Whether on our phone, via the internet or through various devices, we are exposed to gaming elements. Think about your everyday journey to work. The mobile game apps you play with, the badges you earn for hitting the target with your smartwatch, or the loyalty points you receive for shopping. When we think of games, we think of fun and the feeling of exhilaration when we win or complete an adventure.

Mercer’s 2020 Super Fund Executive Report (Mercer, 2017), found that 39 per cent of superannuation funds rated ‘improving member engagement and service’ as their top business and strategic priority. However, the industry is facing a growing distrust and disengagement from Australians, ranging from Millennials to the indigenous communities. Key to this problem is the lack of understanding about how superannuation works possibly due to a general deficiency in financial literacy. So how can the industry transform a seemingly mundane topic into something fun, sticky and engaging?

Perhaps the industry could look at designing mobile-based learning apps that will help teach financial literacy and link them to superannuation. When Millennials are asked about which mobile apps they use to learn about finance, apps like Acorns and the Commonwealth Bank are cited, because these are interactive and teach them to save.

Millennials are acknowledged to be the cohort keen to make a difference and change the world. Imagine a mobile learning app that teaches them how to ethically invest via their superannuation fund by selecting investment options that invest in sustainable initiatives.

Interactive learning principles

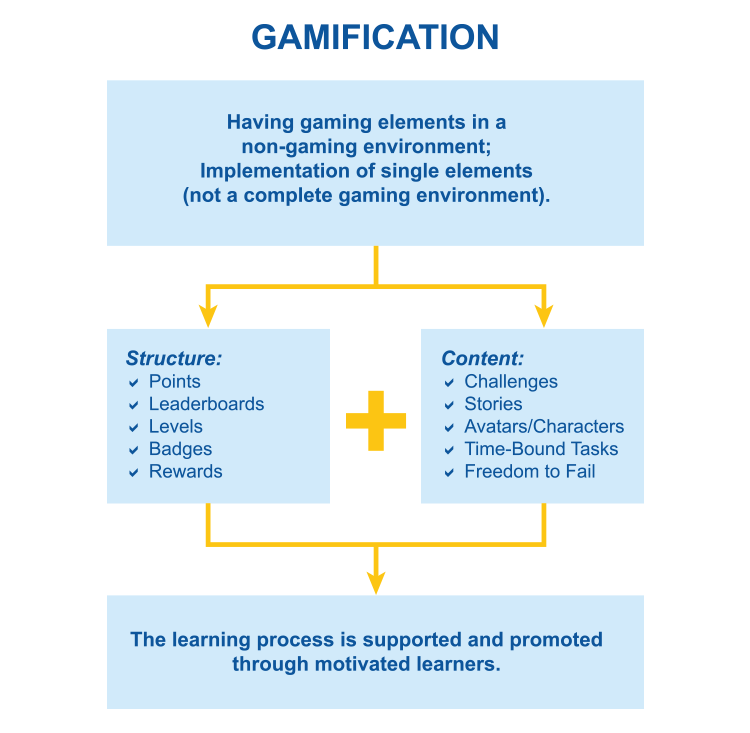

There are key principles to building an interactive learning experience by applying gamification elements, such as:

- Learning must have contextual relevance from a strategy, culture, and values perspective. It needs to be relevant to real life and games can be used to simulate this.

- Learning is most effective when learners are intentionally and repeatedly exposed to a cycle of learning, practicing, reflecting, and then repeating. This can be built into the game mechanics.

- Learning becomes engaging when users share experiences through high score badges and leader boards. The competitive streak in some will kick in to try harder and achieve more.

- Learning is an experience as opposed to a once-off event; entails a process of learning over time, by creating a game that is not time constrained.

- Learning is a social experience, and a gaming environment allows learners to exchange ideas, and gain understanding from collective or shared experiences.

- Learning should provide instant feedback.

A gamification example using these principles is IQ Business South Africa’s online learning delivery used to address resilience for a major bank spread across Africa. Users click on a secure browser link which opens to a game show room complete with game show host, avatar selection and a Wheel of Fortune-like spinner that randomly selects trivia topics. Users earn points with correct answers and learn why immediately if they make an incorrect selection.

Organisations that intentionally incorporate gamification understand that gaming is age irrelevant and should embody the brand and culture of the organisation. So, the game mechanics should be customised to teach users what the brand stands for. A great example of this is when Siemens was faced with major branding and communication challenges involving a diverse set of internal and external stakeholders. Their solution was to design Plantville, an online gaming platform to give the experience of being a plant manager. Players were challenged to maintain operation of their plant while improving productivity, efficiency and facility health. The online game hit the mark with their target stakeholders and more. Stories about Plantville were featured in more than 235 outlets, reaching more than a million people.

Game design

Gamification design elements have structure and content. Structure consists of points collection, leader boards, levels of difficulty, badges and rewards. Content comprises challenges in progressive stages, stories that are captivating, avatars or characters players can adopt, time-constrained tasks and freedom to fail (including the ability to respawn to try again). Behavioural science research shows that gamification can instil behavioural change depending on what the game is teaching, engaging and motivating. Popular gamification technology includes game design tools like Unity and Unreal Engine.

Gamification is also becoming a popular method to engage with customers as it encourages participation, engagement and loyalty. Think of what superannuation members could be interacting with – the website, the app, the social media page or all three. Then integrate game mechanics to draw them in regularly.

There are a handful of superannuation funds that have some degree of gamification in the form of retirement calculators where members can enter financial data, receive a ranking and see where they are likely to retire. Members can plug in different numbers to view different results. This is a start.

Consider gamification when you begin onboarding members. Can members earn loyalty points by completing a survey of the onboarding experience? Perhaps more points are earned when members visit their account to complete a task on the website. The points could then be converted to a tangible reward or even donated to a charity of their choice.

The use of gamification should always be linked to the overall fund strategy targeted at member segments that the funds would like to increase engagement and interaction with. Consider the strategic outcome, is this about increasing membership growth or a preventative strategy to stop further decline in the member segment? Also consider how this segment likes to be communicated with and leverage on technology to reach out to that segment.

The question of ‘what to gamify?’ should be answered by your members. Add gamification to what members care about and something they value. Otherwise incorporating game-like mechanics that do not serve an end purpose will be a complete waste of time.

The future

The future of gaming will invade the corporate world as technology rapidly advances into the areas of Virtual Reality (VR) and Artificial Intelligence (AI). We are likely to see playing freedom across platforms allowing users to move device platforms without any gaming interruptions. Online gaming spectators will become a norm. As user experience and functionality continue to enhance, players can shape, enhance and control their game play. Social media will become more integrated into gaming and gaming will require physical involvement of the participants. Online gaming will become social.

HIQ Learning Services, a company of IQ Group Australia has teamed up with its sister company IQ Business South Africa to incorporate gamification elements into learning and customer engagement. In July 2018, in celebration of Nelson Mandela’s 100th Birthday, IQ Business South Africa in collaboration with VictoryVR, developed a virtual experience that allowed users to stand in Mandela’s shoes. The journey, created in virtual reality, enabled users to stand on the hills near Mandela’s childhood home and his prison cell on Robben Island.

Imagine a VR experience built to teach the next generation of Australians about superannuation and retirement, like a ‘choose your own adventure game’. The choices they make in different phases of their VR life can lead them to different retirement scenarios. The time to incorporate gamification is now. Our future is game ready.