While a great many investment conversations happen over dinner, can the investment community turn the tables and learn a valuable lesson from the restaurant industry?

We propose that there are four ingredients in the recipe to maximise the chances of success in equity investing: enhancement of the potential return from skill, intelligent diversification, dynamic portfolio management, and cost control.

Develop your palate: find the best managers

“The quality of ingredients is important, but one must develop a palate capable of discerning good and bad. Without good taste, you can’t make good food.” – Jiro Ono (Jiro Dreams of Sushi)

Just as a great meal demands quality ingredients, the recipe for investment outperformance commences with the identification of high quality, skilled investors. This, however, is a challenging endeavour. A study by S&P Jones Indices and the Center for Research in Security Prices in December 2015 found that passively managed strategies outperform active managers nearly 80 per cent of the time in the long run, after fees are taken into consideration.

A common selection criteria used by asset owners for unearthing outperforming managers is past performance. We are sceptical of its merit as an indicator of skill and hence a predictor of future performance, as studies have shown that there is a high degree of randomness in short- to medium-term investment returns.

So, in the words of master chef Jiro, how do you develop a palate capable of discerning the good from the bad? The answer lies in a selection process that combines broad quantitative analysis with a rigorous evidence-based qualitative assessment of investment skill.

While this process may uncover a great talent, further work is required to truly enhance and balance this ingredient’s flavour.

Shorten your menu: focus on best ideas

We’ve all been to restaurants where the menu covers off pretty much everything; effectively to become all things to all people and cater to an ever larger audience. Consider McDonalds, which increased the number of items on its menu from 33 in 1990 to 121 in 2014 – up 267%, according to a report in Fortune magazine. But this trend has reversed in the last few years, with menus shrinking across the board. What happened?

Restaurants discovered that larger menus did not necessarily correlate with happier customers. Almost 80 per cent of the profits came from only 20 per cent of the menu items. Moreover, a long list of items distracted the chef’s attention from his or her best ideas. Dishes which did not emphasise the chef’s strengths and talents risked disappointing customers. Is the same scenario playing out in an asset owner’s active equity portfolios?

The last few decades have seen a surge in popularity of ‘core’ strategies with a large number of portfolio holdings. These managers utilise ‘fillers’ in their portfolio – lower conviction positions to make the portfolio more like the benchmark – so that the active risk is dampened. This reduces the potential for ‘excessive’ underperformance against the benchmark in the short term, and makes these strategies more palatable for clients. While this may help the profitability of some asset management firms and protect their businesses from sharp drawdowns, asset owners often experience poor investment returns after fees.

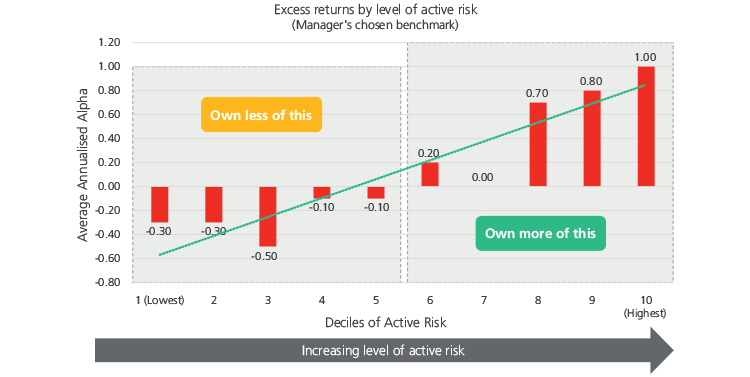

Research by Mike Sebastan and Sudhakar Attaluri in 2014 and Dr Antti Petajisto in 2013 suggests that concentrated products with higher active share are better able to overcome fees and deliver superior returns over time. A highly active portfolio that eschews the fillers and expresses conviction has a wider range of performance compared to the benchmark, but has greater odds of success in the hands of a skilled manager.

We have mandated managers in to create products for our clients that showcase only their highest-conviction investment ideas, disregarding short-term underperformance. While this may increase volatility at the individual manager level, overall portfolio risk can be better managed through an innovative way to structure portfolios.

Figure 1: A skilled manager expressing high conviction leads to higher alpha

Sources: Sebastian & Attaluri (2014), Petajisto (2013)

Diversify your cuisine: manage risk holistically

Menu specialisation has gone hand-in-hand with another welcome innovation for food lovers – food courts. Although not a new concept, food courts have transformed in recent years and compete in offering a range of high-quality eateries, each specialising in a particular cuisine. The premise is simple – each individual restaurant aims for a lasting impression on the customer, yet a varied assortment of specialist eateries under one roof offers the culinary diversity that can attract diners of all tastes and backgrounds.

Assembling a portfolio aiming to succeed in different market environments is not that dissimilar in concept. It is prudent to hire multiple managers, since relying on a single one creates significant dependency and execution risk.

