ASFA, the voice of super, is unveiling some welcome news for retirees as the season of giving approaches – the cost of funding a comfortable retirement fell by 0.5 percent in the September quarter, leaving more money in the pocket for Santa’s little helpers.

The findings come from the latest edition of the peak superannuation association’s ASFA Retirement Standard, as it marks 20 years as the benchmark guide for how much money people need in retirement.

“The easing in short-term retirement budget pressures will be a welcome holiday gift for retirees at this time of year,” said ASFA CEO Mary Delahunty.

“It’s great that in its 20th year of providing Australians with the definitive guide on how much money they need in retirement, the ASFA Retirement Standard can show some relief for retirees after a couple of tough years of rising costs of living.”

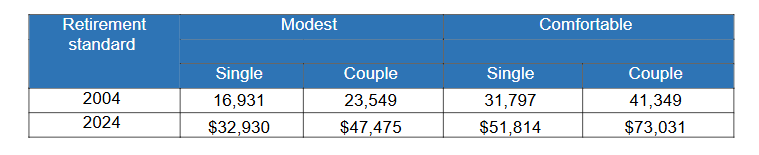

The latest data shows that in order to reach the ASFA Comfortable Standard, couples aged around 65 now need $73,031 annually to achieve a comfortable retirement, while singles need $51,814,

This equates to $595,000 in superannuation savings for a single person retiring at age 67, and $690,000 for a couple retiring at age 67. The September quarter retiree budget fall was driven by factors such as lower automotive fuel prices and Commonwealth and State Government rebates aimed at lowering the cost of energy.

Retirees have also done better over the past 12 months than the wider population, with retirement budgets increasing by 1.8 per cent over the year, compared with a lift in the Consumer Price Index (CPI) of 2.8 percent.

However, Ms Delahunty added that while the short-term picture is positive, over the twenty years of the ASFA Retirement Standard, increases in retiree budgets have outpaced those of the general population, due to the specific costs of people who have finished work.

“This shows Australians need to manage their retirement savings carefully and is why it’s clear Australians need better access to trusted, affordable financial advice to help them plan for their financial future. That’s why we welcome the financial advice reforms recently announced by the Government,” she said.

Spending categories showing the largest quarterly and annual price increases:

- Food: Prices rose 3.3 per cent over the 12 months to the September quarter, with sharp rises for essentials like fruit and vegetables.

- Health: Dental services rose 0.9 per cent this quarter. Over the past 12 months medical and hospital services prices rose by 5.6 per cent.

- Transport: Costs were down in the quarter, with automotive fuel dropping by 6.7 per cent and urban transit down 2.1 per cent.

- Insurance: Costs increased by 2.8 per cent, with rises in premiums across house, home contents and motor vehicle insurance reflecting higher reinsurance, natural disaster and claims costs.

- Travel: International holiday travel and accommodation was up 1.9 per cent in the quarter, while domestic holiday travel and accommodation rose by 1.1 per cent.

20 years of the ASFA Retirement Standard

The ASFA Retirement Standard sets the industry benchmark by capturing the costs of essentials like health, communication, clothing and household goods.

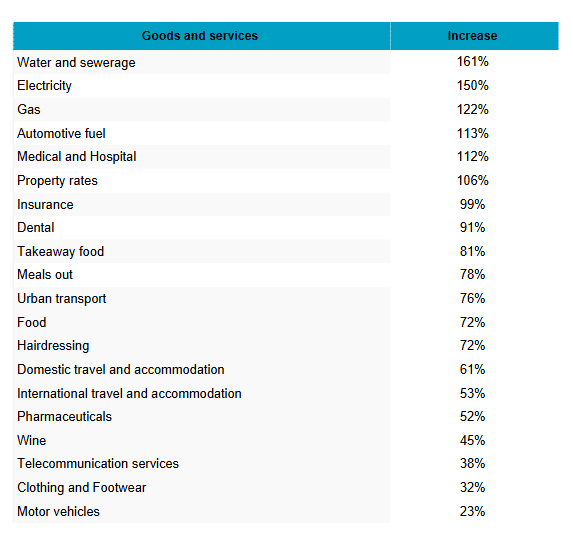

Over two decades the cost of a comfortable retirement has increased by 75 per cent, with modest budgets almost doubling. This compares to the 66.4 per cent CPI increase that has occurred in Australia since 2004. Price increases for necessities and shifting community needs, such as the inclusion of private health insurance in retirement, have contributed significantly to these increases.

Table 1: Comfortable and Modest Retirement Budgets – 2004 vs. 2024

Key long-term trends:

- Electricity – risen by 150 per cent

- Fuel – risen by 113 per cent

- Medical and hospital services – risen by 112 per cent

- Food – risen by 72 per cent

- Property rates and water charges – risen by 106 per cent and 161 per cent respectively

Table 3 below provides details of the price increases over the last 20 years for various categories of retiree expenses.

Ms Delahunty reflected on the Retirement Standard’s evolution. “For two decades the ASFA Retirement Standard has been a trusted compass for Australians, adapting to meet shifting community expectations and provide a clear roadmap to retirement security.

“As the peak association for super, we know that tools like the Standard give our members a helpful way to engage with Australians on their retirement journey.”

