For the first time ASFA, the super peak body, projects a 30-year-old on the median wage will be on track to achieve a comfortable retirement, thanks to July’s superannuation guarantee increase to 12%.

With the 12% super guarantee in place, a 30-year-old with a super balance of $30,000, earning the median wage of $75,000 until retiring at age 67 should accumulate $610,000 in super, well above the $595,000 the latest ASFA Retirement Standard estimates is needed to fund a comfortable retirement for single people who own their own home.

“This is a major milestone in Australia’s retirement system,” said ASFA CEO Mary Delahunty.

“With the super guarantee increase to 12%, we are seeing super fulfill its objective of providing a dignified retirement for ordinary Australians, with today’s 30–year-olds reaping the rewards of decades of progress in our world-class super system.”

From July, employers will be required to pay 12% of their employees’ wage in superannuation, 33 years after the mandatory contribution of 3% was first brought in.

The increase from 11.5% to 12% will see an additional $20,000 added to the super savings of today’s 30-year-old over a lifetime earning the median wage.

“The ASFA Retirement Standard has been providing Australians with guidance towards what a comfortable retirement might look like for over 20 years,” Ms Delahunty said.

“With the 12% super guarantee coming in, we can now say that the system foundations are cemented for young, working people to have a comfortable retirement. It’s a moment all Australians should be proud of.”

Retirement costs up 1.6%

Other findings from the ASFA Retirement Standard for the March quarter, released today, have revealed the cost of a comfortable retirement rose by 1.6% over the past year, lower than the 2.4% increase in the overall Consumer Price Index.

Key findings:

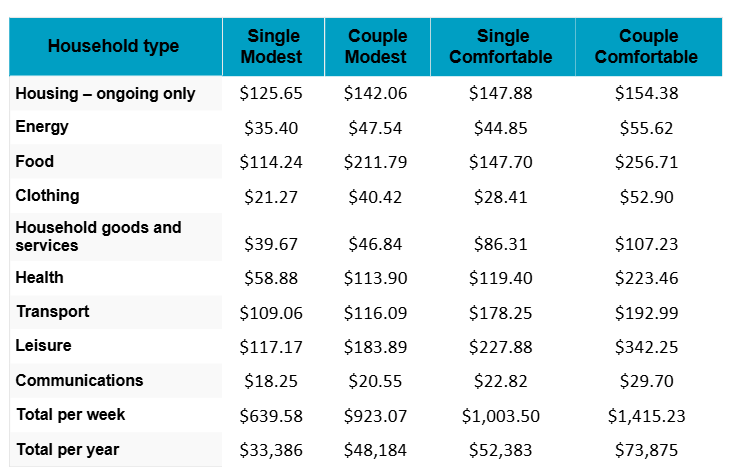

- Most couples now need $73,875 annually for a comfortable retirement

- Most singles now need $52,383 annually for a comfortable retirement

- Costs for a modest retirement rose 1.7% over the past year

(See detailed explanation for definitions of comfortable and modest levels)

- While overall inflationary pressures have eased, retiree budgets for essentials such as food, energy and health continue to rise.

- Fruit and vegetables rose 6.6% and meat and seafood prices rose 4.3% per cent over the year.

- Electricity prices rose sharply in the March quarter, reversing sharp falls over the last six months, as several state-based subsides came to an end and Commonwealth electricity subsidies had timing issues.

Ms Delahunty said while retirees are getting some relief from slowing inflation, essentials costs remain a concern.

“Australians in retirement are starting to benefit from a slowdown in inflation, but the prices of essentials are still rising. It’s a timely reminder that achieving a dignified retirement takes planning, and superannuation plays a critical role in making that possible.”

Renter budgets added to the ASFA Retirement Standard

For more than two decades the ASFA Retirement Standard has been Australia’s trusted guide to budgeting in retirement and is updated periodically to reflect changing circumstances.

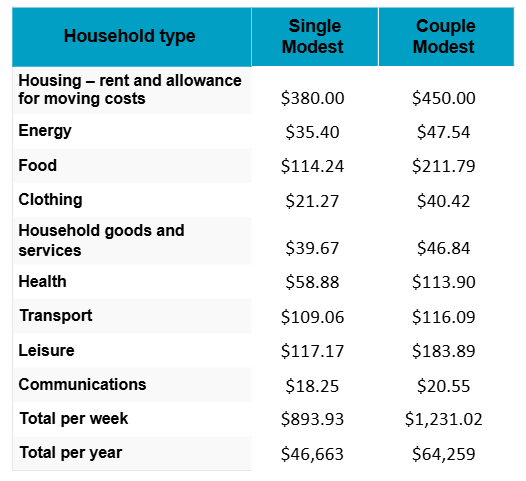

With an increasing number of Australians likely to be renting in retirement, ASFA has added budgets for retirees living at the modest level in private rentals to the benchmark guide (Table 3).

