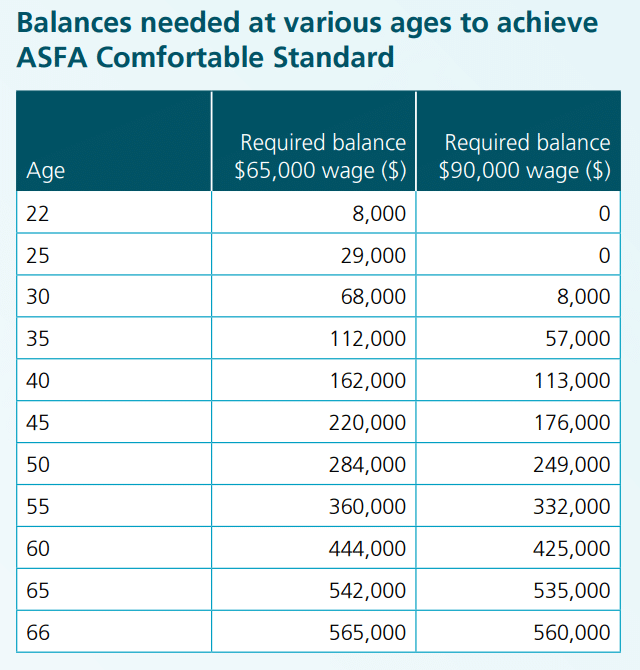

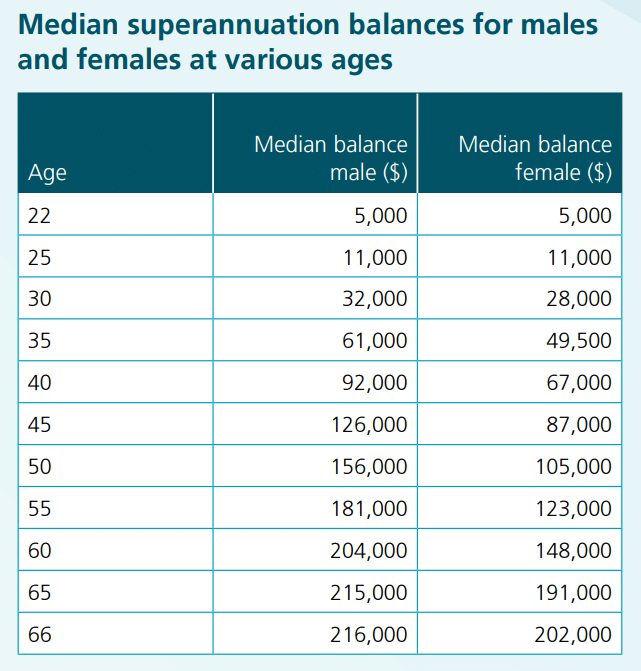

The Association of Superannuation Funds Australia (ASFA) today released new data on the retirement savings needed at various ages to achieve a comfortable standard of living in retirement, together with data on the superannuation balance for the average Australian male and female at various ages.

The analysis indicates that while those on a wage of $90,000 a year will potentially achieve the level of savings required to support a retirement lifestyle at the ASFA Comfortable level, this will require Super Guarantee (SG) contributions at the rate of 12 per cent of wages for around 35 continuous years. For an individual on $65,000 a year, SG contributions at 12 per cent would be needed for around 45 years.

Women generally have lower super balances than men, with the gap starting to widen from age 30 onwards. Leading up to retirement age, the median super balance for women is around 25 per cent lower than for men.

ASFA has long advocated for policy measures to reduce the retirement savings gender gap.

“A key reason for the retirement savings gender gap is women taking time out of the workforce, or working reduced hours, to have and raise children,” said ASFA Deputy CEO, Glen McCrea.

“Compulsory super should be extended to paid parental leave (PPL), including the Government’s PPL scheme.”

ASFA has separately advocated for a ‘Super Baby Bonus’, whereby the Government would deposit $5,000 into the superannuation account of women upon the birth of a child.

“In addition, for women who return to work on reduced hours, extending the Low-Income Superannuation Tax Offset (LISTO) would also boost super balances of low-income earners,” said Mr McCrea.

The LISTO is a government payment that effectively refunds tax paid on super contributions. ASFA considers that the upper threshold should be raised to $45,000 and that the maximum payment be increased accordingly to $700. This change would increase the number of women benefiting from the scheme from around 1.4 million to around 1.9 million per year.

ASFA’s Super Guru website also provides extensive information on the options available for individuals to top up their superannuation savings. There are a variety of tax concessions and co-contributions available that can potentially help individuals to boost their retirement savings.

Access details of the superannuation balance needed to meet the ASFA Comfortable Retirement Standard here and for balances at various ages for the average male and female here.

For further information, please contact:

ASFA Media team: 0451 949 300

About ASFA

ASFA is the peak policy, research and advocacy body for Australia’s superannuation industry. It is a not-for-profit, sector-neutral, and non-party political, national organisation. ASFA’s mission is to continuously improve the superannuation system, so all Australians can enjoy a comfortable and dignified retirement.