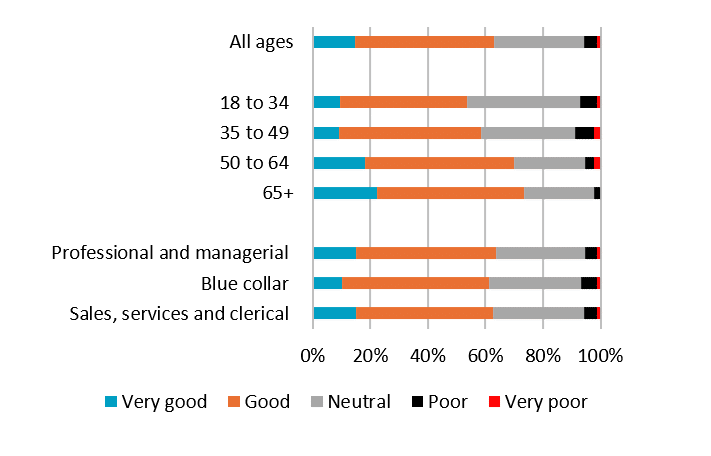

New research from ASFA, the voice of super, into how Australians feel about their superannuation shows they have a high degree of satisfaction with the investment performance of the superannuation fund, with nearly two-thirds rating it as either ‘very good’ or ‘good’.

Key findings:

- Almost two-thirds of respondents ranked their fund’s performance as either ‘good’ or ‘very good’, while only 6% ranked their fund’s performance as ‘poor’ or ‘very poor’.

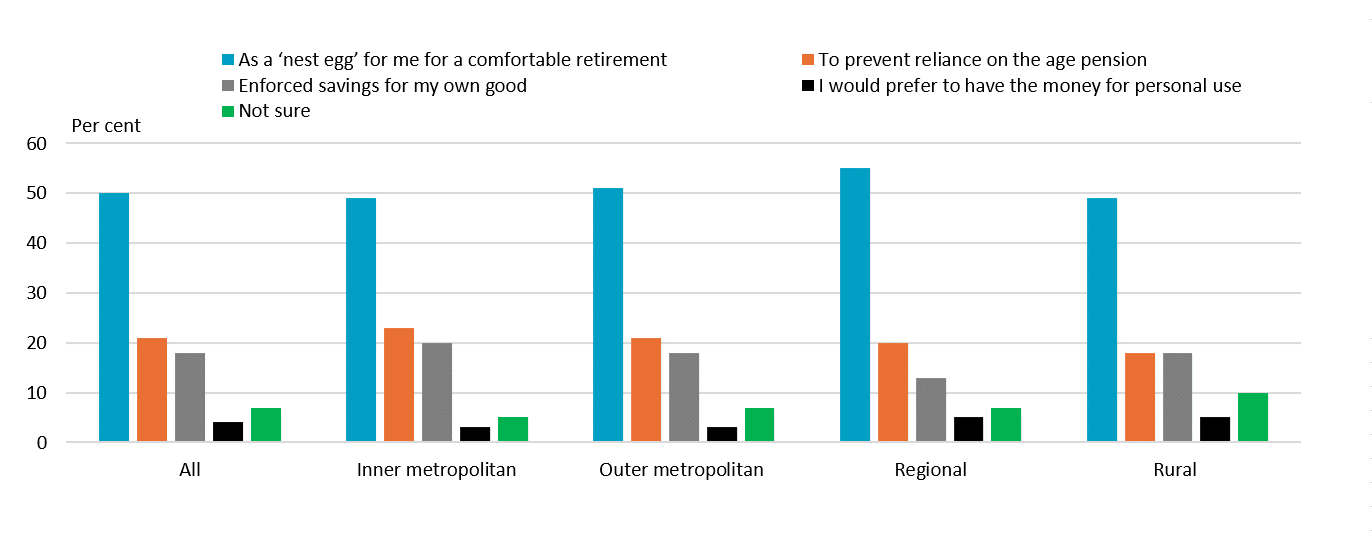

- Around 70% of survey respondents view superannuation as either ‘a nest egg to fund a comfortable retirement’, or a means ‘to prevent reliance on the Age Pension’.

- In contrast, only 4% of respondents would prefer to have their super savings for personal use – and there is no statistical difference by age of respondent.

“This research clearly shows Australians are happy with how their superannuation fund is performing, and support its key role in providing for their retirement. We have a sophisticated, and well-functioning system which consistently delivers for Australians on its job – providing dignity in retirement,” said ASFA CEO Mary Delahunty.

Satisfaction with investment performance was at around the same levels regardless of the type of employment of the survey respondents, with blue collar, professional and managerial and sales, service and clerical workers all providing similar results.

“Superannuation investment is clearly delivering for a broad cross-section of Australian workers. This demonstrates that the diversity and choice within the Australian superannuation system is functioning well,” said Ms Delahunty.

Satisfaction with investment performance tends to increase with age: net favourability increases from 46% for those aged 18 to 34, to 71% for those aged 65 and over.

Australian’s views of their fund’s performance

The research is the third in a series of ASFA publications that explores the findings of a recent survey of 1,500 adults – representative of the broader population in terms of age, gender, education and whether respondents reside in urban or regional areas

Australians support super being used for retirement

The results also show overwhelming support for the use of superannuation in retirement. Around 70% of survey respondents view superannuation as either ‘a nest egg to fund a comfortable retirement’, or a means ‘to prevent reliance on the Age Pension’.

Australian’s views on the purpose of superannuation

Ms Delahunty says this supports the need to enshrine the objective of superannuation in law.

The Superannuation (Objective) Bill seeks to enshrine the objective of super being ‘to preserve savings to deliver income for a dignified retirement, alongside government support, in an equitable and sustainable way.’

“Despite the fact that compulsory superannuation is arguably one of Australia’s most successful public policy initiatives over the past 50 years, there is no legislated objective of superannuation,” Ms Delahunty said.

“The findings of this latest research highlight the need to have the bill passed into legislation to ensure that choices the Parliament makes around laws that govern this country meet the expectations and desires of the vast majority of Australians when it comes to superannuation – that super is there to fund retirements.

“The preservation of superannuation for retirement income is a cornerstone of trust between Australians and their retirement savings,” Ms Delahunty said.

“This trust allows Australians to plan for their future with confidence, knowing that their super is being protected and that they will have the income needed to enjoy a dignified and secure retirement.”

For further information, please contact ASFA Media team: 0451 949 300

About ASFA

ASFA, the voice of super, is the peak policy, research and advocacy body for Australia’s superannuation industry. It is a not-for-profit, sector-neutral, and non-party political, national organisation. ASFA’s mission is to continuously improve the superannuation system, so all Australians can enjoy a comfortable and dignified retirement.