23 February 2023

Australia’s retirement income system is well placed to meet future challenges

A new ASFA Research note: The cost of pensions across advanced economies has found poor system design, population ageing, and elevated inflation are imperiling the long-term sustainability of many OECD retirement income systems.

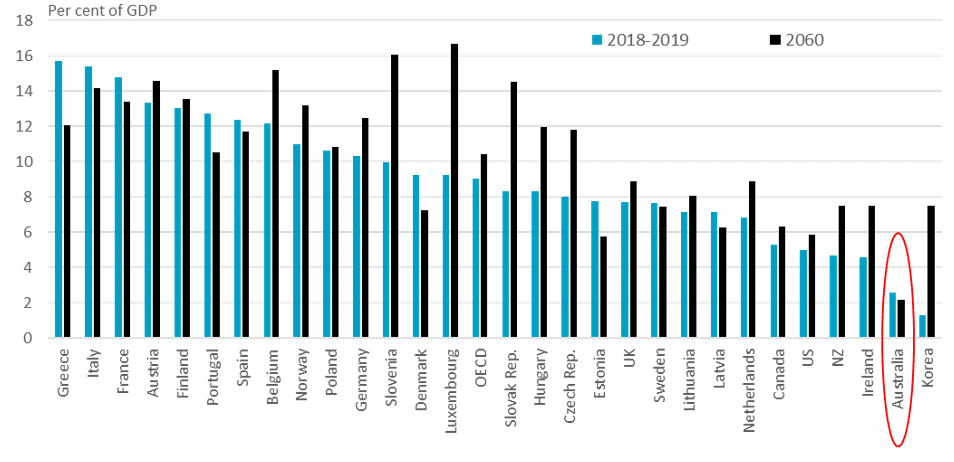

Average OECD government spending on pension payments will rise from 9.0 to 10.4 per cent of GDP over the next four decades. In contrast, Australia’s government pension expenditure is relatively low and is expected to decline – from 2.6 to 2.1 per cent of GDP by 2060 (Refer to chart below).

“Globally, pressures on fiscal sustainability are building and many countries in the OECD face politically challenging reforms to repair their retirement systems,“ said ASFA CEO, Dr Martin Fahy.

“In contrast, Australia’s retirement system is well placed to face challenges to fiscal sustainability, due in large part to our high levels of private superannuation savings helping to reduce government pension spending.”

Key research findings:

- For the OECD as a whole, the proportion of the population aged 65 and over will increase from 17 to 27 per cent over the next three decades.

- Countries where pension spending is expected to increase relative to GDP (in the absence of reform) include Canada, Germany, NZ, the UK and the US.

- In some other countries, pension spending is projected to fall but remain at a very high level – such as, France, Greece and Italy.

- For OECD countries facing sustainability challenges, changes to current policy settings would involve a combination of reduced pension payments and tighter pension eligibility.

Australia’s super system is maturing – with the superannuation guarantee (SG) contribution rate scheduled to reach 12% in 2025. As time goes on, people who reach retirement will have received SG contributions at higher rates, for longer periods of time. This will lead to higher balances for workers at retirement.

“Australia’s unique defined contribution (DC) super system is arguably the best in the world. At a time when most advanced economies are grappling with the fiscal burden of the age pension, Australia’s will continue to be among the lowest of our OECD peers,” Dr Fahy concluded.

Source: OECD, Pensions at a Glance 2021 and ASFA calculations.

For further information, please contact:

ASFA Media team, 0451 949 300.

About ASFA

ASFA is the peak policy, research and advocacy body for Australia’s superannuation industry. It is a not-for-profit, sector-neutral, and non-party political, national organisation. ASFA’s mission is to continuously improve the superannuation system, so all Australians can enjoy a comfortable and dignified retirement.