New global research from Mercer reveals two-thirds of adults expect to live past 80, but only one in three expect to have enough money to afford it. This suggests the statutory or customary retirement age is becoming meaningless, as individuals are working longer, out of either choice or economic necessity. So how should governments, industry and individuals respond?

Mercer’s Healthy, Wealthy and Work-wise is new global research that identifies critical imperatives for financial security in the areas of health, action, technology and structures. The study—which was conducted across 12 countries, seven regions with 7000 adults 18+ and 600 senior decision makers from private and public sectors—showcases relevant data and outlines potential actions to improve financial security.

Key findings included:

- People are not confident they will have enough money to retire: People expect to spend 15-20 years in retirement. Without better planning, it could be that many people are at risk of outliving their savings.

- The retirement age is gone: The expected retirement age no longer applies, as people are working longer. More than two-thirds (68 per cent) of respondents expect to keep working in some capacity indefinitely, or never retire.

- Health is the way to wealth: As working longer requires a degree of physical fitness, health is now intrinsically linked to retirement wealth. Yet only 39 per cent profess to be in excellent/good enough health for the job they have today.

- People are not proactively saving: Eighty one per cent of adults surveyed feel personally responsible for their retirement income, yet many are not taking the required actions.

- Everyone must pitch in: Individuals, employers, and governments must work together to ensure financial security for everyone. Innovation, technology, new ways of thinking and cultural adaptation will all play a part in reinventing expectations to meet new realities.

Financial insecurity

The stress of financial security affects all of us — no matter what our age or career stage – as we each face the prospect of outliving our savings. Those in their 20s and 30s face uncertainty around what to do, how to break into the job market and how to save enough. Women face pay and pension gaps. Older people face ageism. The booming ‘gig economy’ is changing the nature of work itself, raising questions about who will pay for an individual’s retirement.

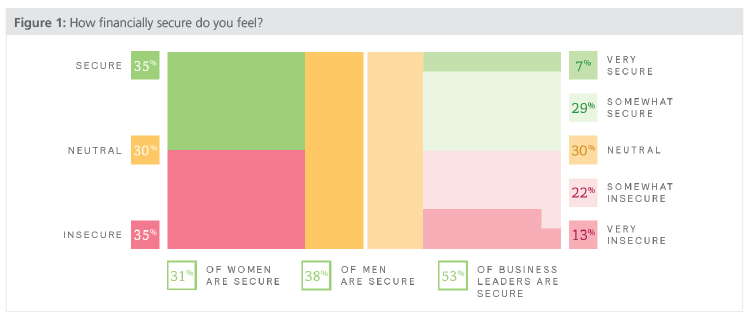

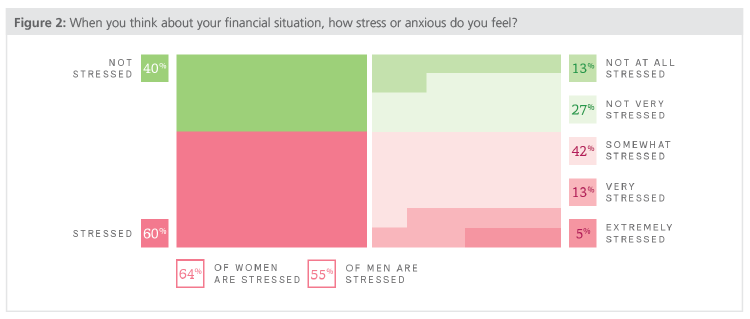

Mercer’s study reveals imbalance between the need to save and our ability to do so – and this affects all of us, regardless of income status. Sixty-five per cent of adults surveyed—and 47 per cent of business leaders—do not feel financially secure (see Figure 1). Sixty per cent of people are at least somewhat stressed by their financial situation, and this figure is higher for women (64 per cent) than for men (55 per cent) (see Figure 2).

Figure 1: How financially secure do you feel?