A single renter aged around 65 would need $46,663 annually, with a couple needing $64,259, to retire at a modest level. The lump sums at retirement needed are estimated to be $340,000 for a single person and $385,000 for a couple. These budgets are significantly above what is provided by the full Age Pension and highlight the key role superannuation plays for retirees who rent.

“These new figures demonstrate how important it is that we build more homes in this country so Australians can buy a house or an apartment,” said Ms Delahunty.

“They also illustrate how super can be the difference between hardship and stability later in life, especially for renters, which is why we need to keep it safe for retirement.”

Detail on changes to the budgets for the March quarter

- Food prices rose 3.2 per cent over the 12 months to the March quarter, up from 3.0 per cent in the December quarter.

- Meat and seafood prices rose 4.3 per cent compared to 12 months ago, the largest annual increase since the December 2022 quarter.

- Fruit and vegetable prices (+6.6 per cent) continue to remain elevated. Fruit prices were up by 12.2 per cent compared with March quarter 2024 due to higher prices for avocados, bananas and strawberries.

- On 1 Jan 2025, a freeze was introduced on the indexation of co-payments for PBS medicines. This, combined with price falls for some non-prescription pharmaceuticals, contributed to the softer quarterly price movement for pharmaceutical products seen this quarter compared with previous March quarters.

- Automotive fuel rose in price by 1.9 per cent in the March quarter, but fell by over 5.1 per cent during the last year. Urban transport fares fell by an average 3.8 per cent over the year, with free or discounted fare initiatives in some States contributing to that.

- International travel and accommodation was down 7.6 per cent due to lower demand after the peak season demand for travel to Europe in the December holiday period.

Table 1: Budgets for various households and living standards for retired homeowners aged around 65 (March quarter 2025, national)

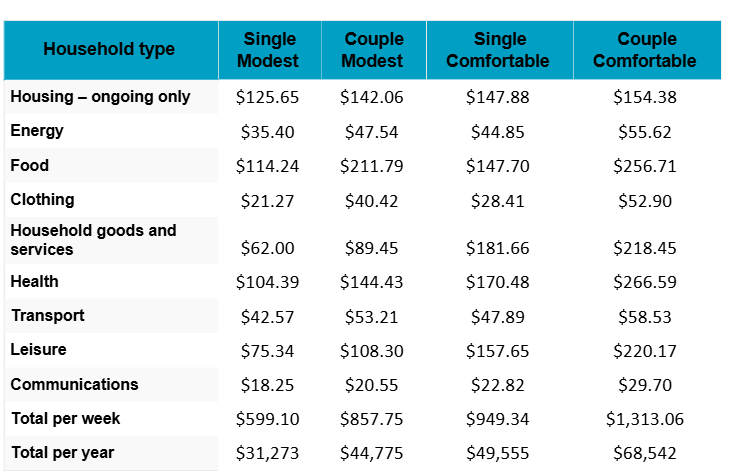

Table 2: Budgets for various households and living standards for retired homeowners around 85 (March quarter 2025, national)

Table 3: Budgets for retirees in private rental aged around 65 (March quarter 2025, national)

The figures in Tables 1 and 2 assume that the retiree/s own their own home and relate to expenditure by the household. This can be greater than household income after income tax where there is a drawdown on capital over the period of retirement. The housing expenses in Table 3 cover private rental at a modest level after receipt of Commonwealth Rent Assistance, and also include and allowance for moving costs. All calculations are weekly, unless otherwise stated. Annual figure is 52.2 times the weekly figure.

For further information, please contact:

ASFA Media Manager, Richard Garfield: 0451 949 300.

About the Association of Superannuation Funds of Australia (ASFA)

ASFA, the voice of super, has been operating since 1962 and is the peak policy, research and advocacy body for Australia’s superannuation industry. ASFA represents the APRA regulated superannuation industry with over 100 organisations as members from corporate, industry, retail and public sector funds, and service providers. We develop policy positions through collaboration with our diverse membership base and use our deep technical expertise and research capabilities to assist in advancing outcomes for Australians.

We unite the superannuation community, supporting our members with research, advocacy, education and collaboration to help Australians enjoy a dignified retirement. We promote effective practice and advocate for efficiency, sustainability and trust in our world-class retirement income system.

About the ASFA Retirement Standard

Since 2004 the ASFA Retirement Standard has served as a retirement companion for Australians, providing a reliable retirement savings guide by benchmarking the annual budget needed to fund either a comfortable or modest standard of living in the post-work years. It is updated quarterly to reflect inflation, reviewed regularly to reflect changes in lifestyle, and provides detailed budgets of what single people and couples would need to spend to support their chosen lifestyle. It is generally accepted by superannuation funds, financial planners, the media, web calculators and by fund members as the accepted benchmark for the adequacy of retirement savings.