18 October 2023

PAUSE and invest the time to check your retirement savings this World Menopause Day

The Association of Superannuation Funds of Australia (ASFA) is encouraging women to pause and take the time to check their superannuation balance to see how they’re tracking towards their retirement goals.

World Menopause Day on 18 October is designed to raise awareness of the challenges posed by menopause and to drive supportive solutions to help improve wellbeing outcomes, across physical, mental, and financial health.

“It’s important for women to engage with their superannuation as they approach Menopause1, and to take small actions which can make a big difference in their retirement outcomes,” said ASFA CEO Leeanne Turner.

Not only do women miss out on superannuation when they take time out to have children, the impact is compounded when women reach menopause and have to reduce their working hours due to associated health issues.

ASFA estimates the combined impact of missing out on Superannuation Guarantee on Paid Parental Leave and unpaid time taken from work due to menopausal symptoms to be $25,000 for a woman with two children.

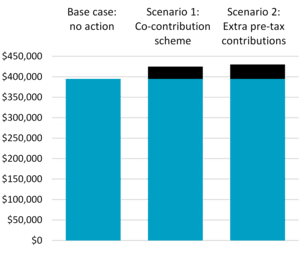

The average superannuation balance for women aged 46-54 is $162,000, significantly less than the average for men of the same age which is $218,000. A 51-year-old woman with $162,000 in superannuation will have approximately $390,000 at retirement at the age of 67 (see Chart 1).

Chart 1: Average super balance at age 51, and projections for future balances

Source: ATO and ASFA calculations. Projections assume average wages ($70,000 per annum) are earned from age 51 until retirement at age 67, and an investment rate of return of 6 per cent (after investment fees and taxes).

ASFA research finds that single women tend to have super balances below the average and that around 15% of women aged 45-54 have a zero-superannuation balance.

Ms Turner says there are several actionable steps to take now to help increase superannuation savings in the lead up to retirement.

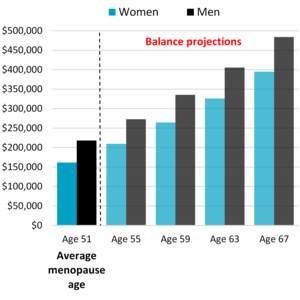

- Take advantage of the super co-contribution scheme and qualify for a 50% top-up on the contribution.For example, a $1,000 annual after-tax contribution to superannuation for someone earning $40,000 per annum (and qualifying for the co-contribution) could mean an extra $30,000 in superannuation at retirement.(2)

- Make additional pre-tax contributions up to your concessional contribution cap of $27,500.(3)For example, making a pre-tax contribution of $2,000 for someone on $90,000 could mean an extra $35,000 in retirement.(4)You may also be eligible to carry forward unused amounts of earlier years’ contributions if you have an account balance of less than $500,000.For example, if you have an account balance of $160,000 and have used $10,000 of your concessional contribution cap for the last 5-years you may be able to contribute an additional $80,000 in concessional contributions in this financial year using the carry forward rule (noting the increase in the concessional contribution cap from $25,000 to $27,500 from 1 July 2021).Chart 2: Projections for super balance at retirement – impact of Scenarios 1 and 2

Source: ATO and ASFA calculations. Projections assume average wages ($70,000 per annum) are earned from age 51 until retirement at age 67, and an investment rate of return of 6 per cent (after investment fees and taxes).

- Make sure that your investment choices align with your risk profile.For example, investing in a defensive option when you have more than 15 years ahead of you before retirement could mean you are earning 1-2% less in returns each year. Switching to a balanced option (with higher long-term investment returns) could mean an extra $40,000 in retirement.

- Holding multiple unintended accounts could be costing you hundreds of extra dollars a year in administration fees. In many cases consolidating your accounts will generate a higher retirement balance, MyGov offers a simple service to assist with consolidating superannuation accounts.For example, some superannuation funds charged a fixed administration fee per annum between approximately $50 and $100 each, consolidating from four to one fund could mean an extra couple of hundred dollars in your savings each year as a result.

- Reviewing your insurance and making sure it is still appropriate for your needs could also save you hundreds of dollars in premium payments each year, resulting in thousands of extra dollars in retirement.For example, you may find as you get closer to retirement that you no longer need the level of insurance you have previously held through superannuation as you may have repaid your mortgage and or no longer have any dependent children.

For further information, please contact:

ASFA Media team: 0451 949 300

About ASFA

ASFA is the peak policy, research and advocacy body for Australia’s superannuation industry. It is a not-for-profit, sector-neutral, and non-party political, national organisation. ASFA’s mission is to continuously improve the superannuation system, so all Australians can enjoy a comfortable and dignified retirement.