The latest figures from ASFA, the voice of super, reveal that retirees are grappling with the with increasing costs for essential goods and services, seeing the cost of funding a comfortable retirement increase by 3.7 per cent over the last 12 months.

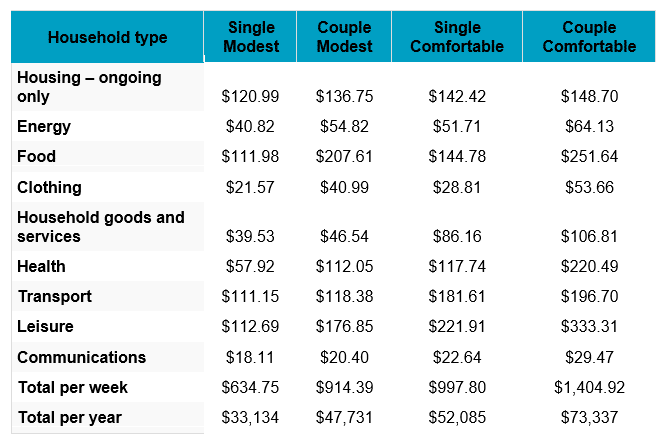

The June quarter saw notable increases in home and vehicle insurance costs, as well as private health insurance prices. These pressures have resulted in further financial strain on retirees, with budgets rising by 0.9 per cent for both singles and couples during the quarter. As a result, couples around the age of 65 now need $73,337 per year to enjoy a comfortable retirement, while singles require $52,085.

For 20 years, the ASFA Retirement Standard has set the industry benchmark, capturing the costs of essentials like health, communication, clothing, and household goods. It not only reflects community expectations but also drives the evolving standards and spending habits of retirees.

ASFA CEO, Mary Delahunty, highlighted the financial challenges that retirees are currently facing. “Retirees are managing an increasingly difficult landscape where the costs of essential goods and services keep rising. Health, home, and transport are vital to their well-being, yet the expenses tied to these necessities are steadily increasing,” she noted.

Ms. Delahunty also emphasised the importance of both compulsory superannuation and voluntary contributions, which provide retirees with the financial security they need to enjoy their later years. “For Australians to have the retirement they deserve, it’s crucial that they have access to adequate superannuation savings,” she concluded.

The latest ASFA Retirement Standard continues underscore the ongoing challenges that retirees face in managing their finances amid persistent cost pressures. As living expenses steadily rise, the need for considered financial planning and adequate superannuation savings has never been more critical.

Spending categories showing the largest quarterly and annual price changes:

- Insurance Costs: Insurance premiums saw a sharp increase, rising by 3.1% in the June quarter and 14.0% over the past year. This surge is largely due to higher reinsurance costs, the impact of natural disasters, and increased claims.

- Private Health Insurance: Private health insurance premiums increased by an average of 3.03% from April 1, marking the largest rise since the pandemic began. This has added to the financial burden on retirees, particularly those on fixed incomes.

- Electricity Prices: Electricity costs rose by 2.1% in the June quarter and 6.0% over the past year. The Energy Bill Relief Fund provided some relief, but without these rebates, electricity prices would have increased by 14.6% over the 12 months to June 2024.

- Food Costs: While annual food inflation eased slightly to 3.3% in the June quarter, down from 3.8% in March, retirees still face rising costs for essentials like fruits and vegetables, which are 3.7% higher than a year ago.

- Clothing and Footwear: Prices for clothing and footwear rose by 3.1% during the quarter, driven by the introduction of new season stock and the end of sales promotions.

- Fuel Prices: Automotive fuel prices increased by 1.7% in the June quarter, adding to the ongoing volatility in fuel costs that retirees must manage.

- Travel and Accommodation: While domestic travel costs remained stable, international travel and accommodation expenses increased by 8.1%.

Table 1: Budgets for various households and living standards for those aged around 65 (June quarter 2024, national)

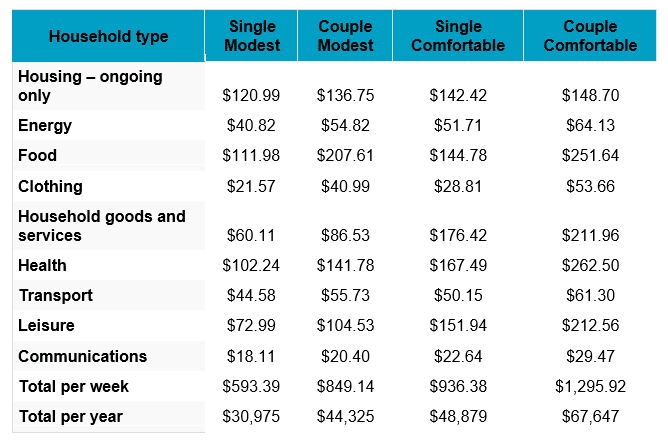

Table 2: Budgets for various households and living standards for those aged around 85 (June quarter 2024, national)

The figures in each case assume that the retiree/s own their own home and relate to expenditure by the household. This can be greater than household income after income tax where there is a drawdown on capital over the period of retirement. All calculations are weekly, unless otherwise stated. Annual figure is 52.2 times the weekly figure.

For further information, please contact:

ASFA Media team, 0451 949 300.

About the Association of Superannuation Funds of Australia (ASFA)

ASFA, the voice of super, is the peak policy, research and advocacy body for Australia’s superannuation industry. It is a not-for-profit, sector-neutral, and non-party political, national organisation. ASFA’s mission is to continuously improve the superannuation system, so all Australians can enjoy a comfortable and dignified retirement.

About the ASFA Retirement Standard

Since 2004 the ASFA Retirement Standard has served as a retirement companion for Australians, providing a reliable retirement savings guide by benchmarking the annual budget needed to fund either a comfortable or modest standard of living in the post-work years. It is updated quarterly to reflect inflation, reviewed regularly to reflect changes in lifestyle, and provides detailed budgets of what single people and couples would need to spend to support their chosen lifestyle. It is generally accepted by superannuation funds, financial planners, the media, web calculators and by fund members as the accepted benchmark for the adequacy of retirement savings.

More information

Costs and summary figures can be accessed via the ASFA website. Australians can find out more about superannuation on the independent Super Guru website.