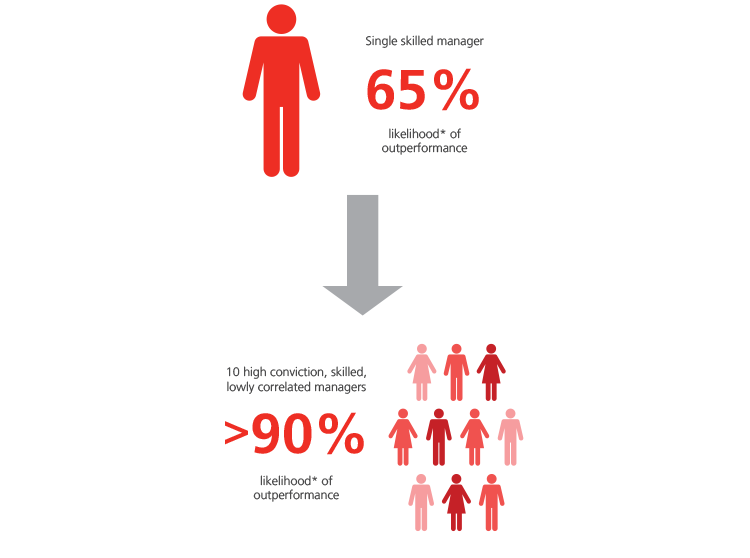

Intelligently combining around 10 concentrated portfolios run by managers with different skills and approaches diversifies the risk taken at the individual manager level and results in overall portfolio risk that is more palatable, but now consists purely of high conviction ideas without any ‘fillers’, leading to a better balance between risk and expected investment returns.

Figure 2: A diversified portfolio of high conviction, skilled, lowly correlated managers increases the odds of success

Sources: Based on Willis Towers Watson Monte Carlo simulations on portfolios of randomly selected Willis Towers Watson FREX-1 rated unconstrained active products. Data Source: eVestment, Willis Towers Watson. All data in USD. Likelihood represents 5-year probability of skilful managers outperforming the benchmark.

Operate in real-time, not calendar time: monitor your investments dynamically

While no business is immune to uncertainty and risks, food establishments that do not respond swiftly to customer feedback expose themselves to greater peril. Likewise, asset owners cannot control their investment returns or eliminate uncertainty.

But failing to respond to changing circumstances – shifts in the market environment or research views on individual managers – in a timely fashion can detract value by increasing opportunity costs and escalating losses. The typical schedule of decision making for asset owners reflects the issue that portfolios are managed not in real-time but in “calendar-time”, leading to delayed investment decisions or slow execution.

Attempts by asset owners to dynamically manage the portfolio are sometimes reactionary to short-term performance. The relatively common practice of selling underperforming managers to hire managers that have recently outperformed can destroy up to 2 per cent p.a. of value on average, according to a study by Research Affiliates on a sample of US Mutual Fund returns from 1991-2013.

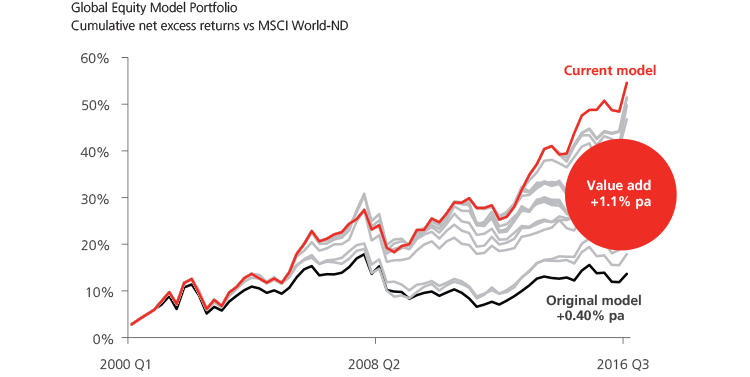

Good portfolio management requires experience in portfolio construction and risk management, ability to separate noise from skill in performance, and decisiveness in making portfolio changes when required. These skills are often beyond the capabilities of the average asset owner, who may wish to consider delegating/outsourcing some or all of these activities in order to improve outcomes. In Figure 3 we illustrate that effective portfolio management can generate substantial value add over time.

Figure 3: Timely decision

making are important contributors to performance

Simulated Willis Towers Watson equity portfolio in action since 2000

Sources: eVestment, Willis Towers Watson. All data in GBP. Data as at 31/09/2016.

Based on Willis Towers Watson Global Equity Model Portfolio. Data as at 31/09/2016. The Model Portfolio has been maintained since the beginning of 2000. The original model had four highly rated Global Equity Managers. The current model has six highly rated Global Equity Managers. Portfolio Manager changes can be made quarterly and can include adding/removing managers and adjusting their weights. Transaction costs are charged. There have been a total of 16 managers used over the model’s history. Model turnover has been 15.4%pa, with an average manager tenure of 8.2 years.

Streamline your kitchen: save on costs

How can asset owners squeeze costs while still employing fund managers of the highest calibre, running a concentrated portfolio of their best ideas?

In our restaurant setting, downsizing the menu provides an opportunity to streamline the kitchen and increase cost efficiency. We leverage our institutional clients’ pooled quality and size, and our long-term relationships with managers in exchange for substantial discounts on management fees. Additional savings can be made through better scale and management of other operating costs (for example, custody and administration).

In this way, the focused equity approach provides an opportunity to streamline costs, resulting in higher alpha potential after fees compared to the typical approach of implementing core portfolios.

Food for thought

The world of stock markets and gastronomy may seem like chalk and cheese, but success follows a similar recipe.

To succeed in the competitive world of active management, asset owners hungry for success need to go further than simply selecting managers.

By journeying from manager selection to portfolio construction and implementation, we discovered the four ingredients in the recipe for investment success. These may seem burdensome for the average asset owner with limited governance but can be managed effectively by delegation. After all, the difference between ordinary and extraordinary is just that: extra.

Bon appétit.