In the age of the customer, as super funds strive to be at the centre of any and all financial decisions, how funds assist and advise members in retirement falls woefully short. Most retirement plans are carefully calculated with income stream drawdowns, matching asset allocations, longevity projections; coupled with dedicated implementation and ongoing support. Yet when it comes to applying for and maintaining the Age Pension members are often sent a balance letter and wished the best of luck.

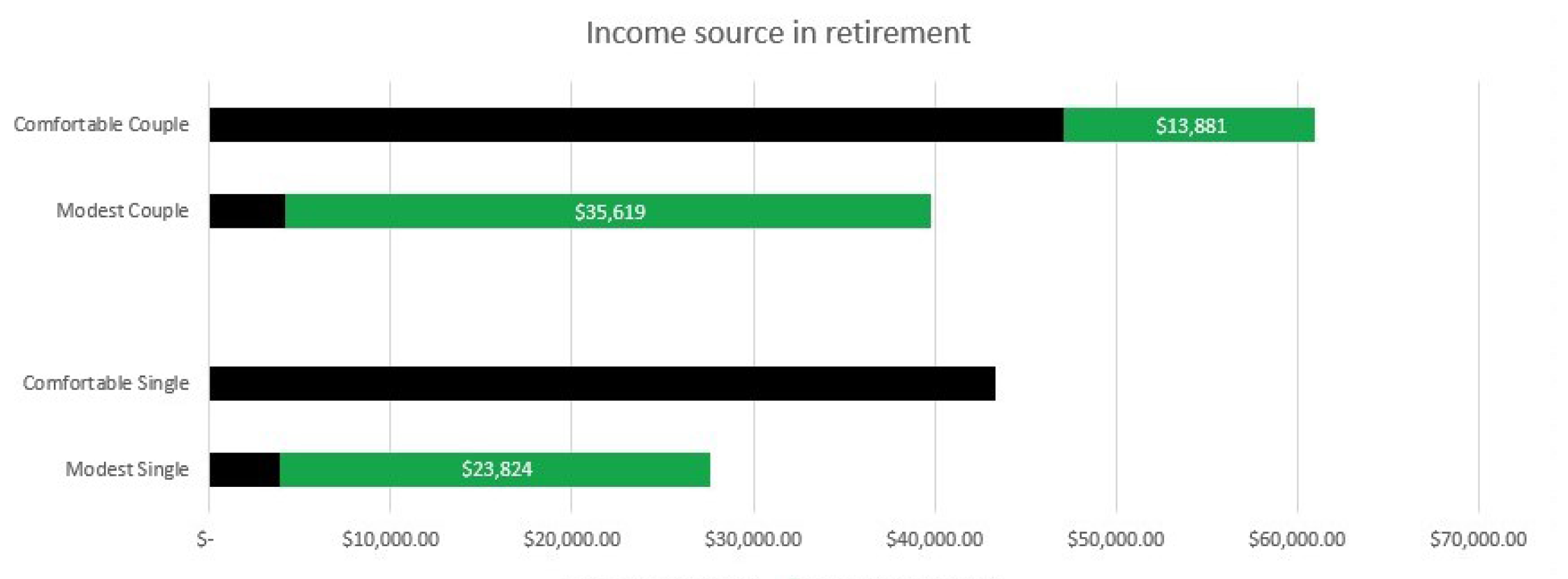

A couple with enough superannuation assets for a comfortable retirement standard, as defined by ASFA, will still receive approximately $14,000 per annum via the Age Pension. 63 per cent of all seniors receive either a full or part pension in retirement. It is a crucial cornerstone of retirement income.

Many members find the Centrelink and Age Pension experience daunting, demoralising and demeaning. In a comprehensive study (The Centrelink Experience: From ‘waiting, frustrating, hopeless’ to ‘helpful, friendly, positive’) conducted by National Seniors Australia and Retirement Essentials in June 2018, 61.5 per cent of people who had applied for an age pension since 2016 were left dissatisfied or ambivalent with their experience. 82 per cent of all respondents identified that they sought help and assistance with the process.

However, funds assisting members with their superannuation retirement income needs have limited scope to help them in their interactions with Centrelink, being at odds with the sole purpose test. In fact, APRA and ASIC recently wrote to trustees, including in their correspondence the following:

3. Is the deduction consistent with the sole purpose test? The sole purpose test (section 62 of the Superannuation Industry (Supervision) Act 1993) means that only costs associated with advice that relates to the member’s superannuation and insurance obtained through superannuation may be deducted from the member’s superannuation account. Advice that relates to investments outside of superannuation, for instance, cannot be funded from superannuation account deductions. There is a range of data points accessible to trustees that would suggest the deductions made may be inconsistent with the sole purpose test (for instance, the value or frequency of the deduction for the fee).

In this context an option for a fund might be for advice about Centrelink to be provided by a related entity and be charged for directly rather than a deduction being made from a member’s account.

Applying for payment

Looking at most funds’ forms and guides for their account-based pension products, members are required to complete 10 to 15 questions and supply proof of identification. Funds would normally then set up this ongoing income stream within 5 to 10 working days. All in all, a fairly easy set up compared to applying for the Age Pension.

To apply for Age Pension you are required to answer up to 90 questions on eligibility and 59 questions on assets and income. You must provide evidence of every bank account you own as at the application date, provide evidence of assets and superannuation, prove your identity by presenting at a Centrelink office. And that’s if your situation is simple.

