The latest ASFA Retirement Standard shows that a near 10 percent fall in electricity prices in the December quarter has contributed to retirees being better off, even though the cost of maintaining a comfortable retirement has increased slightly over the last 12 months.

The cost of a comfortable lifestyle rose by around 1.3 per cent over the last 12 months – just over half of the Consumer Price Index increase of 2.4 per cent over the same period.

“The good news for retirees from the latest Retirement Standard is there has been a substantial easing in price increases for the goods and services they purchase. However, the last couple of years of high inflation are still weighing on their ability to fund a comfortable retirement,” said ASFA CEO, Mary Delahunty.

The ASFA Retirement Standard has provided a comprehensive benchmarking guide for people weighing up their retirement options for 20 years.

The latest ASFA Retirement Standard shows that couples aged around 65 now need $73,077 per year to achieve a comfortable retirement, with $51,805 for singles, after both retiree budgets rose by 0.1 per cent in the December quarter. The budgets at the modest level of retirement were basically unchanged.

Higher costs for domestic holiday travel and accommodation and home and vehicle insurance added to the cost of retirement in the December quarter.

Retirees have made up some of the shortfall through strong investment returns gained last year. Balanced superannuation fund options showed a typical return of at least 10.5 per cent for calendar 2024, with some funds recording nearly 12 per cent while returns for accounts in the retirement phase were even higher.

“While recent strong investment returns are helping retirees and those planning for retirement in achieving their desired retirement lifestyles, the most recent Retirement Standard budgets reinforce the fact that Australians need both compulsory superannuation and voluntary contributions which are preserved until retirement to have the sort of retirement they need and deserve,” Ms Delahunty said.

Detail on changes to the budgets

Electricity prices fell 9.9 per cent in the December quarter and 25.2 per cent in the past 12 months, driven largely by the introduction of the 2024-25 Commonwealth Energy Bill Relief Fund (EBRF) rebates from July 2024. (Excluding the rebates, electricity prices would have risen by 0.2 per cent in the December 2024.)

Insurance cost rose 1.1 per cent – the weakest quarterly rise since the June 2022 quarter – thanks to easing reinsurance and replacement and repair costs contributing to a moderation in insurance premium price growth across house, home contents and motor vehicle insurance.

Spending categories where there were significant price developments:

- Food prices rose 3.0 per cent over the 12 months to the December quarter, down from 3.3 per cent in the September quarter. Price rises eased across most food categories apart from meat and seafoods. Fruit and vegetable prices remained 6.3 per cent higher compared to 12 months ago, despite falling 3.3 per cent this quarter.

- Domestic holiday travel and accommodation rose by 5.7 due to an increase in travel demand during the school holiday period driving up prices for airfares and accommodation.

- Beer prices were up 1.2 per cent in the quarter, with the price of spirits up 1.1 per cent.

- Pharmaceutical products fell 1.6 per cent due to an increase in the proportion of consumers who qualify for subsidies under the Pharmaceutical Benefits Scheme (PBS). Increased take-up of 60-day prescriptions also lowered the cost for some prescription medicines.

Details for the various updated budgets:

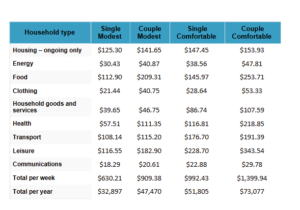

Table 1: Budgets for various households and living standards for those aged around 65 (December quarter 2024, national)

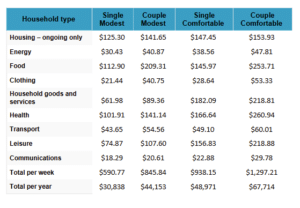

Table 2: Budgets for various households and living standards for those aged around 85 (December quarter 2024, national)

The figures in each case assume that the retiree/s own their own home and relate to expenditure by the household. This can be greater than household income after income tax where there is a drawdown on capital over the period of retirement. All calculations are weekly, unless otherwise stated. Annual figure is 52.2 times the weekly figure.

For further information, please contact:

ASFA Media Manager, Richard Garfield: 0451 949 300.

About the Association of Superannuation Funds of Australia (ASFA)

ASFA, the voice of super, has been operating since 1962 and is the peak policy, research and advocacy body for Australia’s superannuation industry. ASFA represents the APRA regulated superannuation industry with over 100 organisations as members from corporate, industry, retail and public sector funds, and service providers. We develop policy positions through collaboration with our diverse membership base and use our deep technical expertise and research capabilities to assist in advancing outcomes for Australians.

We unite the superannuation community, supporting our members with research, advocacy, education and collaboration to help Australians enjoy a dignified retirement. We promote effective practice and advocate for efficiency, sustainability and trust in our world-class retirement income system.

About the ASFA Retirement Standard

Since 2004 the ASFA Retirement Standard has served as a retirement companion for Australians, providing a reliable retirement savings guide by benchmarking the annual budget needed to fund either a comfortable or modest standard of living in the post-work years. It is updated quarterly to reflect inflation, reviewed regularly to reflect changes in lifestyle, and provides detailed budgets of what single people and couples would need to spend to support their chosen lifestyle. It is generally accepted by superannuation funds, financial planners, the media, web calculators and by fund members as the accepted benchmark for the adequacy of retirement savings.