Being a fan of the movie The Sound of Music I am rather glad that the Australian Treasury has a model called Maria. Some of the lyrics from that musical are also quite relevant to the Treasury model: “How do you solve a problem like Maria? How do you catch a cloud and pin it down?”

The Model of Australian Retirement Incomes and Assets (MARIA) is a dynamic microsimulation model that seeks to model the life paths of all Australians and to project future retirement savings and income in retirement. It uses a range of ATO and Department of Social Security data as well as ABS and other data. MARIA then uses Treasury analysis and projections—the ‘input parameters’— to model the lifepaths (including employment status, superannuation contributions and balance) of each individual for one year. The output from the model becomes the input for the following year, and so on, year by year, as individuals’ age from working life to retirement and death.

In some ways it is bit like the SimCity group of computer games, but less entertaining. You can design your own future retirement system through changing various parameters and settings. Depending on your work the future can either deliver dream retirement outcomes for many or be a dystopian future of austerity and struggle.

ASFA’s Dr Martin Fahy has recently called for the MARIA model to be made publicly available. While this would not attract as many users as SimCity it would be highly attractive to those who want to model the future based on current or alternative policy settings. What the policy and research community would like to do is to catch the cloud and pin down exactly how the model works. Once done, the need for various warring models would be more or less eliminated. For instance, the Grattan Institute GRIPE model could be given a well needed early retirement.

While the MARIA model is not yet publicly available, the Treasury recently published some interesting results from their model.

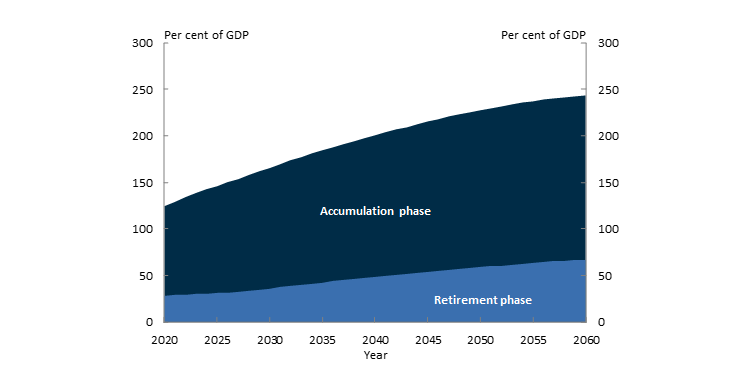

MARIA projects that total superannuation balances will grow from around 125 per cent of Gross Domestic Product (GDP) in 2020 to nearly 245 per cent of GDP in 2060 (Chart 1). These projections indicate that the aggregate value of superannuation balances will continue to grow relative to the size of the economy across the entire projection period, but the rate of growth will slow over time.

Chart 1: Total value of superannuation assets

The notion that ageing Baby Boomers will lead to a rush of assets out of the super system as they retire is not supported by the projections. However, drawdowns are expected to grow from around 2 per cent of GDP in 2020 to over 6 per cent of GDP by 2060. Superannuation will be delivering, and delivering big. However, investment earnings in the overall superannuation system will be more than enough to cover these payments so aggregate assets will grow.

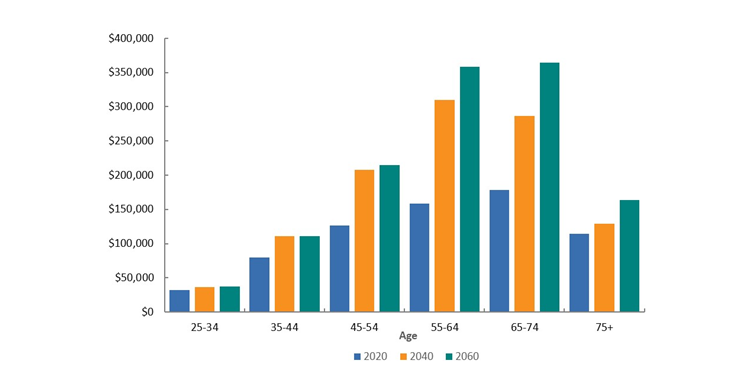

Treasury have also published projected superannuation balances. Chart 2 shows the MARIA projected median superannuation balances of different age groups over the next forty years.

Chart 2: Median superannuation balances from 2020 to 2060, by age group (2019 dollars, AWE deflated)

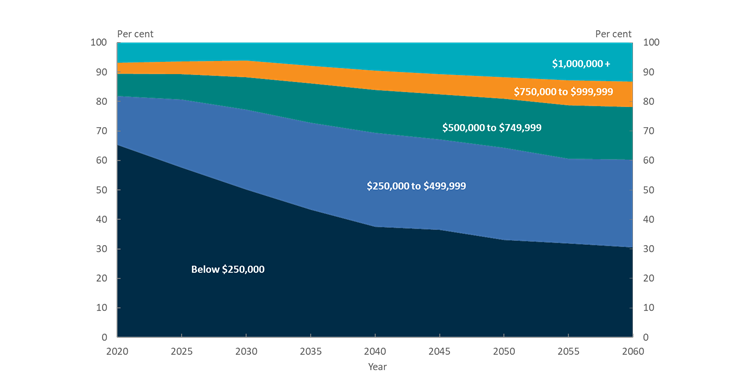

Superannuation balances are projected to grow strongly, particularly for individuals aged over 55 as the system matures. Chart 3 shows the projected increase in the number of people with higher superannuation balances at retirement as the system matures.

Chart 3: Proportion of superannuation balance ranges at retirement (2019 dollars, AWE deflated)

65 per cent of people retiring in 2020 are expected to have balances below $250,000 at retirement. The proportion is expected to decrease to 30 per cent by 2060.

Conversely, the proportion of people retiring with a superannuation balance of over $1 million is projected to grow over time. MARIA projects that only 7 per cent of people retiring in 2020 will have a balance over $1 million, whereas 13 per cent of people retiring in 2060 will have balances above this amount.

The recent publication of projections by Treasury is a good first start. Hopefully in the not too distant future researchers and policy analysts will be able to access a working version of the MARIA model and create their own Retirement SimCity of the future.