The focus of global regulatory pressure is shifting towards building resilience in the financial system against the impact of climate change and other sustainability-related issues. At a minimum, investors should be taking actions to avoid reputational risks and protect their “social licence to operate”. This means showing evidence of considering sustainability-related risks in their decision making.

The pace of change in sustainability is accelerating. Smart beliefs, sophisticated measurement and thoughtful implementation are driving better investment practices. However, it would appear that most asset owners rely on asset-level or manager-level practices to manage sustainability risk. Is it possible to integrate sustainability-related risk management or, indeed, assess portfolio resilience, when making top-down or total portfolio construction decisions?

In the absence of a view as to whether the market is more likely to over or underestimate future outcomes, it is intuitively desirable to structure a portfolio so that it is resilient to as wide a range of economic environments as possible.

Similarly, a natural starting point for portfolio strategy is to look at resilience through the lens of potential sustainability scenarios that might occur. To assist this, we believe that a portfolio resilience “score” should be added to investors’ definition of “portfolio quality”.

So, what does that look like?

The assessment of a portfolio from a top-down perspective using only high-level asset class definitions is unlikely to provide a complete lens into the exposure of a portfolio to sustainability-related risks. Therefore, assessment of portfolio resilience will require bottom-up analysis. There are two key dimensions to portfolio resilience:

- Materiality – which sustainability-related risks are likely to be the most impactful?

- Magnitude – where there are material risks, how large are the exposures to these risks?

And in developing an approach for assessing portfolio resilience, four criteria should be applied:

- Objective/data-driven – the portfolio resilience score should, to the extent possible, be derived from objective data, rather than being dependent on subjective views for the evolution of individual risks

- Systematic/repeatable through time – the method should be largely mechanistic and able to be readily repeated over time on different portfolio configurations

- Modular – the method should be able to be applied at different levels of “depth” of the portfolio, to allow portfolio resilience to be assessed at different levels of granularity

- Pragmatic – the approach should involve a degree of effort both in terms of calculations and data collection that is commensurate with an investor’s sustainability beliefs and the way in which the resilience score will be used.

To the extent that an investor has a belief that material risks are mispriced by the market, these views can be overlaid in order to identify and evaluate the size of sustainability-related return opportunities. The matrix below, depicts a way of dimensioning investor sustainability-related beliefs to highlight whether the advantages that a particular investor perceives will be worth the effort. An investor that sits towards the bottom left of the matrix above will generally look to take a simple approach, whereas an investor that sits in the middle or to the top right of the matrix would benefit from a more sophisticated approach.

How a portfolio resilience score is used within an investor’s process will depend on the extent to which non-financial motivation and/or beliefs relating to materiality and mispricing are ascribed to sustainability. It will also depend on the degree of sophistication of an investor’s investment process, for example whether the investor allocates to discrete asset class or adopts a “total portfolio approach” where all investment opportunities compete against each other for scarce capital.

Comparison against a reference portfolio

Simplistically, the objective of portfolio construction is to maximise the utility of a portfolio to the investor, considering both its financial and non-financial characteristics. One way to think of is developing a portfolio that improves on a naïve reference portfolio through multiple lenses – any decision to allocate away from the reference portfolio should improve on the utility of the portfolio to the investor. Therefore, if an investor holds a portfolio that has greater exposure to sustainability-related risks than the reference portfolio there should be a supporting set of beliefs related to mispricing and/or a return hurdle.

An investor who holds beliefs that sustainability-related risks are material could and should implement extensions of this basic approach including:

Portfolio Quality

Portfolio quality refers to the extent to which a portfolio meets the needs of the end user, or members in a superannuation context, in both financial and non-financial terms. A balanced scorecard is the best way to assess portfolio quality and we use five lenses in our scorecards.

| Efficiency | Efficiency refers to the level of compensation received for taking on investment risk (that is, return per unit of risk). |

| Diversity | By having as diverse an exposure to different return drivers as possible an investor is able to reduce its reliance on any one return driver as the primary “engine” of future return outcomes. |

| Robustness | Robustness refers to the ability of the portfolio to withstand the multi-faceted risks that may impair achieving the portfolio’s mission. Robustness includes portfolio resilience. |

| Implementation | Funds with certain competitive advantages have the opportunity to access a greater opportunity set than the five primary macroeconomic return drivers (also known as “bulk betas”). The implementation lens also assesses whether the additional return received creates value after accounting for higher fees. |

| Peer risk | In order to deliver superior peer relative performance an investor needs to invest “differently” to its peer group, but this also creates exposure to the risk of peer-relative underperformance. |

Identification of the sustainability-related risks that a portfolio is most exposed to, and if there are any risks to which a portfolio is more exposed to than the reference portfolio. This analysis can also be run at the manager level and used to inform engagement with an investor’s outsourced asset managers and help to understand these risks in more detail.

Attribute the portfolio resilience score between different parts of the portfolios, such as at the asset class level. This would allow an investor to observe whether there are any particular parts of the portfolio that are large contributors to exposure to sustainability-related risk. This could in turn be used to highlight particular areas of the portfolio in the portfolio construction process.

A practical framework for assessing portfolio resilience

Having described the concept of portfolio resilience, what can be implemented today for most asset owners?

