“Gnōthi seautón” which means “know thyself”, is a proverb from Greek philosophy, attributed most popularly to Socrates. The saying has been well known throughout history; from ancient philosophical texts, right through to a more recent version being used in the Matrix movie, where an inscription outside the Oracle’s place pays homage to the original on the Temple of Apollo in Delphi.

Knowing members for better business strategy

The business plan, as required under APRA’s SPS 515 Strategic Planning and Member Outcomes, is now a practical issue for funds. It is a forward looking, detailed document to be produced on a rolling three-year basis. The media and industry commentary on member outcomes coverage has largely focused on the benchmarking aspect of the regime; the concept that we must compare a fund to another fund. But how do you produce a business plan, or compare your fund to another, without first knowing whether a fund stands on its own two feet for its own members?

For too long, super has got away with knowing as little as possible about the individuals that make up funds, instead focusing on managing a fund at the “pool” level. They forget that all of those zeros that make up millions or billions of funds under management, actually comprise everyday individuals saving for retirement, who are all unique, rather than a homogenous group.

Bringing DB member-centric thinking to DC

As funds get bigger and bigger, it is interesting to compare Australia’s industry to the way that the giant overseas pension plans are managed. However many of these still operate in a defined benefit (DB) system—rather than a defined contribution (DC) system—where, irrespective of their scale, employers/sponsors must have detailed knowledge of each employee because the final ‘promised’ benefit has been predetermined by variables such as their unique length of employment, salary and age for example. DC funds on the other hand do not promise to deliver a specific outcome for each member, they simply need to grow the overall fund as big as possible.

In DC, having been borne of the managed fund environment, we aggregate and manage money to simpler metrics. We don’t stop to think beyond an assumption that individuals have deliberately accessed that pool to benefit from scale, and that their unique requirements are easily diluted by the overall fund’s average targets. But as we know, the average depth of Sydney Harbour is not a relevant number, in isolation, when the world’s largest cruise ship needs to sail into it.

The member outcomes regime has, in the process of calling out poor performing funds, inadvertently questioned simple funds management style thinking. It has recognised that assessing funds across a range of metrics is more important than single short-term performance figures. It has asked funds to demonstrate that they understand the members who make up their pools of assets, and once they have done this, how they intend to manage the pool of assets to achieve what those individuals require.