If you or your partner are still working, you are required to report fortnightly and provide them with your last year’s tax return, which may have nothing to do with your future income.

If you owned a business that is another 24 questions plus providing complete evidence of the business including tax returns, even if you are winding down the business.

Own an investment property and that’s another 45 questions plus proof. And if any of these assets, business or income are part of a trust there is a supplementary 97 questions about that ownership structure.

All these additional questions and documentation may not even be used in your assessment as they may only reflect the past scenario and not the current situation as it is common for people to wind down businesses or sell assets prior to retirement.

Centrelink technology drive

In 2015 Centrelink started receiving funding for its Welfare Payment Infrastructure Transformation (WPIT) project. This project is described as such on the Centrelink website:

“WPIT will change the way we service the community. It will help us modernise our processes and technology to better meet the needs of all customers.

Transforming welfare service delivery will make it easier for people to interact with government. It also means people will have a seamless experience across face-to-face, phone and digital channels.”

On face value this digital overhaul is perhaps long awaited and if Centrelink can deliver on this promise that would be a great outcome for everyone. The project is entering the third tranche now which is focused on jobseekers, older Australians, carers and those with disabilities. This tranche will cost the Australian Government $600 million over four years. The total project is expected to cost $1.5 billion over its life.

Centrelink outcomes

Centrelink is currently driving everyone to set up, use and apply for their entitlements via the myGov platform. Many clients report the experience of walking into a Centrelink office for the first time as quite confronting; being greeted at the triage desk and then told to go use the bank of computers where there is very little personal assistance. Many may never have used myGov before, or the last time they did was so long ago they have forgotten all their passwords.

Clients have also reported incorrect information being given to them by staff, especially where they appear to have too many assets to receive any benefit. They describe being ‘laughed out of the office’ after being told they ineligible for anything because they have too much money, or too high an income but in reality, can often be eligible for a small Age Pension or the Commonwealth Seniors Health Card (CSHC). A couple can have income of just under $110,000 per annum and still qualify. If they are both not working, they can have superannuation assets of over $3.2 million and still receive this card, as superannuation and account-based pensions are deemed under the income test.

Centrelink has a Key Performance Measurement of processing 80 per cent of all age pension claims within 49 days. However, in the senate estimates a response given to a question on notice from Centrelink showed that 48.5 percent of the 61,460 applications fell outside of that service standard. 9,899 of those claims were older than 26 weeks.

In a perfect world every one of our members would be able to simply set up a myGov account and log in to complete their Age Pension application. However, the difficulties that the elderly and remote face with technology are well documented.

Even if our members have access to the internet, they may not have the comprehension, literacy and numeracy required to adequately complete the process.

Digital inclusion

Telstra with the assistance of Roy Morgan, RMIT University and the Centre for Social Impact at Swinburne University, publish and measure digital inclusion in a report that measures the Australian Digital Inclusion Index (ADII). In 2018 their third iteration of the report found that digital inclusion for the majority of Australians is improving but the divide is widening in certain cohorts.

The index measures such things as access, affordability and internet ability to create a rating out of 100. The average for all Australians is 60.2.

Their work also focuses on the divide between various cohorts. Unsurprising is the divide between rich and poor Australians. The richest household income cohort has an average of 72.1 versus 41.3 for those with the lowest household income. This divide has been widening since 2014.

The ‘Capital – Country gap’ between rural and capital city Australia has improved over the last three years but remains at 8.5 points hig

her in capital cities (62.4) than in country areas (53.9).

| Rank | Select demographic | ADII score | Points change since 2017 | Ranking change since 2017 |

|---|---|---|---|---|

| 1 | Household income Q5 (under $35k) | 41.3 | +1.3 | – |

| 2 | Mobile only | 42.7 | +1.2 | – |

| 3 | Aged 65+ | 46.0 | +2.3 | – |

| 4 | Less than secondary education | 47.4 | +2.0 | – |

| 5 | Disability | 49.2 | +1.2 | – |

| 6 | Household income Q4 ($35k – $60k) | 51.3 | +1.6 | – |

| 7 | Not in labour force | 52.0 | +2.1 | – |

| 8 | Indigenous Australians | 54.4 | +1.4 | – |

| 9 | Age 50-64 years | 58.1 | +2.7 | – |

| 10 | Completed secondary | 58.3 | +2.9 | – |

| Australia | 60.2 | +2.2 | – | |

As you can see the top groups of people with low digital inclusion scores are those with the lowest household income, people who only have mobile access, people over the age of 65, people with low levels of education and those with a disability.

These are the exact cohorts of people that require the most assistance with Centrelink and the Age Pension, yet they are being driven to a digital only solution.

Industry leadership

Australia’s superannuation industry continues to demonstrate its ability to innovate solutions, processes and services that improve the member experience. The super industry must work with the Government and Centrelink to advocate for change to their technology and service programs to improve and simplify member access to the Age Pension, the backbone of the Australian retirement system.

These solutions cannot just be an elegant digital design but must focus on the real needs of their customers, our members. Those Australians who most require the assistance of Centrelink are being excluded through low digital inclusion. While it’s possible to build the most elegant solution, it’s worthless if no one uses it or understands it.

As the largest generation enters into retirement, we owe it to our members, clients and customers to assist them in all areas of their retirement journey.