We are at a historic turning point in the housing market where we need to rethink the way people buy homes.

The median time required to save a 20 per cent deposit for a Sydney home is now 12.6 years, according to the ANZ CoreLogic Housing Affordability Report 2023.

Falling home ownership rates are reducing financial security and threatening to rob millions of Australians of a dignified retirement.

The traditional mortgage market can no longer be the only financing tool to step an increasing number of middle-income Australians into home ownership, shoring up their retirement prospects. The way we finance housing purchases needs to evolve and institutional capital has a role to play in that evolution.

Amid this backdrop, a new solution has emerged as a potential catalyst for transformative change. Shared equity investments are enabling institutional investors to effectively invest in residential real estate while supporting middle income earners to purchase a home.

There is a strong case for super funds to be an active voice in the debate about home ownership and involved in the early stage development of shared equity in Australia – not only because of its criticality to retirement, but also to:

- deliver strong diversified returns

- increase member engagement, and

- reduce political pressure to raid super for housing deposits.

Why home ownership, not just rental relief, is a key part of the solution

In the main, public and private-sector led approaches to the housing challenge have focused on supply and rental relief – yet home ownership remains the primary aspiration for most Australians.

As documented in Treasury’s Retirement Income Review – Final Report, the home is the most important component of voluntary savings. It improves retirement outcomes by reducing ongoing housing costs and acts as a store of wealth that may be drawn upon to help fund retirement.

Falling home ownership rates among pre-retirement Australians is therefore of great concern, and, if not reversed, will significantly impact retirement outcomes for many Australians and create significant fiscal pressure for the economy.

Treasury’s 2023 Intergenerational Report is alert to this, noting changing home ownership trends and rising mortgage indebtedness are a fiscal risk to Age Pension spending, and will impact superannuation draw down rates.

Federal and state governments have tried to help with home ownership with First Home Buyer (FHB) grants, equity financed second mortgages, and the Home Guarantee Scheme (HGS). However, the challenge to step more people into home ownership is more widespread and nuanced than the support the government can provide.

Shared equity now a proven home ownership solution

After a successful first year of operation, HOPE Housing has demonstrated that its shared-equity financing solution delivers home ownership sooner to middle income earners in Australia. In the year ended 31 December 2023, the HOPE fund, alongside 23 essential workers, secured 17 properties, with 15 of those settled and the essential workers taking possession.

To achieve this outcome HOPE’s Investment Committee meticulously evaluated 43 properties, granting approval to 37 of them, each assigned with a set valuation for potential acquisition. Subsequently, 17 of these properties made their way into HOPE’s portfolio, with 82% of them secured at prices below the set valuation. The remaining 18% were acquired at the exact valuation price. This showcases a discerning trend among homebuyers who, even with the support of a co-investor, remain steadfast in their pursuit of securing a home for the best possible price.

Demand for our housing solution is surging ahead, currently surpassing the pace of investment inflows. Our waitlist boasts over 2500 essential workers eagerly anticipating their turn to be part of our innovative housing initiative.

The fund is self-liquidating, through a combination of on-market sales and its Equity Buy Out program, which enables homeowners to progressively attain full equity ownership over the life of the fund. Distributions are paid to investors when a home is sold or equity is purchased by the homeowner.

Superannuation funds are early in their investment journey with attainable housing models, however it is expected this will occur in the not-too-distant future, mirroring the pathway of M&G and Legal & General in the UK, who offer similar shared ownership solutions.

Strong diversified returns (different from the landlord model)

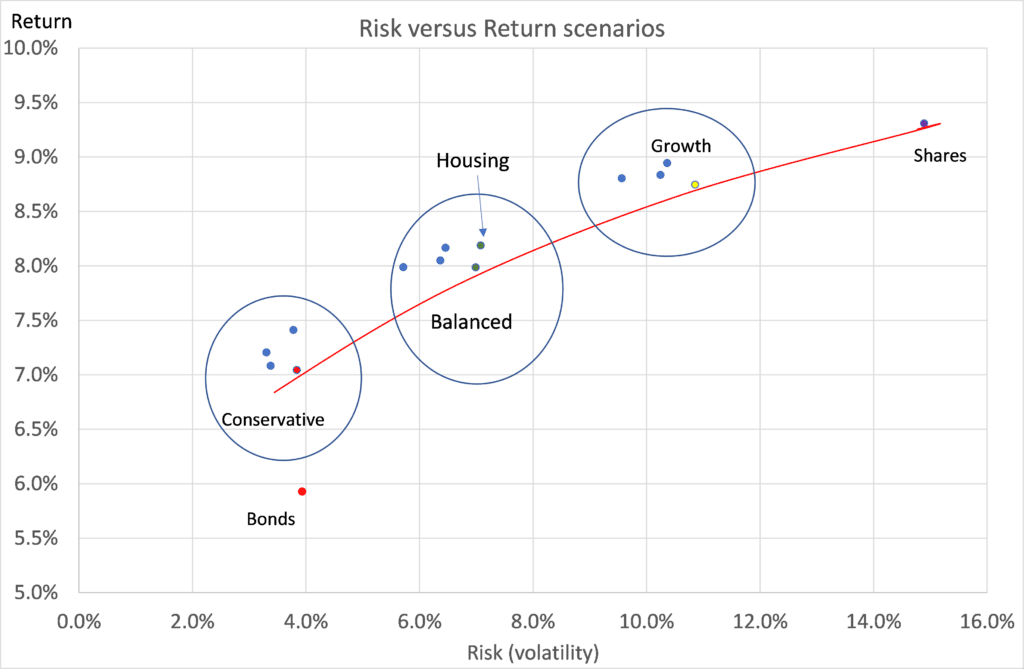

While build to rent, based around the traditional landlord, has been a favoured solution in the UK and the US, research from LongView and PEXA see Figure 1) shows importing offshore models is unlikely to be effective in the Australian context because of Australia’s relatively high capital growth and lower yields. (Figure 1).

