New research by The Association of Superannuation Funds of Australia (ASFA) finds allowing early access to superannuation for housing would not make home ownership more attainable for the majority of aspiring first-home buyers and those with low superannuation balances.

“Worsening housing affordability presents a significant challenge. ASFA supports the aspirations of young people to buy a home and agrees everyone deserves a secure place to live, particularly in retirement,” said ASFA CEO, Mary Delahunty.

“While superannuation may seem like a tempting pot to raid, our analysis shows it will only benefit those young people who are already more likely to be able to afford a home, and not solve the crippling supply-side deficit that is fuelling our housing crisis.”

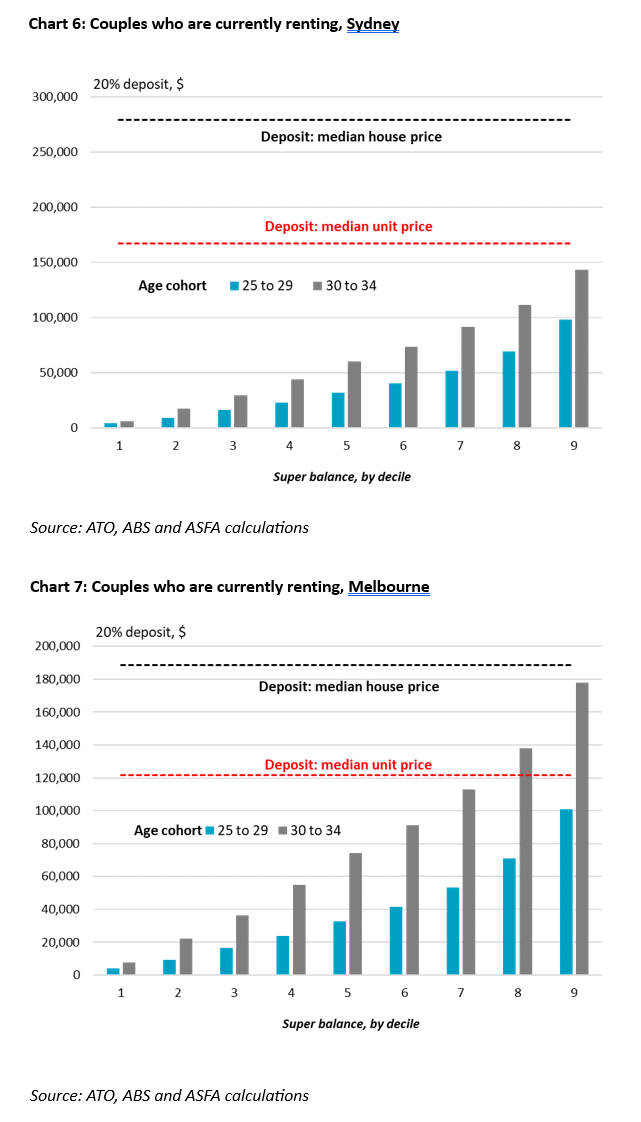

ASFA, the voice of super, examined an ATO sample of 300,000 taxpayers, in combination with ABS data to assess the distribution of superannuation balances for prospective first-home buyers aged 25-34 across Australia’s major capital cities (Chart 6, 7 ), and charted that against the housing deposits required for a median-priced houses and units (equivalent to 20 per cent of home valuation).

The data show no-one in this age group in Sydney, whether single or in a couple, could raise enough money for the deposit on an average house or unit by using their superannuation alone, even if they drained their retirement savings.

In Melbourne, prospective house buyers are similarly unable to raise the deposit for a house by accessing all their super. In the Victorian capital only a couple in the top 20 per cent of superannuation balance holders could gather a deposit for a unit by using all their retirement savings.

By way of contrast, a young Sydney couple with the median amount of superannuation would be more than $150,000 short for the deposit on a median-priced house if they withdrew and used only their super.

ASFA’s analysis shows early access to superannuation would not solve the barrier-to-entry challenge of insufficient housing deposits for first-home buyers. Such a policy would likely benefit only a minority of people with high superannuation balances who are already more likely to achieve home ownership.

Additionally, it would likely push up house prices by increasing demand-side pressure on the housing market, putting home ownership even more out of reach for most aspiring first-home buyers.

While superannuation will likely not be the only source of a home deposit for most aspiring home owners, ASFA’s research illustrates the yawning gap between the average super balance of most young people and the cost of a deposit.

“Accessing superannuation is not the silver bullet to solving Australia’s housing crisis,” said Ms Delahunty.

Key research findings:

- Early release of superannuation would risk exacerbating lack of access to and unaffordability of home ownership

- People who have relatively low superannuation balances, and thus have a relatively low amount of funds available for a housing deposit, could in effect be priced out of the market for a first home – even with access to additional funds through superannuation

- As access to the measure increased, additional nominal purchasing power available to prospective first-home buyers would be competitively build into higher house prices

NOTES:

ASFA analysis of the 2020 Covid-19 Early Release Scheme found that nearly 1 million Australians closed or largely cleaned out their superannuation accounts as a result of early release payments, with the vast majority of recipients aged under 35.

For further information, please contact ASFA Media team: 0451 949 300

About ASFA

ASFA is the peak policy, research and advocacy body for Australia’s superannuation industry. It is a not-for-profit, sector-neutral, and non-party political, national organisation. ASFA’s mission is to continuously improve the superannuation system, so all Australians can enjoy a comfortable and dignified retirement.