Figure 2: When you think about your financial situation, how stress or anxious do you feel?

It’s time to retire retirement

As we move towards a world where people live longer, flexibility in work becomes vital so people can choose how long to work for and on what terms. In short, the idea of retirement needs to be retired so we can consider the different ways an individual might gain financial reward into their older age.

Of course there are those for whom work has become the only savings plan: no job means no income. In other words, financial security requires staying employed and employable. The study shows that people do understand that to remain relevant and valuable requires lifelong learning to keep skills current and relevant in an ever-changing job market. Eighty-six per cent say that continuing to develop professional and personal capabilities is important.

Health increasingly important to long-term wealth

In addition to the required skills to continue earning and saving, we are relying on good health to be able to work as long as necessary, making health vital to wealth. Although the research found health is the most important priority when it comes to quality of life and financial security now and in later years, Mercer’s report also uncovered people are only doing the basics when it comes to their health. It stands to reason that only 39 per cent professed to be in excellent or very good health as it relates to their ability to perform on the job.

To live better later we need to act smarter now

Although most of us accept the responsibility that “it’s up to me” to save enough income for later years, we do not take the necessary actions. One-third of us have not made any later-life financial calculations and only 26 per cent of us are confident we can save enough for retirement. The research indicates several paths to increased financial confidence, including how employers and government should engage people in saving for the future; redesigning retirement plans; and using smart technology to simplify, track and help people stay financially in control.

Another invaluable finding from the research is that a resounding 79 per cent of adults trust employers to give sound, independent advice on planning, saving and investing. Specifically, the workforce is looking to employers as a trusted provider of easy-to-use, secure digital tools to “help me, help myself,” driven primarily, but not exclusively, by technology-first Millennials – the largest segment of the workforce. Ninety-three per cent of under-35s are interested in secure, easy-to-use, jargon free, online financial tools to help manage their finances, but the same is true for 85 per cent of total respondents. Additionally, across all age groups, two-thirds are comfortable managing their savings using mobile banking, online tools or smart apps.

However, that isn’t to say different employee groups don’t have different needs. In fact, employers will benefit from personalising plans and benefits to meet those needs. Millennials—who expect to and will actually live longer—face a savings gap, compounded by changing jobs more frequently over their lifetimes, than previous generations did. Women face a gender gap in salary inequity, career continuity and access to employer-sponsored retirement plans and, thus, in their ability to save. Both groups represent opportunities to build and sustain committed and diverse workforces.

Mercer actuary and global thought leader on superannuation and retirement income, Dr David Knox said that although the report did not include data from Australia, many of the global findings were directly transferrable to the situation here in Australia.

“The stress of financial security is impacting all countries, organisations and people. Leaders need to work together to ensure financial security does not become the next generation’s burden and the time to cultivate financial security is now,” he said.

“Everyone has a role to play in closing the savings gap,” said Eve Read, consulting leader, DC & individual wealth, Mercer. “The majority of our research participants trust their employer to provide sound independent advice and although many companies may not want to offer advice, they can have a real impact on the financial security of their workforce through other initiatives.

“Evidence suggests that workers without financial concerns are more productive and those with employers who provide financial wellness solutions are more engaged in their work. It’s a win-win for both employers and employees,” added Read.

The current state of fi

nancial security calls for revolution. The good news is that if action is taken now, there are opportunities to address the financial savings gap and put people on a path that runs concurrently with today’s cultural norms. Society is changing – and our approach for savings and financial security should change alongside it.

The catalyst for Mercer’s research was the convergence of several global trends including economic uncertainty, pension shortfalls, people living longer, ageism and reductions in employee benefits, among other factors. These trends intersect health, wealth and careers, so planning for financial security must account for each of these core areas. The existing expectation to retire at a certain age no longer applies. As people live and work longer, it is time to retire the concept of retirement as we currently know it. To live well later we need to act now – and responsibility to act is incumbent across the private sector, public sector and individuals.