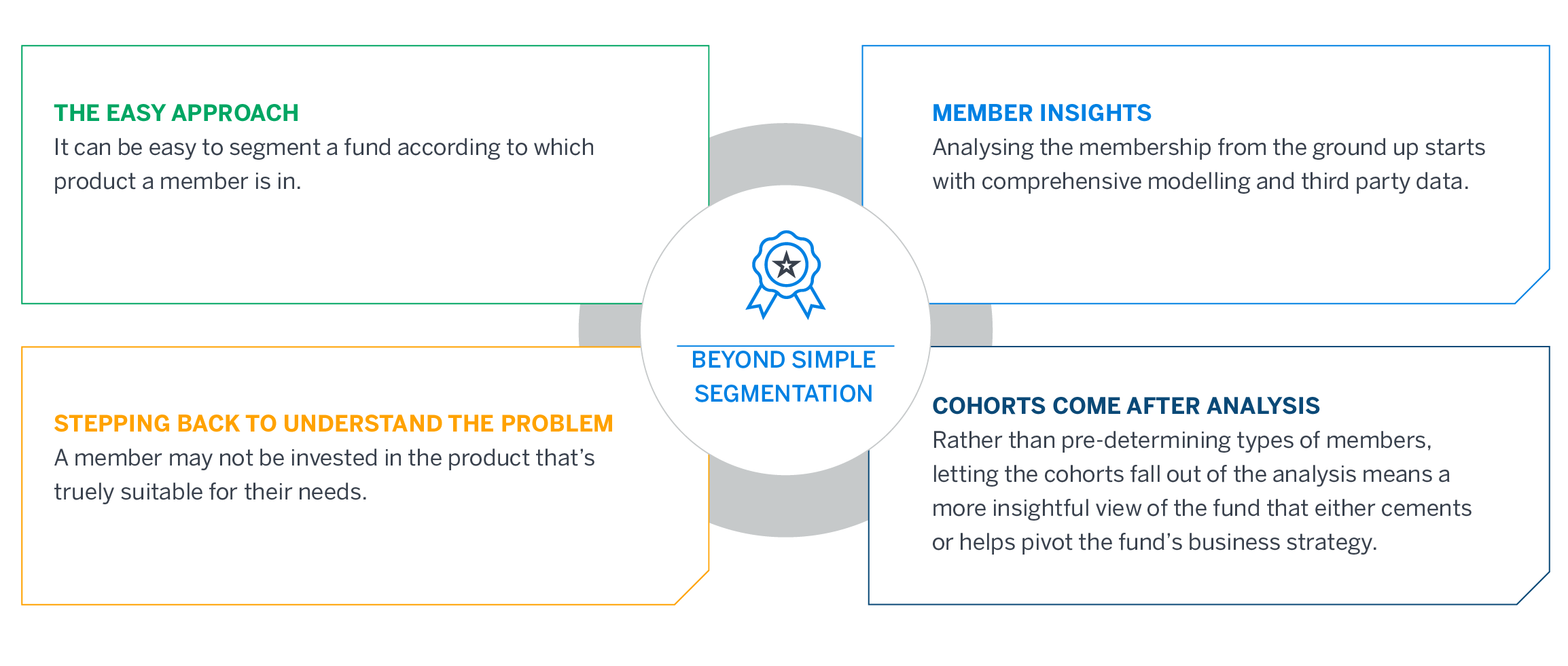

Using technology to move beyond simple segmentation

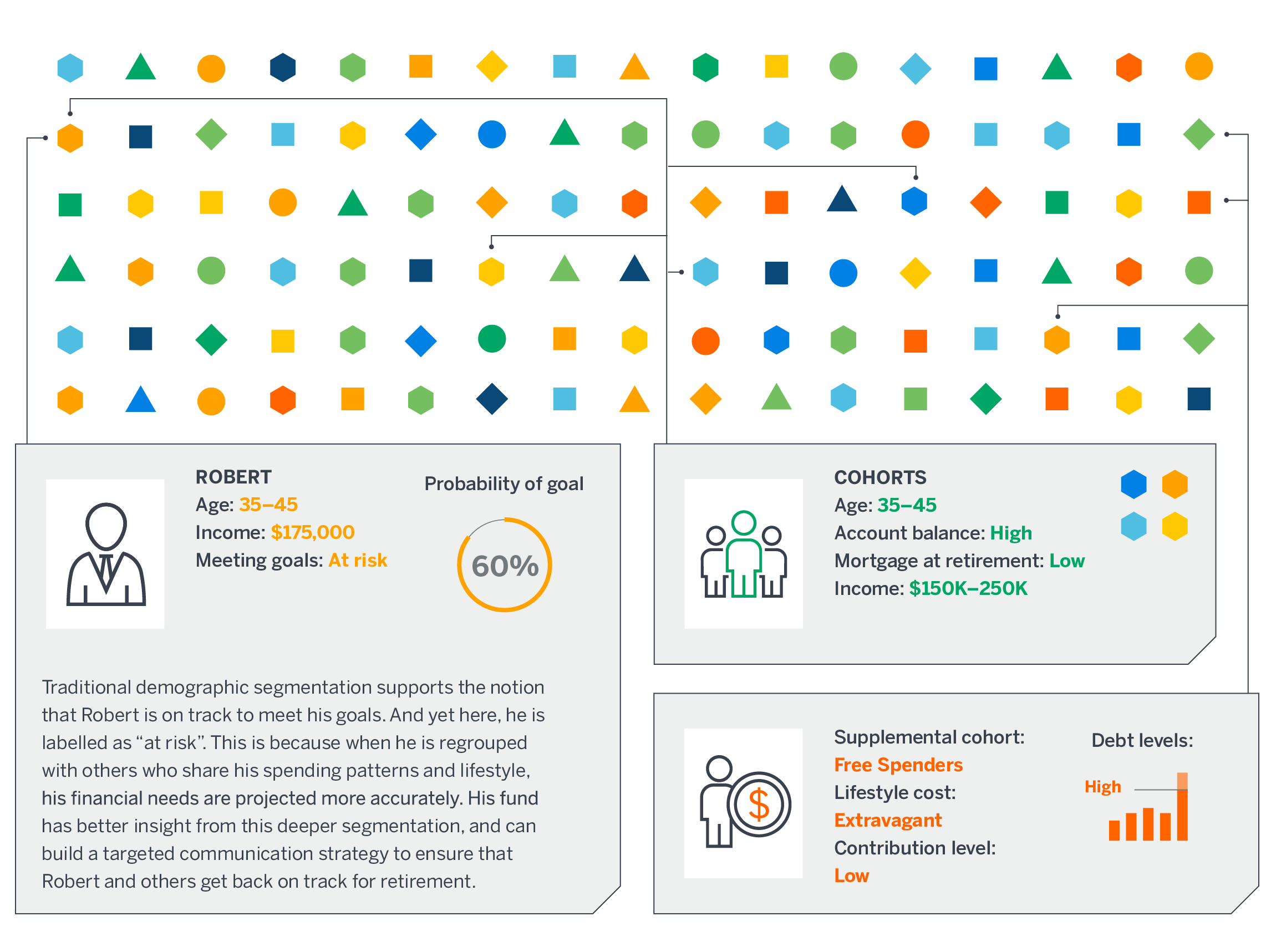

Done properly, a fund would understand itself, not as a pool divided into a few types of members, but as individual member outcomes aggregated up into groups, to form a holistic picture of what the fund really looks like. A bottom up approach, rather than a top down one.

If that sounds like an overwhelming task, that’s because it has been, up until now. But, as we approach the end of this decade, with the data and technology available to us, it’s easier than one might first think.

Our understanding of modelling has changed: it’s become real-time, and it’s no longer based on simple, linear assumptions. It’s outcomes and goals based rather than simply risk based. It is genuinely forward looking.

We also have data science available like we never have before. If a global shopping centre chain can pinpoint the exact geography for its next centre, based on data science, super funds should be able to say, with a great deal of confidence, what it’s doing for each member.

Combining such technological tools to form a real time, expert opinion on where a fund is right now, and how it’s planning on delivering outcomes, is more important than ever.

Technology is the only way a fund can implement the business plan for SPS515 that is a living and breathing vehicle; one that moves with the changes in economic cycles and demographics; smoothing out short term trends over the long term. And, perhaps most importantly, data and sophisticated modelling is how we combine the member services and investment management parts of a super fund for holistic outcomes delivery. It ensures segmentation isn’t just used for basic marketing purposes, and it challenges assumptions like the one that states lifecycle investing is the only way to combine member data with investment strategy.

Analysis on an individual level

Getting from A to B

Member outcomes requires three things of funds: they must show where they are right now, know where they are going, and how they are planning on getting there. It is only after they can do this, and demonstrate that they “know thine own self”, that they can better benchmark themselves against another fund. And, arguably, for funds who offer choice products, doing so will mean that they might be able to prove there is no suitable other fund to compare themselves to after all.

It is time for the industry to pivot to being more consumer-led, and less peer-driven. We will continue to lag behind most other industries until we do. In the meantime, the member outcome regime will be one way that regulation forces us to incrementally get there.