There are a number of issues that prevent the realisation of a full best practice vision for assessing portfolio resilience to sustainability-related risks; a number of the analytical tools are work in progress and/or some of the required data may be problematic to obtain. However, using data that should be

readily available and tools that are already accessible, we believe that most asset owners can make significant progress today in assessing the resilience of their portfolios to sustainability-related risks. We suggest using these five steps:

| Step | Suggested | Issues and Future improvements |

|---|---|---|

| 1 – Data capture |

|

|

| 2 – Materiality analysis |

|

|

| 3 – Define reference portfolio |

|

|

| 4 – Calculate resilience score | Use ESG ratings data to determine magnitude of exposure to material sustainability-related risks

|

|

| 5 – Benchmarking |

|

|

Example portfolio resilience analysis

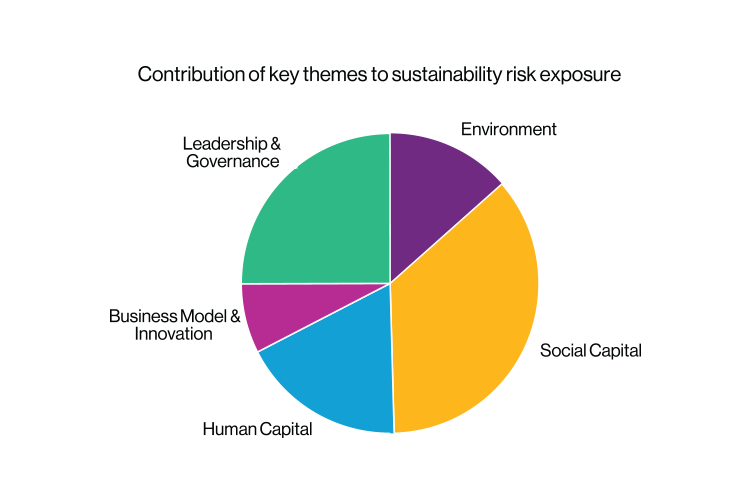

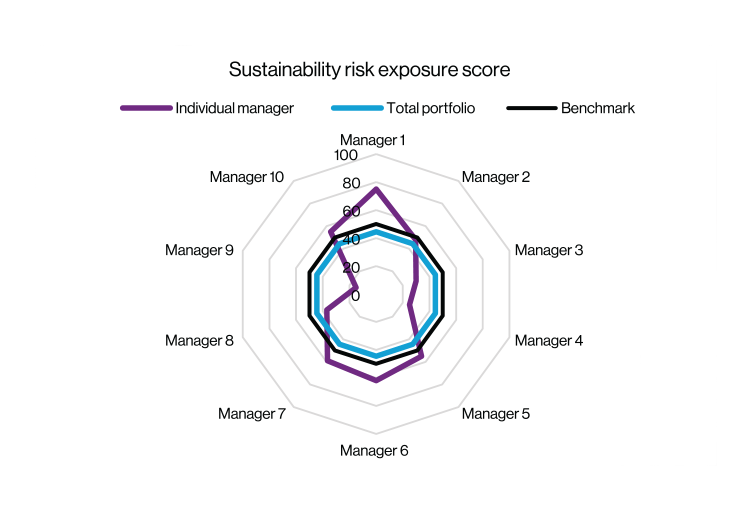

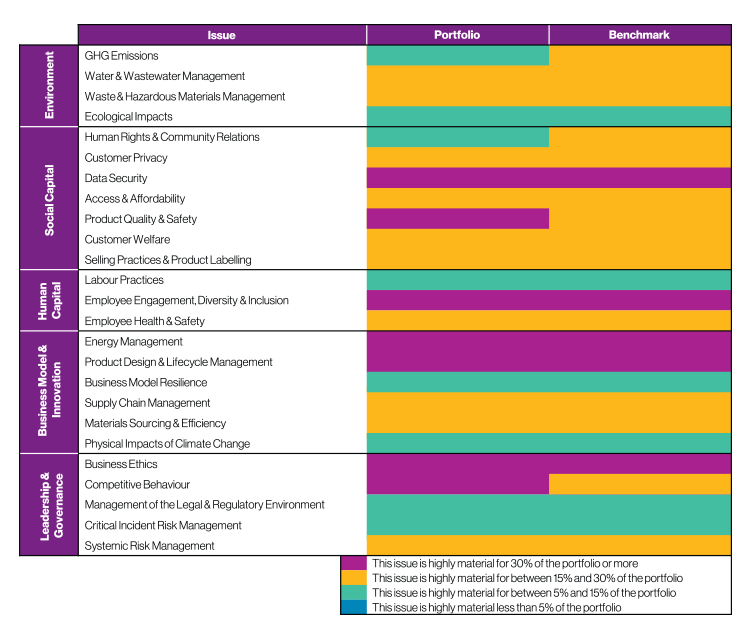

The key outputs from portfolio resilience analysis are a list of the sustainability-related risks that are material to a portfolio, and a portfolio risk exposure “score”, along with comparisons to any relevant benchmark(s).

Materiality can be illustrated visually using a heatmap such as the one below, which shows the proportion of a portfolio for which various sustainability-related issues are expected to be highly material:

A portfolio risk exposure score can be attributed to individual managers or asset classes to identify whether there are any outsized contributors to sustainability-related risk exposures. The total portfolio score can also be attributed to individual sustainability-related issues to augment the materiality heatmap. The score can be expressed either in absolute or relative terms (for example, as a percentile rank compared to the broader security universe) – we prefer the latter as ESG scores are generally not uniformly distributed.

Having taken this first step and repeated the measurement of portfolio resilience over time, we would note the adage “what gets measured gets managed”. Therefore, an investor with a sufficiently sophisticated investment process will naturally look for ways to improve portfolio resilience to sustainability-related risks, subject to meeting its other objectives.