The Schroders Global Investor Survey 2018 spoke to more than 22,000 people around the world – and revealed that Australians are misjudging what retirement might look like for them, with the impact being that their retirement planning may not lead to them living the lives they hoped for when they finish work.

As ASFA raises frequently, one of the biggest questions we need to address with retirement saving is “adequacy”. This survey seeks to understand what adequacy looks like from the perspective of people still working as well as those already retired. It then compares these results to highlight any gaps between the expectations and reality of retirement.

Here are some of the key findings from the annual survey for this year.

Retirement spending

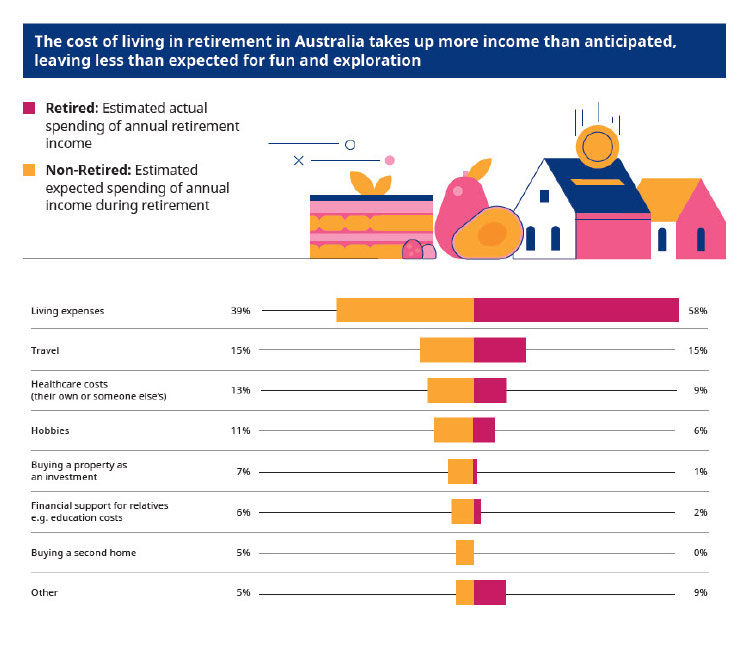

The biggest misconception is around what percentage of a retiree’s wealth will be required to cover living expenses. Australians who have not yet retired expect that they will use 39 per cent of their retirement income on living expenses. The reality is that retired people surveyed are using 58 per cent of their income on living expenses — a nearly 20 per cent gap between expectation and reality.

Living in Australia is not cheap. That 58 per cent figure is the third highest in the world, only very slightly behind South Africa and Canada, both at 59 per cent. The global average is close to 50 per cent.

Retirement saving

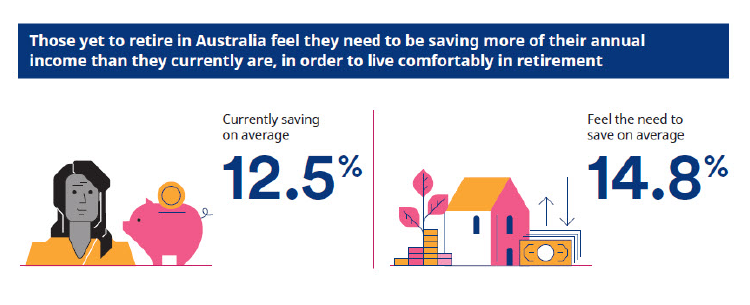

Savings rates are also below what people believe they need to save, a problem that exists globally. Working Australians feel they should be saving 14.8 per cent of their current income for a comfortable retirement, but they only save an average of 12.5 per cent. This is despite Australia possessing a world-class superannuation system that provides compulsory contributions of at least 9.5 per cent per annum. Only Denmark sees people saving more than they actually think they will need.

While it’s reassuring to see that Australians are saving on average 12.5 per cent of their income for retirement, largely as a result of our compulsory retirement saving system, there is still a savings gap to overcome to ensure people are better prepared for retirement.

