29 November 2023

Retirees continue to face unavoidable cost pressures

Australian retirees continue to face significant cost pressures on their household budgets across a range of expenditure items.

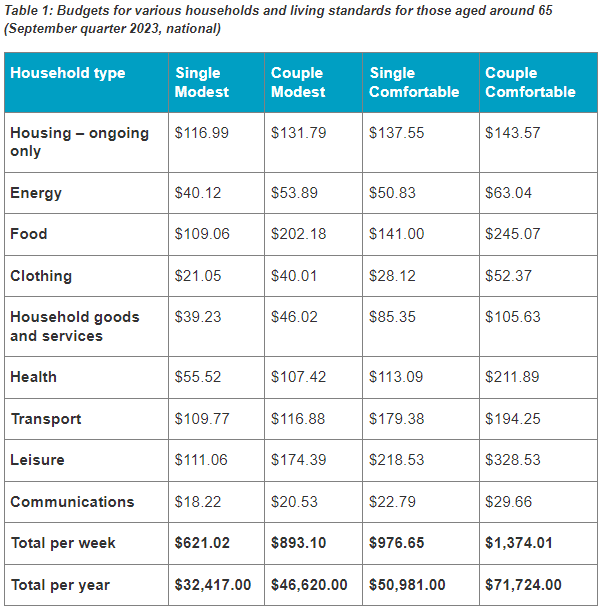

The Association of Superannuation Funds of Australia (ASFA) finds the annual expenditure needed to reachASFA’s comfortable Retirement Standard rose 1.3 per cent in the September quarter to hit a record high of $71,724 per year for couples.

The annual expenditure needed by singles rose 1.5 per cent to $50,981, taking the annual increase to 5.5 per cent. This was about the same as the 5.4 per cent increase in the general CPI.

“Retiree budgets have been under sustained pressure for the last two years,” said ASFA Interim CEO, Leeanne Turner.

“In the past 12 months alone utility prices have surged more than 12 per cent as the cost of electricity, water, and gas continues to rise.”

The cost of electricity was up on average by 4.2 per cent in the September quarter. The cost increase was even greater for households not eligible for electricity rebates. This includes retiree households in a number of States who are not eligible for the Age Pension or the Seniors Health Care Card. Excluding the rebates, electricity prices increased 18.6 per cent.

There also were significant increases in housing costs, with a 4.4 per cent increase in the quarter in council rates, and a 4.7 per cent increase in water and sewerage charges. Typically increases in these categories occur annually in the September quarter.

Increased petrol prices also had a substantial impact.

Automotive fuel prices rose 7.2 per cent in the September quarter, which is the highest quarterly rise since March 2022.

However, there was better news in regard to some other categories of expenditure. Annual food inflation eased to 4.8 per cent in the September quarter, down from 7.5 per cent in the June quarter and the peak of 9.2 per cent in December 2022. Fruit and vegetable prices fell 6.4 per cent compared to 12 months ago.

The ASFA comfortable standard includes the cost of everyday expenses such as health, communication, clothing and household goods and reflects community expectations as well as changing lifestyle expectations and spending habits.

Spending categories showing largest quarterly price increases:

- Insurance (+2.8%) rose across house, house contents and motor vehicle insurance. This was the strongest quarterly rise since 2000.

- Medical and hospital services rose 1.0% as some private health insurance providers increased premiums after being frozen. Typically, private health insurance providers increase premiums in April. Indexation of Medical Benefits Schedule fees from July 2023 also contributed to the rise.

- Dental services rose 2.5% driven by rising wages and input costs.

- Telecommunication providers increased mobile and internet plans. The rise of 1.9% for telecommunication services was the largest quarterly rise since 2000.

- Postal services rose 8.2% due to higher fuel costs and postage rates for parcel delivery.

Details for the various updated budgets follow.

The figures in each case assume that the retiree/s own their own home and relate to expenditure by the household. This can be greater than household income after income tax where there is a drawdown on capital over the period of retirement. All calculations are weekly, unless otherwise stated. Annual figure is 52.2 times the weekly figure.

For further information, please contact:

ASFA Media team: 0451 949 300

About ASFA

ASFA is the peak policy, research and advocacy body for Australia’s superannuation industry. It is a not-for-profit, sector-neutral, and non-party political, national organisation. ASFA’s mission is to continuously improve the superannuation system, so all Australians can enjoy a comfortable and dignified retirement.