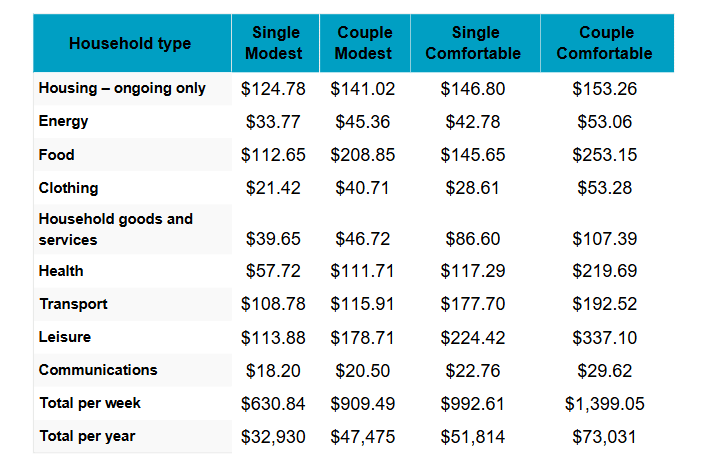

Table 2: Budgets for various households and living standards for those aged around 65 (September quarter 2024, national)

The figures in each case assume that the retiree/s own their own home and relate to expenditure by the household. This can be greater than household income after income tax where there is a drawdown on capital over the period of retirement. All calculations are weekly, unless otherwise stated. Annual figure is 52.2 times the weekly figure.

Table 3: Price increases over the last 20 years

Australians’ expectations of retirement

In addition to the Retirement Standard, ASFA has released the latest findings of its survey* into Australians’ expectations of retirement.

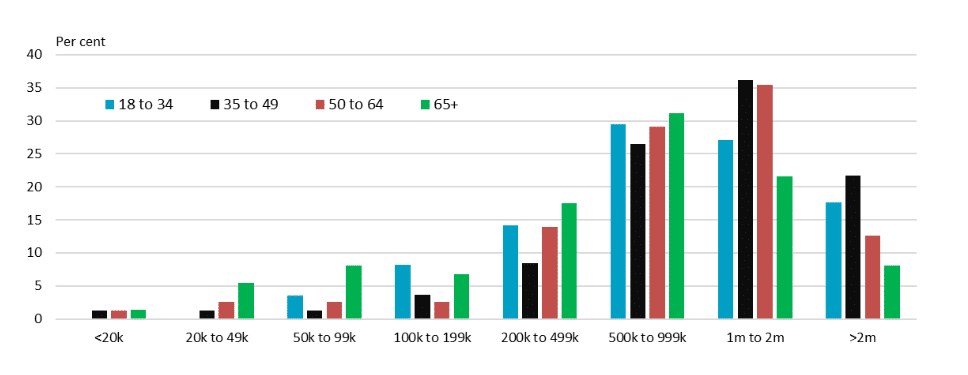

The comprehensive and representative survey found 30 per cent of respondents felt they will need between $500,000 and $1 million in superannuation to retire comfortably. Around the same proportion said they would need between $1 million to $2 million.

The research found only half the people surveyed had sought professional advice to plan their retirement.

ASFA CEO Mary Delahunty said the varied results of this research highlight the need for quality financial advice to be more accessible to help Australians make the best decisions to improve their retirement outcomes.

“It’s clear from our research that many Australians are overestimating the amount of money they need to comfortably retire, while some are underestimating it.

“This is where access to affordable and accessible financial advice could make a world of difference, and why ASFA supports the Government’s recent announcement of Tranche 2 of the Delivering Better Financial Outcomes (DBFO) reforms, which will help increase the supply of financial advice, thereby lowering the cost of high-quality advice. These reforms will help people make confident, informed decisions about their retirement.

“ASFA remains committed to working across the sector and with the Government to ensure the DBFO reforms, that seek to address these issues, pass Parliament as soon as possible,” Ms Delahunty added.

Table 4: Distribution of the amount of super individuals think they need for a comfortable retirement

* The survey comprised 1,500 adults – representative of the broader population in terms of age, gender, education and whether respondents reside in urban or regional areas.

For further information, please contact:

ASFA Media team, 0451 949 300.

About the Association of Superannuation Funds of Australia (ASFA)

ASFA, the voice of super, is the peak policy, research and advocacy body for Australia’s superannuation industry. It is a not-for-profit, sector-neutral, and non-party political, national organisation. ASFA’s mission is to continuously improve the superannuation system, so all Australians can enjoy a comfortable and dignified retirement.

About the ASFA Retirement Standard

Since 2004 the ASFA Retirement Standard has served as a retirement companion for Australians, providing a reliable retirement savings guide by benchmarking the annual budget needed to fund either a comfortable or modest standard of living in the post-work years. It is updated quarterly to reflect inflation, reviewed regularly to reflect changes in lifestyle, and provides detailed budgets of what single people and couples would need to spend to support their chosen lifestyle. It is generally accepted by superannuation funds, financial planners, the media, web calculators and by fund members as the accepted benchmark for the adequacy of retirement savings.

More information

Costs and summary figures can be accessed via the ASFA website. Australians can find out more about superannuation on the independent Super Guru website.