Investing into retirement

Retirees continue to be active investors in retirement, particularly in Australia and it is important that the retirement investment solutions available to them can help them meet their expectations and, importantly, avoid surprises.

One of the biggest challenges with retirement saving and retirement spending is financial literacy. If people are continuing to be active investors into their retirement, it is important that they do this wisely and understand how investing as a retiree might differ to investing their super during their working lives. Some of the differences include; different tax status, greater focus on capital preservation (as retirees no longer have the future earnings lever), focus on generating an income, less appetite for surprises and uncertain life expectancy. These will all lead to a different investment strategy. Objective-based investment strategies (where there are risk objectives as well as return objectives) have been developed by a number of fund managers with retirees in mind and incorporate many of the characteristics of the retiree in their design.

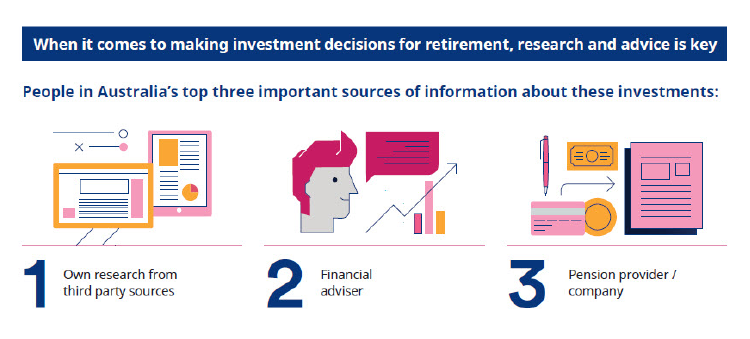

One of the interesting results of the survey was how people seek advice on their investments both over their working lives but also in retirement. Increasing savings earlier is important to achieving the desired outcomes in retirement, but knowing what to do, and when, is key. Of the 22 countries surveyed, only three of them ranked financial advisers as the most important source of financial information. Younger generations consider their friends, family and colleagues a more important source of information than older people do.

Millennials on retirement

The further down the age scale you go, the more the gap between expectations and reality are amplified. Millennials expect to spend only 27 per cent of their wealth on living expenses. This is concerning because it is this demographic that can have the most impact on their retirement outcomes by acting on the reality now.

Adequate versus comfortable retirement

There are also some interesting insights from the broader data set. In terms of comfort levels, 85 per cent of respondents indicated that they had sufficient wealth to maintain their desired living standards. This would seem to suggest that most people feel they have enough wealth in retirement. However, when prompted on this, 61 per cent of Australian respondents said they do not have enough to live comfortably, or could do with more income to live comfortably.

The reasons given for requiring more to live comfortably in retirement included increased life expectations, the costs associated with health care and aged care, in addition to the rising costs of living.

The funding gap

What the survey ultimately shows is that a “funding gap” exists in retirement between what retirees will have and what they want to have due to the different views on retirement saving, retirement spending and retirement investing.

One issue when judging the funding gap is deciding what happens to consumption as people age. Most people assume it declines markedly. However, this is not necessarily the case. Our research shows that those over 85 consume about only 10 per cent less than those at age 65. This result is due to the fact that inflation boosts the costs of consumption, a fact that further increases the funding gap.

Education the key

In order to achieve adequate retirement, we must find ways of educating pre-retirees as to the reality of life in retirement. This can come from an individual’s own experience by talking to the elders they know, but education must also come from elsewhere.

Educating people who are approaching retirement is a task that falls to all participants in the finance and superannuation industry. Furthermore, it stands to reason that financial literacy should be a priority for society more broadly. Low levels of financial literacy among the population in Australia need to be addressed, and realistic retirement planning (saving, spending and investing for retirement) must form a part of that education.

There are clearly a number of lessons we can learn from our elders where the experience of a retiree differs from what working Australians expect in retirement. If only we could speak to our future selves, they would no doubt tell us to be more financially literate and seek to better understand how the benefits of saving more, saving early and investing appropriately can lead to a more prosperous retirement.

The full results of Schroders Global Investor Survey can be found on Schroders’ website.