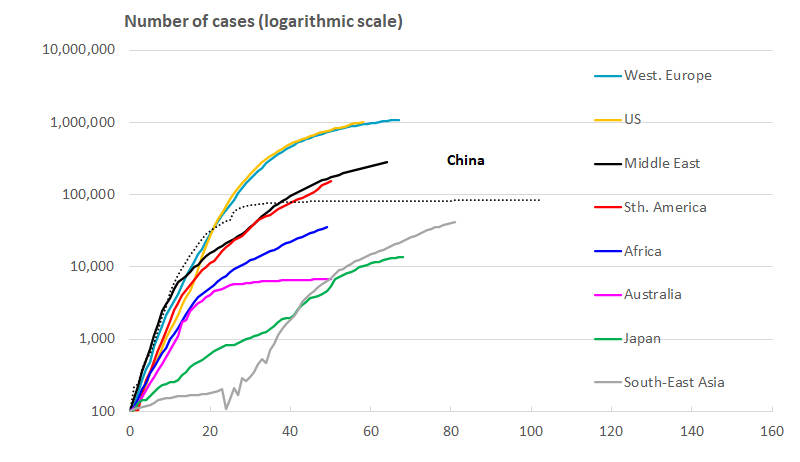

While I am certainly not calling the end of the crisis and am conscious of hubris, the recent good news about transmission rates of Coronavirus throughout the country does allow you to think about the future in a slightly more positive way. In the short term at least, there is the prospect of a gradual relaxing of the restrictions on travel and social gatherings and potentially a return to work in the office in some form in the not too distant future. The chart below from our most recent ASFA Economic Update highlights Australia’s strong performance in combating the spread of the virus in comparison with most other countries.

The prospect of things we used to take for granted like a morning jaunt to the café or even an all staff on-site ASFA meeting seems closer than we had reason to expect a month ago. And the return of such simple pleasures as meeting friends for dinner or walking in the park without the purpose of exercise may now be within reach.

But as the possible loosening of the lockdown prompts us to think of the future, we must also consider the possible long-term impacts of the superannuation early release scheme on our industry. Part of the success in averting disaster has also been the Government’s economic package in response to the crisis which has done so much to shore up the economy. Of course, as part of that package, they looked to the Australian superannuation industry.

Over the last few weeks we have been working with industry, the regulators and the Government to smooth out some of the wrinkles in what is an enormously challenging operational exercise. With this largely accomplished, benefits are now being paid out to those in need. A special mention should be given to the ATO for its substantial contribution to helping superannuation funds process these benefits quickly.

However, the fact remains that in a crisis the Government turned to the superannuation system. We must acknowledge that event and digest it. We have complained about the ceaseless tinkering with the superannuation system and the impact it has had on certainty and confidence in the past, but changing the preservation rules in such a swift and broad fashion also potentially changes the underpinnings of our system.

The immediate impact of the early release scheme for members, however necessary it is for them to get access to the money, will be to crystallise losses in a market that has fallen by more than 20 per cent and, unless they top up their benefits in the future, their financial position in retirement will be impaired significantly. The sell orders that will flow daily into the share market between now and September will also do little to quell market turmoil and negative sentiment.

The deeper impact however is on the nature and promise of superannuation altogether. Unless certainty is provided about how superannuation might be used in a crisis in the future there will be an enormous impact on funds’ investment strategies and in what they can invest. The Future Fund would have a very different strategy and long-term earnings potential if the Government advised that 50 per cent of its holdings had to be at call or a sinking fund for emergencies at any time.

If superannuation funds are required to keep one eye on the present for their investments their ability to provide patient capital able to assist industry as it recovers from the economic shock of the Coronavirus—to invest in nation-building infrastructure, to support digital and innovation investments and ultimately to produce strong long-term returns for members in retirement—will be impaired.

An aged relative used to caution me when I was young about playing with implements in a possibly reckless manner with the following reprimand, ‘only use things for the purpose for which they were intended!’. In my case the objective may have been to stop me from using a hammer as a baton or some other act of childish high spirits, but it is good advice, and better advice than I gave it credit for at the time. Superannuation is a world-class public good with varied benefits for Australia and Australians. The industry is very proud to be able to assist Australians suffering in the current crisis, however superannuation can only work properly if it is used for the purpose for which it was intended.