Australians are being urged to devote one hour these holidays to check in on their super as a new survey reveals we trust our super funds more than any other financial institution.

“Jump online these holidays to check your super is working best for you and that your security settings are up to date. It takes less than an hour and could make a big difference to your retirement,” said ASFA CEO Mary Delahunty.

“For a 30-year-old, even the simple act of rolling three superannuation accounts, including one with higher fees, into one low-fee account could result in an extra $20,000 in retirement and takes less than 20 minutes,” she added.

“That’s one extra fabulous holiday when you stop working for less time that it takes to hose the deck for Christmas day,” she added.

ASFA has today also published new survey results revealing Australians trust their super funds more than their bank, the Government and insurance companies to act in their best interests.

The survey also found more than 90 percent agreed that superannuation plays an important role in ensuring financial wellbeing in retirement and nearly 80 percent of people trust their fund to make sound financial decisions.

“It’s heartening to see Australians place such trust in the super system and their super funds,” said Ms Delahunty.

“We all have a role in guarding that trust. The super sector has had a great year for financial returns and has also made meaningful improvements to the service members receive.

“In 2026 super funds will continue to invest to ensure members get the best possible risk-adjusted returns, improve services and work together to keep members’ super safe.

“Members also have a role to play in making sure their super is working how they want it to and are keeping security settings up to date. The summer break is the perfect time to do this.”

Super summer check-in

ASFA recommends members take a few simple steps to check in on your super:

- Check your details are up to date: don’t miss any important communications from your fund. Either login to your superannuation fund account or get in touch with your fund through their call centre.

- Don’t use passwords for your super account that you use elsewhere, and change them regularly: super is likely to be your biggest asset other than your home, so help to keep it safe.

- Assess if your investment and insurance settings are right: you could be missing out on potential savings if you’re not in the right type of investment for your age and risk appetite. Equally, it’s important to check you are getting the appropriate insurance cover through your super fund for your life stage.

- Nominate a beneficiary to receive your super: while not a cheery Christmas topic, telling your fund who you want to receive your super in the event of your death helps make sure your savings go where you want them to and can save your loved ones time and distress.

- Consider maximising your super contributions: you can have a total of $30,000 in tax-concessional contributions (including employer contributions) this year so if you’re not on track to hit that ceiling, consider topping up your contributions.

- Check if you have more superannuation fund accounts than you need: you can check online through your myGov account how many superannuation accounts that you have. If you have more than one think about consolidating into your active account (but take into account any loss of insurance cover that might happen). You can consolidate accounts simply online through myGov.

- Seek advice: most super funds provide general advice or limited financial advice at no or low cost on topics such as insurance cover, investment options and whether to make additional contributions. A little advice can go a long way.

4 in 5 are positive about their fund’s performance

Survey results* revealed today by ASFA show 79% of super account holders have a positive or very positive level of satisfaction with their fund’s performance.

For FY24-25 typical growth superannuation products averaged a 10.5% return with a 7.1% average over the last ten years.

The results, taken from a sample of over 1,500 people, are consistent across gender, age, education level, occupation and household income.

The two exceptions who have lower satisfaction are people who speak a language other than English at home, who have a satisfaction rate of 69%, and those who own no asset classes (such as shares or property) other than super. This group has a satisfaction level of 72%.

“These results show that Australians think super really is working for them, and also emphasise the benefits of choice in our super system. While four in five people are satisfied with their fund’s performance, those who aren’t are free to change fund or change their investment settings,” said Ms Delahunty.

“The results also show us that we have more work to do when it comes to some important groups including those who don’t speak English at home.”

When asked if superannuation plays an important role in providing financial security in retirement more than 90% agreed. That rose to 96% amongst people who are retired, demonstrating that people who have lived experience of life after work particularly value the role super play.

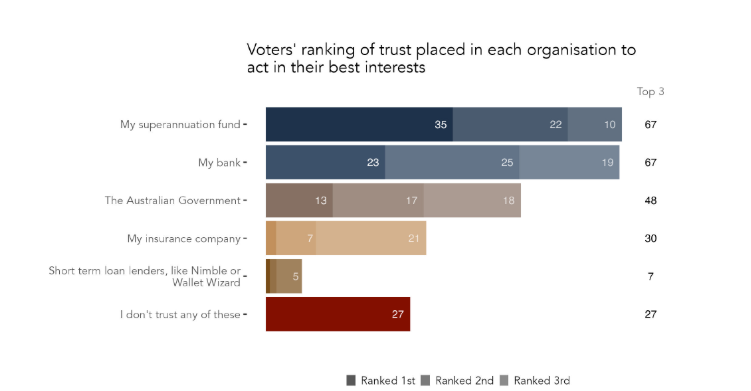

Another question asked which financial or government institution respondents trusted to act in their best interests. (Figure 1)

Super funds received the highest share of number one trust rankings and were also the most likely to be placed in respondents’ top three trust organisations.

Figure 1:

More analysis of ASFA’s survey can be found in the report The view of Australians on Superannuation providing financial security in retirement

Interviews with ASFA CEO Mary Delahunty on the report or on tips to maximise and secure super are available.

*The survey was conducted by in early 2025 on behalf of ASFA. The sample size was 1,507 Australian citizens aged 18 and older, and who were enrolled to vote and were representative of the Australian population

For further information, please contact:

ASFA media team

0451 949 300

mediaunit@superannuation.asn.au

About the Association of Superannuation Funds of Australia (ASFA)

ASFA, the voice of super, has been operating since 1962 and is the peak policy, research and advocacy body for Australia’s superannuation industry. ASFA represents the APRA regulated superannuation industry with over 100 organisations as members from corporate, industry, retail and public sector funds, and service providers. We develop policy positions through collaboration with our diverse membership base and use our deep technical expertise and research capabilities to assist in advancing outcomes for Australians.

We unite the superannuation community, supporting our members with research, advocacy, education and collaboration to help Australians enjoy a dignified retirement. We promote effective practice and advocate for efficiency, sustainability and trust in our world-class retirement income system.