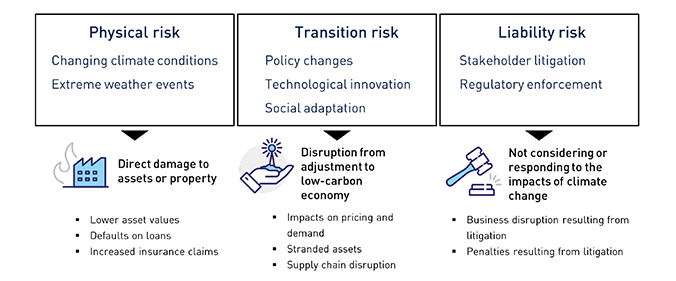

Since 196 nations signed the Paris Agreement in December 2015, climate risk has become an economic reality. What matters for investors are not only the physical impacts of climate change, but also what these mean in an investment context.

Regulators and policymakers are becoming increasingly focused on the urgency of decarbonisation. Here in Australia, APRA has released their draft guidance on managing the financial risks of climate change, which will seek to ensure that APRA-regulated institutions are managing the risks and opportunities that may arise from a changing climate, in line with APRA’s approach to other types of risk.

Figure 1: APRA’s Three Key Climate Risks

Source: APRA. Draft CPG 229 Climate Change Financial Risks.

Ignoring climate risk in portfolios has therefore become a risk in itself. But by positioning correctly, investors may be able to hedge portfolios. Additionally, the current and projected flow of capital into decarbonisation solutions may provide multi-decade investment opportunities.

Sustainable investing tailwinds

Responsible investing is one of the most topical areas in our industry today. This is not surprising when you consider Australia’s responsible investment market now accounts for 37 per cent of total professionally managed assets, a number that is rapidly increasing, with 86 per cent of Australians now expecting their savings and superannuation to be invested responsibly.

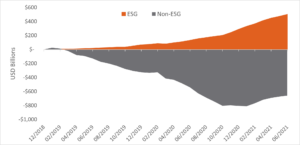

The seismic shift in investor preference is easily visible when looking at global flows into equity funds.

Figure 2: Global Cumulative Monthly flows into Equity Funds

Source: Morningstar, BetaShares. Morningstar universe defined as Global Open-End Equity Fund. ESG defined as funds with ‘Intentional Attributes: Sustainable Investment – Overall’.

In response, institutional asset owners worldwide now routinely incorporate environmental, social and governance (ESG) factors into their investment processes. According to a survey by Morgan Stanley, 95 per cent of institutional asset owners are integrating or considering sustainable investing in all or part of their portfolios. 57 per cent envision a time when they will only allocate to managers with a formal ESG approach.

Whilst a focus on sustainability appears key for fund managers looking to attract assets, the rising scrutiny from investors, regulators, and consumers is also becoming critical for individual company directors looking to attract capital to their organisations.

Approximately 40 per cent of global companies currently have a confirmed emissions reduction target1 . The remaining 60 per cent will need to reassess supply chains and dramatically increase spending on decarbonisation solutions.

