Intergenerational Report

The inexorable rise in importance of the retirement phase versus the accumulation phase is driven by these simple facts:

- Super System

-

- Our compulsory defined contribution super system only started 30 years ago and is maturing

- Demographics

- A lot of people living in Australia were born around 65 years ago – the baby boomer bubble!

- People get older, and live longer as time passes

- Financials

- Increasing compulsory contributions

- Voluntary contributions from tax incentives

- Strong investment returns

Rise in demands and expectations of retirement

CommBank IQ’s recent report showed that people over 55 are continuing to increase their spend greater than the Consumer Price Index (CPI)—by 9 per cent to 13 per cent—while younger individuals are spending below CPI by 0 per cent to 6 per cent. This highlights that even in difficult times, retirees are willing to spend and broadly expect to earn significant income from their super to do that.

Many retirees, particularly the recent and soon-to-be retirees, have:

- high expectations of technology supported service capability from their super funds

- increased funds to support their lifestyles compared to older retirees

- a need for retirement advice, both financial and regarding lifestyle

- where interested, time to use web based financial tools to optimise use of their nest eggs.

Opportunities and challenges for super funds

Super funds need to be able to maximise after-fees, after-tax (credits) investment returns to provide retirees with the best possible retirement withdrawal and income streams benefits. They also need to meet their retired members’ increasing retirement service expectations – across ease of access to information and funds, advice, and a range of benefit options to best fit their individual changing circumstances over time.

A key part of this is addressing the basic question many retirees ask themselves. How long will my super money last? This depends on:

- the current balance in their super account

- the aged pension they are/will receive

- their living expenses and aspirational spending needs

- their age, gender and health

- many other unknowns outside the control or data collecting ability of the fund, such as household situation, investments outside super, home ownership etc.

Super funds need to be able to provide income streams that meet their retired members’ financial security and benefit their best financial interests. To do this, super funds need to find ways to reflect their members’ current and future financial circumstances reasonably accurately, which is difficult to near impossible in full, but needs to be attempted; acknowledging the limitations to help members to achieve their retirement needs.

Retirement phase SWOT analysis for super funds

The following tables present a SWOT analysis highlighting six critical areas and key considerations for a super fund to be successful in enhancing member outcomes in the retirement phase.

| Retirement income | |

| Opportunity | Enhance retired members’ lives by providing pensions which grow and support quality of life.

A retirement phase market that is growing at a rate greater than GDP and already pays $11bn in pensions every year. |

| Challenge | To meet members’ needs and expectations by generating sustainable high returns with limited risk and ensuring sufficient income for their lifetime, while maintaining strong governance and risk management. |

| Strengths | Big funds have increasing brand power, the scale to keep fees down, and the ability to invest in new design and systems.

Small funds have member loyalty and flexibility with outsourcing capability in a growing market. |

| Threats | Big funds – potential complacency and loss of hunger to innovate.

Small funds – costs and regulatory pressures. |

| Investment returns | |

| Opportunity | Global choice of markets and fund managers and the ability to invest in innovative and illiquid asset classes. |

| Challenge | Managing in-house investment teams during periods of underperforming. |

| Strengths | Ability to make long term investments which match liabilities.

Scale for private unlisted assets and the capability to manage illiquidity. |

| Threats | Poor investment performance compared to the market and competitors.

Overseas mega fund managers or financial arms of tech players establishing or expanding in Australia. |

| Longevity protection | |

| Opportunity | Provide assurance to retirees of some income for as long as they and their spouse live – to meet their core and comfort needs. A key element of a fund’s retirement income covenant. |

| Challenge | Keeping it simple. Complexity of design and communication of products / options which deliver value to retirees.

Getting the right mix of longevity insurance and investment strategy. |

| Strengths | Big funds have the ability to research and fund innovative products tailored to their clients’ needs.

Small funds will increasingly gain access to generic pension product designs from third parties. |

| Threats | Reluctance of retirees to lock money away.

Limited longevity expertise within funds. |

| Advice | |

| Opportunity | As the Levy Report sets out, there is a huge demand and need for financial advice, especially around retirement. |

| Challenge | Providing advice at an affordable price to ensure members ask and take advice. |

| Strengths | Super funds, with their large memberships, are in the ideal position to provide advice and indeed need t o if they are to best meet their purpose. |

| Threats | The Federal Government not implementing the Levy Report reforms, resulting in super funds not being able to give enough advice to members. |

| Fees and costs | |

| Opportunity | To enhance member outcomes by reducing fees – the only controllable element of net investment returns. |

| Challenge | High inflation of input costs including wage growth.

Improving productivity. |

| Strengths | Big funds – ability to invest in technology to drive more efficient and effective operations.

Small funds – flexibility to innovate using third parties in fintech, regtech and funds management. |

| Threats | Inability to keep costs sufficiently low, leading to lack of competitiveness, failing to meet members’ best financial interests and ultimately ceasing business. |

| Regulation, governance, risk management | |

| Opportunity | To be the best globally governed financial institutions in the world.

To improve embedding a true culture that prioritises members’ interests first in everything a super fund does. |

| Challenge | To be truly open to change to improve organisational culture, governance, management operational performance.

To be strong in dealing with conflicts of interest for fund versus member. |

| Strengths | Existing legal trustee fiduciary duty and member best interest framework. Existing APRA framework with extensive risk management and governance standards.

Substantial industry good practice guidance. |

| Threats | Complacency on good governance and good management. Bigger is not necessarily better, especially on leadership and performance.

The $3.5 trillion honey pot that is super naturally increases the risk of (i) attracting fraudsters with sophisticated techniques to steal data and scam members, and (ii) poor industry behaviour which conflicts with the best interests of members such as potentially misusing inside knowledge of impending unit price changes from revaluing unlisted assets. |

Taking action: what should super funds do?

- Make the mindset change from a focus on super accumulation and support insurance during a member’s working life, to providing retirement income and longevity assurance. Ensure a retirement income centric approach is reflected in all the fund’s governance and management to truly embody the objective of super as per the Treasury’s current consultation paper – “to preserve savings to deliver income for a dignified retirement…”.

- Make the big investments now in the specialist skilled professionals and the systems that will enable you to deliver the best retirement phase solutions and support for members.

- Consider whether you should merge to create or be part of a larger fund to provide the scale necessary to deliver enhanced retirement phase outcomes and services.

- Encourage all to continue to lobby for compulsory inclusion of self-employed individuals, including gig economy workers so that all Australians can have a secure, dignified retirement.

- Relentlessly focus on reducing costs by improving efficiency, avoiding corporate bureaucracy creep, and closely monitoring and reporting cost statistics.

- Use your internal audit function and external independent advice as part of your required APRA annual and triennial reviews on risk management to dig deeper into your current governance and risk management practices, including benchmarking your fund against best practice.

- Leverage technology to provide good value advice to all your members, particularly around retirement planning.