ASFA is deeply concerned by policy proposals which paint superannuation as the bandaid to Australia’s chronic housing shortage, and offer little in the way of building of new homes.

“Building more homes is the solution to Australia’s housing shortage, and its’s unfair to ask young people to mortgage their retirements in an attempt to get on the property ladder, amid a housing-affordability crisis,“ said ASFA CEO Mary Delahunty.

“While ASFA welcomes constructive discussions on how best to ensure everyone in this country has a safe place to live, our research demonstrates that early withdrawal of superannuation will worsen intergenerational inequity without fixing the core problem of desperately needed housing supply.”

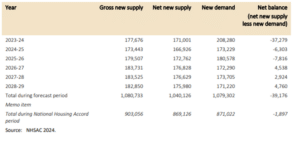

ASFA notes Australia’s current nationwide housing shortfall of 30,000 homes is projected to grow by a further 40,000 by 2028. (Table 1)

Policy measures to allow first home buyers to withdraw up to $50,000 from their superannuation to purchase a house would rob future generations of Australians of the dignity in retirement that they deserve.

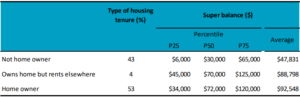

New research by ASFA, the voice of super, finds half of all renters aged 30 to 39 have less than $30,000 in superannuation savings, much less than the deposit of $120,000 or more currently needed to purchase an entry point home. (Table 2)

An earlier ASFA examination of the housing deposits required for median-priced houses and units in Australia’s ’major capital cities found almost non-one in the 25-34 age group in Sydney, whether a single or couple, could raise enough money for a deposit on an average house or unit by using their superannuation alone, even if they emptied out their retirement savings.

“These measures may serve to further boost the purchasing power of high-income, high super-balance buyers who are already well placed to purchase property, but they will not make home ownership more attainable for the majority of aspiring first-home buyers and those with low superannuation balances,.” added Ms Delahunty.

ASFA considers policy measures which would see young people drain their superannuation savings for housing would further penalise the large cohort of young Australians who withdrew retirement savings through the Covid-19 pandemic Early Release Scheme.

“Young people deserve strong ideas and real policy solutions that allow them to aspire genuinely for both a safe place to live and income in their retirement.

“Repeating the mistakes of the pandemic and asking the same cohort of young people to rob their future selves by raiding their super – something never asked of older generations – would suggest we’ve abandoned the goals of fair and equitable retirement and housing market policy settings in this country, ” Ms Delahunty concluded.

ASFA Research Key Findings

- Generally those with higher superannuation balances already achieve home ownership.

- Opening up access to super balances would provide substantial tax benefits for upper income earners with only small benefits going to low-income earners.

- Many low-income individuals have already depleted their super balance through COVID early release.

- Allowing early release of superannuation for housing would worsen intergenerational equity.

Table 1: Projections of new market supply, demand and net balance

Source: NHSAC 2024

Table 2: Super balance, by housing tenure

Source: HILDA data prepared for ASFA

For further information, please contact ASFA Media team: 0451 949 300

About ASFA

ASFA, the voice of super, is the peak policy, research and advocacy body for Australia’s superannuation industry. It is a not-for-profit, sector-neutral, and non-party political, national organisation. ASFA’s mission is to continuously improve the superannuation system, so all Australians can enjoy a comfortable and dignified retirement.