Australians from non-English speaking backgrounds (NESB) are facing a retirement savings gap when compared with the overall population, with women and people over 55 experiencing the largest gap, according to new research from the Association of Superannuation Funds Australia (ASFA).

ASFA, the voice of super, analysed ATO data and found that while overall the average superannuation balance of Australia’s 2.7 million NESB individuals has risen, non-English speakers are still well behind English-speaking Australians in their super balances, and women and people aged over 55 are particularly disadvantaged.

“People from non-English speaking backgrounds make up 16 per cent of total super account holders in Australia and unfortunately, their super balances are lower across every age group when compared with the general population,” said ASFA CEO, Mary Delahunty.

“The upcoming Federal Budget presents a clear opportunity to address the retirement savings gap for people from non-English speaking backgrounds. ASFA is calling for an increase in the Low-Income Superannuation Tax Offset (LISTO), which would boost the low super balances of more than 200,000 people from non-English speaking backgrounds,” Ms Delahunty added.

“Increasing the Low-Income Superannuation Tax Offset to $45,000 would mean $700 directly put towards the retirement savings of some of Australia’s lowest paid workers, providing an extra $200 per year than what is currently contributed by government and also substantially increasing the number eligible for the tax offset.”

ASFA predicts that, for a person aged 35 and retiring at age 67 who is on a wage of $44,000 a year, receiving a LISTO payment to their superannuation account of $700 a year would lift their superannuation balance at retirement in today’s dollars from around $293,000 to $336,000, a substantial increase.

“In addition to increasing the Low-Income Superannuation Tax Offset, we believe government should look to areas of the economy where underpayment – or non-payment of super – may have a disproportionate impact on those from non-English speaking backgrounds.

“We’ve called for superannuation to be paid to gig economy workers, and we repeat that call to government,” said Ms Delahunty.

ASFA welcomes the planned introduction of paying the 12 per cent Super Guarantee on Commonwealth Paid Parental Leave and the positive impact this will have for many women from non-English speaking backgrounds.

However, the low median super balances for those people aged 25 to 34 also means that early release of superannuation for housing deposit purposes would be even more ineffective for NESB individuals, with housing prices bid up by the small minority of people mainly from the non-NESB group with high super balances.

“As the voice of super, we know how important it is to highlight areas of our world class system that need additional attention to deliver dignity in retirement for all Australians. We have forwarded this research to the Government, to the Minister for Immigration, Citizenship and Multicultural Affairs and other key decision-makers to consider for the upcoming budget,” Ms Delahunty concluded.

Key research findings

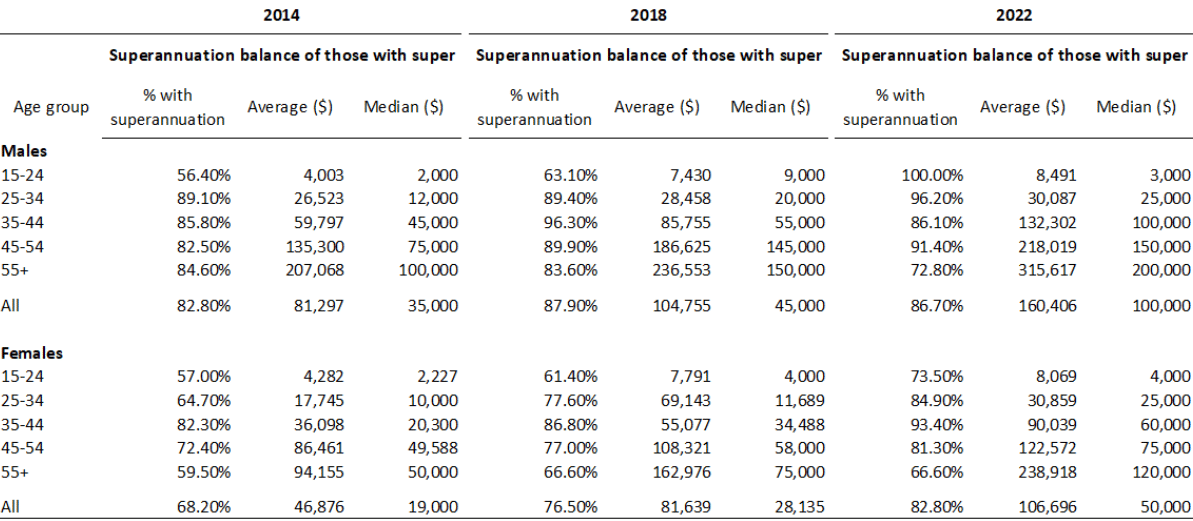

- The increase in the median account balance for NESB males was from $35,000 to $100,000 and for NESB females from $19,000 to $50,000, in the eight years to 2022.

- For NESB males aged 55 plus and not yet retired, the increase in median balances was from $100,000 to $200,000 and for females it was from $50,000 to $120,000.

- The median balances for those aged 55 plus were lower than for the equivalent general population, which were $250,000 for males and $170,000 for females.

- Superannuation coverage rates for the NESB group have increased since 2014 and are now at about the same overall rate for the general population for males but are still at a slightly lower rate for females.

- Superannuation coverage rates for those aged under 35 are higher than for the general population, reflecting the fact that many younger persons with an NESB background are temporary residents who have an entitlement to paid work.

- The substantial absolute number and proportion of Australian residents who are NESB also highlights the need for communications and provision of financial information, guidance and advice be available across the range of community languages active in Australia.

Source: HILDA data prepared for ASFA

For further information, please contact ASFA Media team: 0451 949 300

About ASFA

ASFA, the voice of super, is the peak policy, research and advocacy body for Australia’s superannuation industry. It is a not-for-profit, sector-neutral, and non-party political, national organisation. ASFA’s mission is to continuously improve the superannuation system, so all Australians can enjoy a comfortable and dignified retirement.