The Association of Superannuation Funds of Australia (ASFA), the voice of super, finds the cost of funding a comfortable retirement increased by 3.3 per cent over the last 12 months, due to a raft of higher costs, including medical expenses and insurance premiums.

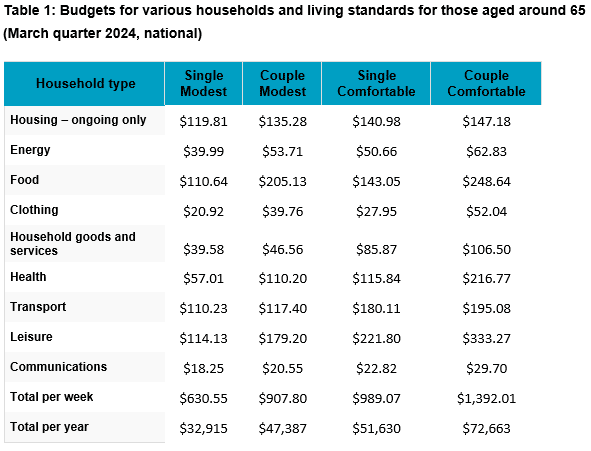

In the March quarter, the ASFA Comfortable Retirement Standard rose 0.7 per cent to hit a record high of $72,663 per year for couples, and $51,630 per year for singles.

“Retirees continue to feel considerable cost of living pressure on their household budgets. Fortunately, in the past three months, we’ve seen the pace of price rises ease somewhat in key spending categories, namely food and fuel,” says ASFA CEO Mary Delahunty.

Since 2004 The ASFA Retirement Standard includes the cost of everyday expenses such as health, communication, clothing and household goods and reflects community expectations as well as changing lifestyle expectations and spending habits.

“Ongoing inflationary pressure reinforces the need for Australia’s strong superannuation system which is designed to ensure retirees can achieve a dignified lifestyle in their post-work years, and adequate retirement income to withstand these more challenging times,” concluded Ms Delahunty.

Spending categories showing the largest quarterly and annual price changes:

- Medical and hospital services rose 2.3 per cent in the quarter, higher than the 1.2 per cent in the December quarter.

- Insurance prices rose 3.7 per cent from the December quarter and 16.4 per cent annually, which is the strongest annual rise since 2001. Higher reinsurance, natural disaster and claims costs continue to drive higher premiums for house, home contents and motor vehicle insurance.

- Annual food costs rose by 3.8 per cent, down from the 4.5 per cent in the December quarter. Bread and cereal prices rose by 7.3 per cent over the year, with prices for dairy products rising by 4.1 per cent over the year. Over the quarter the price of fruit and vegetables was up 2.5 per cent offset to an extent by a 0.7 per cent fall in meat and seafood.

- Automotive fuel prices on average fell by 1.0 per cent in the March quarter, with an average unleaded petrol price for the quarter of $1.94 a litre.

- Electricity prices rose moderately at 2.0 per cent over the year. The introduction of the Energy Bill Relief Fund rebates from July 2023 has driven down and moderated increases for eligible households. Many self-funded retirees have not been eligible for these past rebates but will qualify for the rebates to be paid in forthcoming quarters that were announced in the Budget. Excluding the Energy Bill Relief Fund rebates, prices increased by 17.0 per cent over this period.

- Domestic travel and accommodation rose 1.3 per cent over the quarter. Holidaying domestically has remained popular and prices remained elevated for domestic accommodation and airfares.

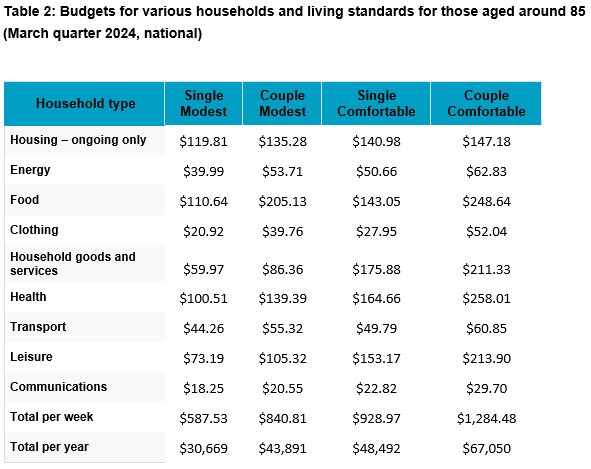

The figures in each case assume that the retiree/s own their own home and relate to expenditure by the household. This can be greater than household income after income tax where there is a drawdown on capital over the period of retirement. All calculations are weekly, unless otherwise stated. Annual figure is 52.2 times the weekly figure.

For further information, please contact:

ASFA Media team, 0451 949 300.

About ASFA

ASFA, the voice of super, has been operating since 1962 as the peak policy, research and advocacy body for Australia’s superannuation industry. ASFA represents the APRA regulated superannuation industry with over 100 organisations as members from corporate, industry, retail and public sector funds, and service providers.

About the ASFA Retirement Standard

Since 2004 the ASFA Retirement Standard has served as a retirement companion for Australians, providing a reliable retirement savings guide by benchmarking the annual budget needed to fund either a comfortable or modest standard of living in the post-work years. It is updated quarterly to reflect inflation, reviewed regularly to reflect changes in lifestyle, and provides detailed budgets of what single people and couples would need to spend to support their chosen lifestyle. It is generally accepted by superannuation funds, financial planners, the media, web calculators and by fund members as the accepted benchmark for the adequacy of retirement savings.

More information

Costs and summary figures can be accessed via the ASFA website. Australians can find out more about superannuation on the independent Super Guru website.