Australia’s superannuation industry regularly ranks within the top five most successful retirement systems in the world. In fact, Willis Tower Watson ranked Australia’s superannuation industry #1 in 2022. Yet, our intense focus on accumulation for the past three decades has impacted progress when it comes to decumulation, creating a real cost to retirees and leaving many with a less than optimal retirement experience.

Link Advice has released the Retirement Reality: Advice and the Age Pension whitepaper to help industry leaders understand what members want when it comes to improving the retirement experience for everyday Australians. Focused on respondents based on their eligibility for the Age Pension, the research outlays their challenges but also brings to light preferences for fund solutions, specifically around accessibility, relevance and affordability.

Opportunity for differentiation

With the RIC deadline now behind us, super funds are moving quickly to meet their obligations. What’s less clear is how trustees should best navigate the precarious area of affordable and accessible financial guidance especially against increasing compliance costs, slow uptake and competing priorities.

One of those priorities is the growth of new members and the retention of existing ones throughout the accumulation and decumulation lifecycle. What many may not see yet is that there is a strong link between these two objectives. Few funds have found a way to provide guidance that is relevant, personalised and accessible. This could be a burning point of differentiation, especially as advice has become a scarce commodity in the past few years.

Age Pension: Ignored hurdle

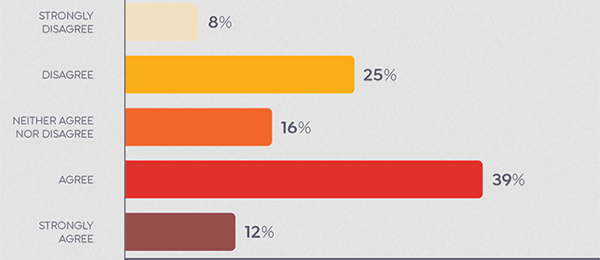

Additionally, the survey examined an oft-missed area of retirement: the Age Pension. According to a previous study by our research partner Retirement Essentials, 88 per cent of retirees were dissatisfied with the Age Pension and processes. This is further reinforced by our findings with one third still reporting low confidence after having applied for the Age Pension.

Troubled by a complex process through Centrelink, those seeking a healthy retirement have found it “too hard, too complicated and too long.” Over 88 per cent of retirees were also dissatisfied with the process, with many complaining about lengthy applications, poor online pathways and lack of assistance. Older Australians are at a vulnerable time in their life, confronted with an overwhelming process where one mistake might cost them a considerable amount of their retirement income or entitlements. It calls into question whether the system design is adequately user-friendly for them.

Retirement Essentials Director Jeremy Duffield said he finds it “disturbing” how many people are applying late for the Age Pension, especially as it means they’re missing out on their full entitlements. In fact, they’ve found that a one-year delay in application can typically cost a member far more than 1 per cent of investment outperformance or a 10bp fee cut can contribute. “With a long retirement horizon ahead, they just can’t afford to do that. That’s why we think it’s so important for super funds to offer help and education about the Age Pension,” he said.

There is a real cost to this issue not being solved. Researchers have found that on average we make around 226 decisions a day on food alone, while others claim we make 35,000 daily decisions generally. As life becomes more complex, the more decisions we make, the more likely we are to suffer from decision fatigue. In fact, in the face of active decision-making versus contemplating your decision, studies have found that people demonstrated reduced persistence and endurance plus greater procrastination. In essence, the more complicated the decision is, the more it can wear us out or put us off.

And that’s exactly what we’re seeing when it comes to the Age Pension. According to the survey, another third of those eligible had delayed their Age Pension application by more than a year. Not only is the current Age Pension experience pushing retirees away, it is also affecting the likelihood of them receiving the full benefit of their entitlements and potentially reducing their quality of life.

How funds can help

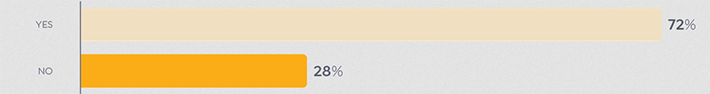

Getting better guidance in the lead up and into retirement should be intertwined with improved Age Pension support. In fact, with over 70 per cent of respondents in our survey reporting they want more help from their super fund, there is a real opportunity to satisfy member needs and become a trusted source for their retirement matters.

Building solutions and strategies designed to solve member needs and satisfy their preferences must be first and foremost. Understanding where and how to resolve their genuine pain points, like the Age Pension application, should be second nature when assessing how to improve the overall retirement experience.

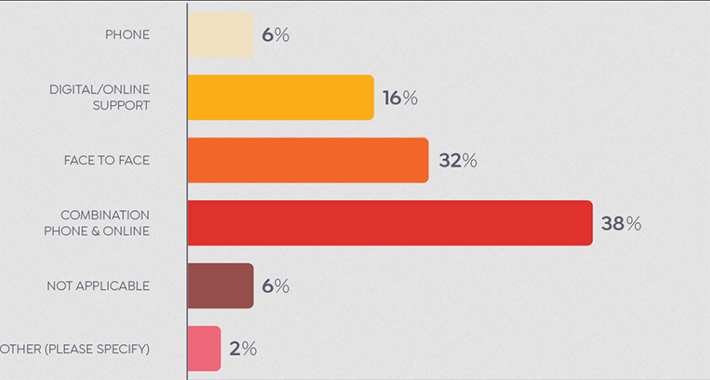

For example, a combination of phone and online tools was ranked the number one choice for accessing support by retirees. This suggests that Age Pension and retirement guidance should be considered through an omnichannel lens. Multiple channels should be considered to allow members to choose what works best for them at the time they decide to access it.

Additionally, our survey found that when examining the advice needs of Future Age Pensioners – men (83 per cent) were more likely than women (71 per cent) to pay for advice. This is likely due to women having smaller savings pots or the perception that advisors may not understand their needs. However, affordability seems to be the pre-eminent reason, even though appropriate advice could prove more valuable than its initial outlay in setting them up in the long run.

Regardless of segment, gender, age or experience, finding a way to provide retirement advice and guidance that is relevant, personalised and accessible for any and all members is essential.

With the advent of the RIC, super funds are now at a critical tipping point to ensure they play a more active role in assisting retirees to move seamlessly into retirement. We believe that it is in every fund’s best interest to not only better understand the needs of their members going into retirement but also their fears and challenges. One of those challenges is the Age Pension, and by helping retirees navigate its difficult depths, funds can improve the retirement experience by tenfold and create a differentiated member proposition that will better serve fund growth and member retention in the future.

Download a full copy of the report here.