The early release scheme

The Coronavirus Economic Response Package Omnibus Bill 2020 received Royal Assent on 24 March 2020 and became law, and will remain in place until 24 September 2020.

You know the substance of it – the changes allow eligible employees and contractors who have had their hours cut or lost their jobs altogether to submit two applications for up to $10,000 each from their superannuation fund, one each in the 2019–20 and 2020–21 financial year.

The Government expected 1.6 million to apply, and there’s been a lot more already. Trance 2 will make the number even higher.

Potential claims: how many jobs are affected by COVID-19

ASFA estimates 2.5 million people either lost their job or saw a reduction of 20 per cent or more in hours in April, and thus were eligible for the new early access measures. That number has been increasing since April.

It includes 607,400 jobs lost during April, and of those who remained employed, around 1.8 million worked less hours than usual – a massive increase of about 1.4 million. Of the additional 1.4 million, about 500,000 did not work at all (but were still retained by their employer). Using these numbers, at the end of May, the number of individuals eligible for early release of their superannuation could have been approaching 3 million.

During June, potential further job losses were somewhat offset by the reopening of some businesses. Beyond June, employment conditions and thus those eligible for early release are hard to predict. Also, the late June spike in cases in Victoria and consequent return of some restrictions shows the potential for a tightening of restrictions.

How many have applied for early release

Around 20 per cent of the labour force and about 15 per cent of the total number of individuals with a superannuation account are expected to receive early release payments.

Applications for early release were continuing to flow to the ATO at a substantial 150,000 per week in the second half of June, though that’s well down on the nearly 700,000 applications made in the first week. Based on that flow, the total number by 30 June might be about 2.5 million, equivalent to about $18 billion for the 19/20 financial year and nearly 19 per cent of the labour force. Another spike in applications can be expected from 1 July when the second tranche of releases becomes available. The ATO website actually had a meltdown on 1 July but people lodging tax returns would also have contributed to that.

Industry, retail funds dominate early release over public sector funds and SMSFs

APRA data shows that the bulk of early release payments have been made by industry funds. Industry funds account for around 65 per cent of payments by value, with retail funds accounting for around 29 per cent. Public sector funds account for about 5 per cent. Only around 1 per cent of early releases are from corporate funds.

There is a relatively low incidence of early release payments in most public sector and corporate funds as the bulk of their members are still working.

The volume of early release payments from SMSFs is not likely to be high. Over 40 per cent of SMSF members are retired and/or are of an age where unconditional release is possible. Also, SMSF members are older and wealthier on average compared to fund members more generally.

What kind of members are applying for early release?

Not surprisingly, funds with many members employed in hospitality, restaurants and clubs have the highest rates of early release so far, at between 15 and 20 per cent of their accounts. Funds whose members are concentrated in public sector employment have very low rates of early release, at three per cent or less of member accounts.

Somewhat surprisingly, funds with membership concentrated in health related services have had substantial numbers of applications, at about 11 per cent of accounts. Many casual and part-time health workers have had reduced hours or no employment due to the cancellation of many forms of elective surgery.