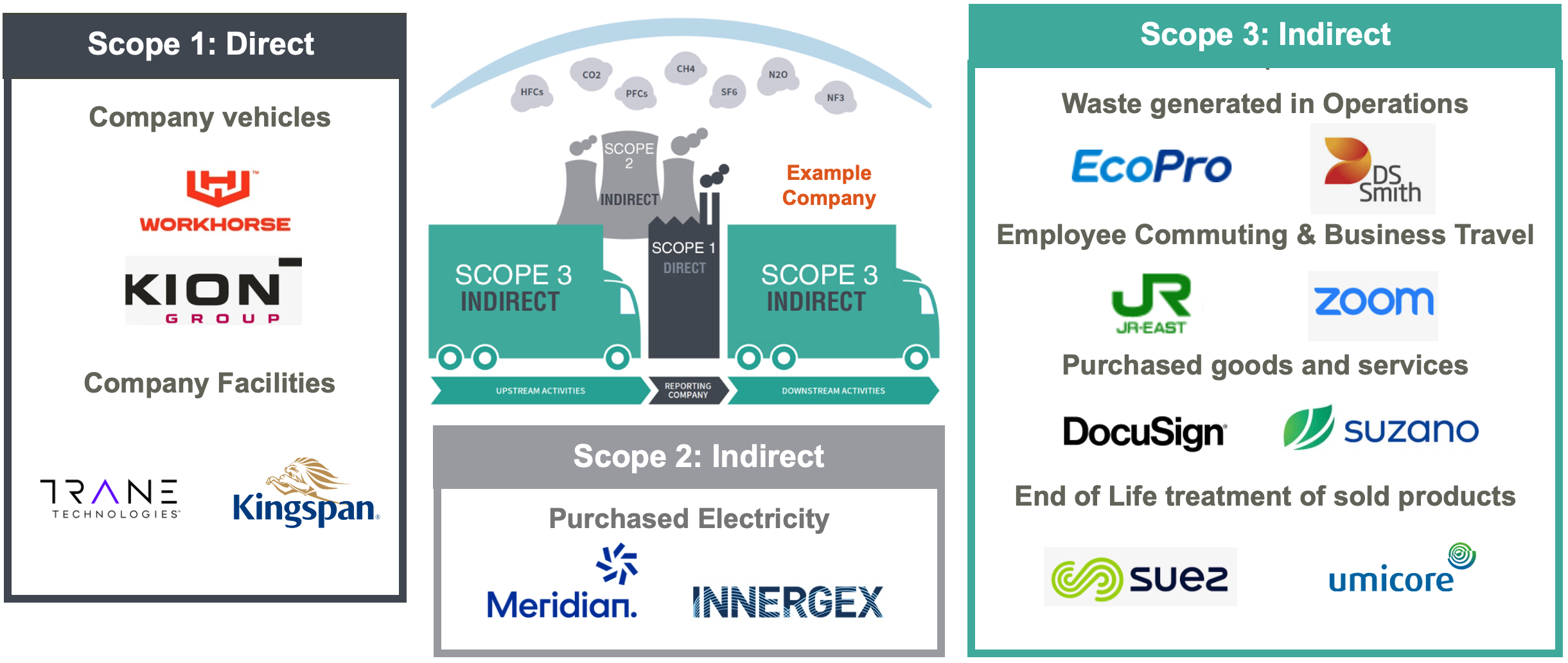

Every company is responsible for three types of carbon emissions. To achieve net-zero, significant spending is required across all three:

- Scope 1: Direct emissions from owned or controlled sources

- Scope 2: Indirect emissions from the generation of purchased energy

- Scope 3: Indirect emissions (not included in Scope 2) that occur in the value chain of the reporting company, including both upstream emissions (from purchased goods) and downstream emissions (from sold products).

Current spending is not enough

Agreements have been made and goals set, but we are currently falling far short of global targets.

If we are to meet a goal of net-zero by 2050, it is estimated that the current annual investment needs to triple to USD 1-2 trillion per year.

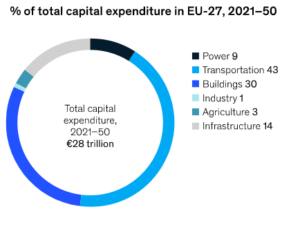

The European Union alone is estimated to require EUR 28 trillion in investments over the next 30 years to reach net-zero.

Figure 3: % of total capital expenditure in the 27 EU countries, 2021-50, to achieve net-zero emissions

Source: McKinsey & Co, Report: How the European Union could achieve net-zero emissions at net-zero cost, 3 December 2020

1UNEP (2018). The Emissions Gap Report 2018. United Nations Environment Programme, Nairobi

Beyond renewable energy – Five climate innovation pathways

According to the United Nations Intergovernmental Panel on Climate Change (IPCC) projections, the renewable share of energy production would need to increase from around 15 per cent at present, to at least around 60 per cent by 2050.

However, the deep cuts to carbon emissions required to limit global warming cannot be achieved by clean energy alone – the total solution is much broader. Outside of government initiatives, arguably the most immediate and deepest cuts will come from companies that can reduce their own carbon emissions, and the solutions and technologies enabling them to do so.

These segments contain either pureplay decarbonisation companies or those enabling the transition of others across the entire value chain.

- Green energy

- Green transportation

- Water and waste improvements

- Enabling solutions

- Sustainable products

Figure 3: Examples of companies enabling others to reach emissions targets

Source: BetaShares, iClima.

Investing in global companies fighting climate change

While increased climate action may be crucial for our environment, the significant ramp up in spending and activity could also result in monumental flows of capital into companies at the forefront of emissions-reducing innovation

‘Impact investing’ historically has been limit

ed to illiquid or private markets, however the universe of listed companies operating in these areas has increased. There are now more portfolio tools available enabling institutional investors to hedge against climate risks and seek to benefit from the opportunities the decarbonisation mega-trend presents.

The BetaShares Climate Change Innovation ETF (ASX: ERTH) aims to provide exposure to some of the leading global companies at the forefront of decarbonisation innovations.

In developing ERTH, one of the main objectives was to provide investors with exposure to a comprehensive range of the solutions required to achieve the targeted reductions in carbon emissions. Consistent with this, the index that ERTH aims to track goes beyond clean energy businesses and holds companies that enable reduction or avoidance of CO2 emissions within one or more of the five segments outlined above.

For example, Saint-Gobain is a French multinational corporation that operates in the traditionally carbon-intensive building materials segment, producing a range of glass and insulation products that contribute significantly to insulation and energy savings in buildings. As well as committing to reducing its own Scope 1 and Scope 2 emissions by 25 per cent by 2025 and 33 per cent by 2030, Saint-Gobain’s products sold in one year enable the avoidance of over 100 times the Group’s greenhouse gas emissions, which represents the prevention of over 1,200 million tons CO2 equivalent over their lifespan (Scope 3 emissions).

Saint-Gobain accounted for 3.5 per cent of ERTH’s portfolio as of 24 August 2021.

To qualify for inclusion in ERTH’s index, companies must derive at least 50 per cent of their revenue from one or more of the five key climate avoidance segments. The fund also employs prudent sustainability screens to eliminate companies directly involved in fossil fuel power generation and certain other negative business activities (see the fund’s PDS for further detail).