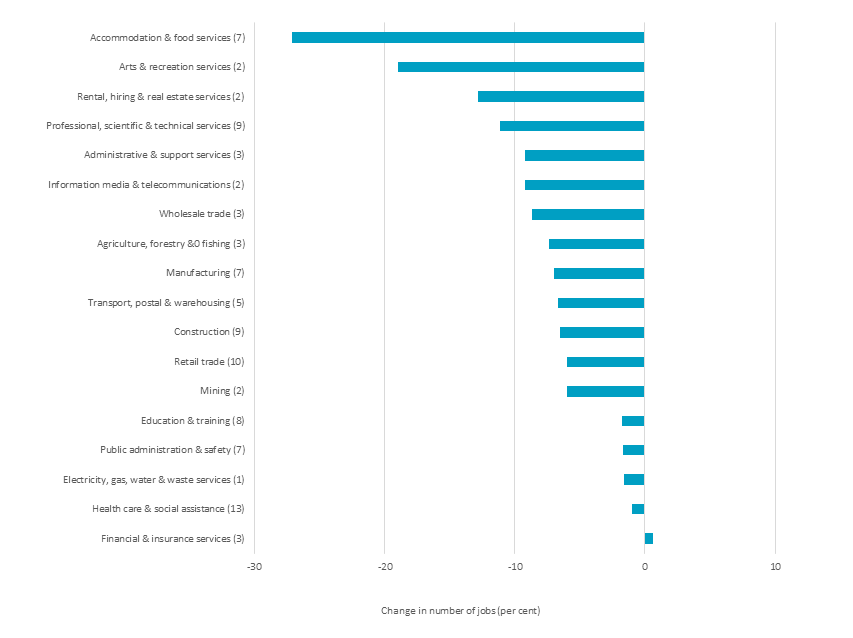

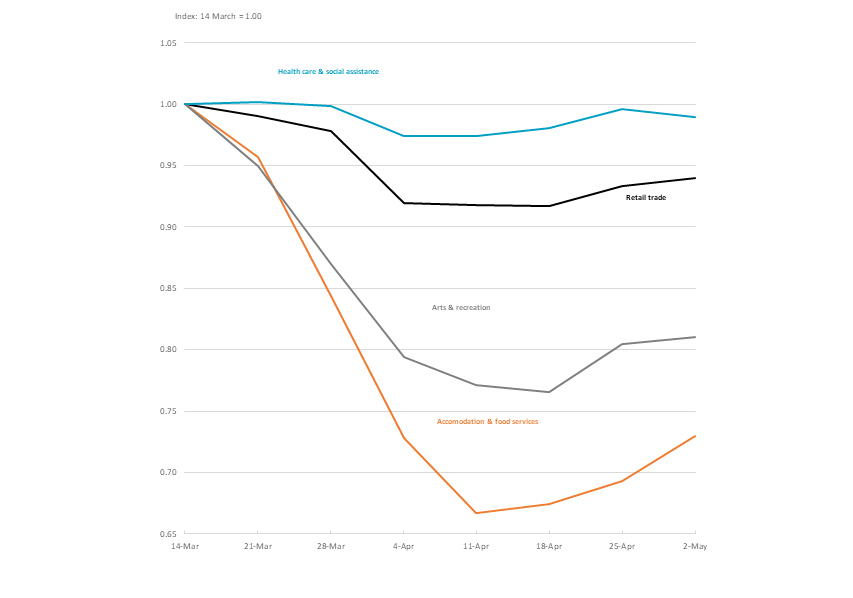

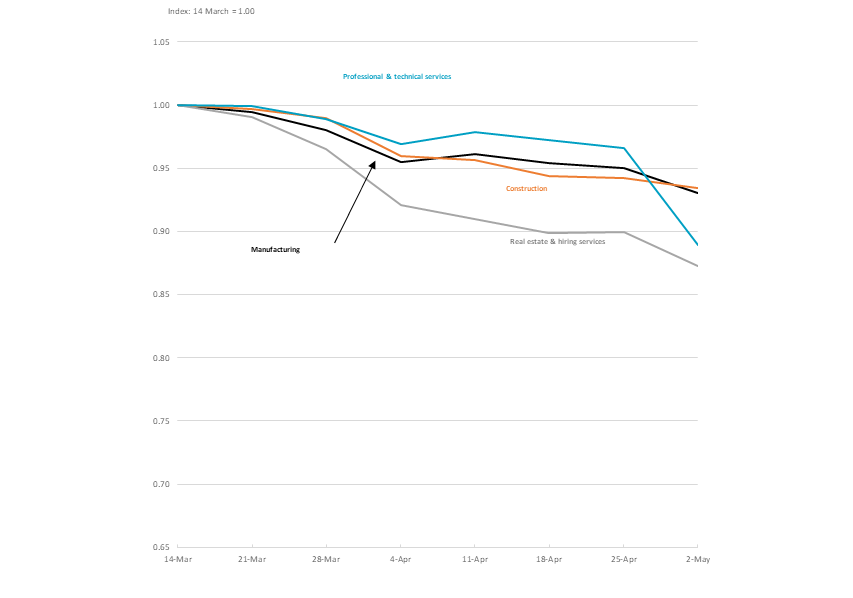

The largest work hour reductions (in percentage terms) have been in accommodation and food services, and arts and recreation services, as shown by the charts below. Financial and insurance services bucked the private sector trend with an increase in employment between 14 March and 2 May, reflecting the uneven impact on different sectors of COVID-19. Job losses in health services, education and training, and public administration were relatively modest in percentage terms. Casual employees in those sectors, however, in many cases have endured a significant impact on the hours worked and paid for.

Chart 1: Change in number of payroll jobs, from 14 March to 2 May

Note: Number in parentheses is the share of total employment (in % terms) for each industry.

Chart 2: Number of payroll jobs, selected industries

The age and gender distribution of applicants for early release

Table 1 below shows most applications (52 per cent) have been made by those aged under 35. Many younger people are employed in industries particularly affected by the downturn in employment, such as retail and hospitality. They are also less likely than older age groups to have other forms of accessible savings.

Table 1: Early release applications by age band

| Age range | Number of applications |

|---|---|

| 20 or less | 23,400 |

| 21 – 25 | 172,100 |

| 26 – 30 | 268,000 |

| 31 -35 | 247,700 |

| 36 – 40 | 198,500 |

| 41 – 45 | 150,800 |

| 46 – 50 | 134,300 |

| 51 – 55 | 101,200 |

| 56 – 60 | 58,800 |

| 61 – 65 | 15,700 |

| 65 – 70 | 1,000 |

| 71 and over | 200 |

| Total | 1,371,900 |

The amount left in accounts after the early release payment

Some individuals, especially those in older age groups, have substantial superannuation balances. However, many of the younger applicants in a recent ASFA survey did not. Around 25 per cent of applicants had a balance under $6,000 after taking money out through early release and around 40 per cent had under $10,000. Around 5 per cent to 10 per cent had a nil or very low balance.

This not only leaves relatively little for any further release after 1 July, but also for the eventual retirement savings of the individuals concerned.

Why compulsory superannuation will matter more

ASFA has estimated that compulsory superannuation has led to household savings being around $500 billion higher than they would otherwise have been, and is particularly important for low income and younger people.

For these Australians, the net impact of each dollar of saving via compulsory superannuation is much higher than the average for all employees. Lower income households tend to consume a greater share of permanent extra income, consistent with the idea that they just don’t save as much because of cash flow constraints.

Compulsory superannuatio

n has resulted in employees aged under 35 having additional savings approaching $100 billion in total, or around $22,000 per person. Through the early release provisions they have therefore had access to significantly more savings at a time of need. For many, however, the fallout is the withdrawal of almost all of their biggest financial asset, jeopardising their future retirement funding. The potential calamitous impact of our younger and lower income members emptying their retirement savings through early release reinforces the case to move the Superannuation Guarantee rate to 12 per cent as soon as possible. This will help provide adequate retirement savings and also financial security for individuals in times of extreme financial need beyond COVID-19.

For more details on the impact of COVID-19 early release on retirement savings and what can be done, read the research paper here.