Figure 1: Property Compound Annual Growth Rate (CAGR) (1986-2021) and Yield (2021) – selected cities comparison

A major benefit of shared equity solutions for investors is they provide private markets with access to the owner-occupied segment of the residential property asset class, as opposed to a tenant/landlord segment. This distinction is important, as data from CoreLogic suggests that capital growth in owner-occupied properties outperforms tenanted investment properties.

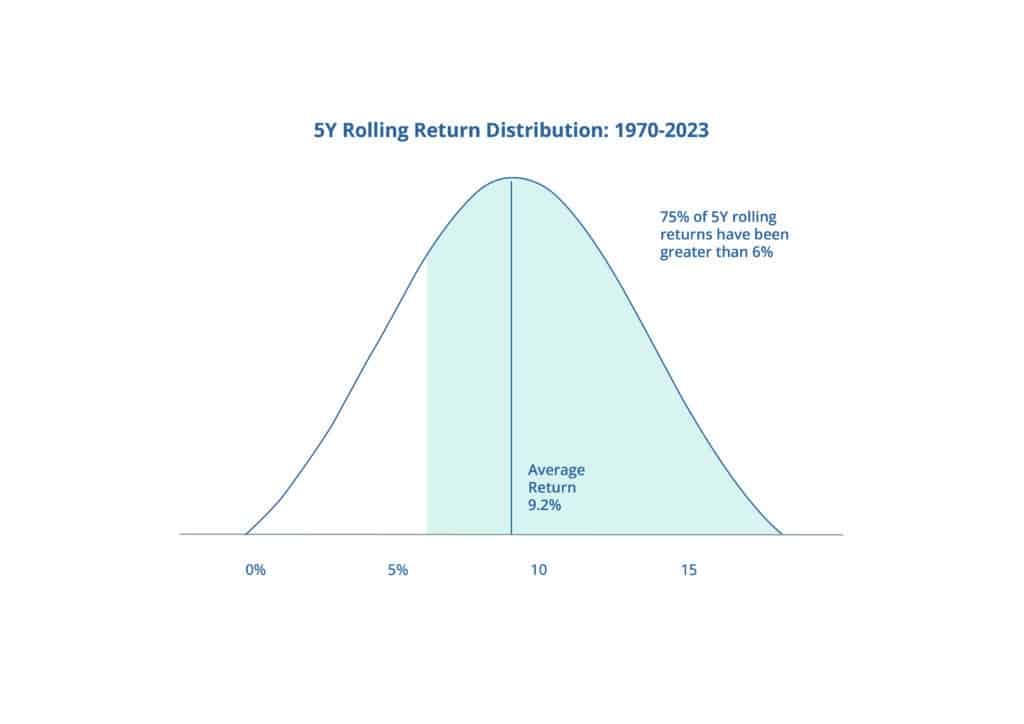

Looking at the Sydney housing market in the chart below, since 1970 on a rolling 5-year basis there have been no negative returns and the market has delivered an average annualised return of 9%. Over that period, the market outperformed HOPE’s forward looking model assumption 75% of the time.

In addition to strong growth, the residential property asset class is low to negatively correlated to Equity and Bond Markets.

The strong returns offered by the shared equity solution are evident in HOPE’s performance to date. The HOPE fund has delivered a Portfolio Return of 11.4% (Gross Portfolio IRR as at 31 December 2023 for the period since inception of the fund in October 2022).

These results can be attributed primarily to the mandate given to HOPE’s Investment Committee. This mandate not only emphasises the need for each property to be investment grade, but also advocates for diversification within the portfolio. Diversification, in this context, extends beyond financial metrics and incorporates geographical dispersion, profiles of essential workers, and impact return.

Assisting home ownership could lead to increased member engagement

Three quarters of non-homeowners (76%) would like to own their own home, according to a Susan McKinnon Foundation survey. Only 45%, however, believe it likely that they will.

Members will reward funds that demonstrate leadership on this issue with their savings. There is an opportunity for mid-tier funds to scale through a differentiated proposition.

Any super fund that helps Australians fulfill their desire to buy a home stands to gain a massive surge in member loyalty – especially those with member cohorts more affected by housing affordability.

Reducing political pressure to raid super

Housing has become one of the biggest concerns facing Australians, ranking behind only cost of living pressures, according to market research firm Ipsos. If we don’t evolve the method by which we enable home ownership to occur, more and more members will be locked out of the dream of home ownership.

Australians unable to purchase homes may begin to ask why their super is being invested in affordable housing offshore, such as the UK, when it could be supporting local housing. If super funds don’t unite on this issue, they will be buffeted by more calls from voters to draw down their retirement savings to fund home ownership.

Political pressure on super is mounting, with NSW Senator Andrew Bragg seeking to use a new Senate inquiry into the retirement system to explore allowing more people to access their super balances to fund home purchases. By participating in establishing a shared-equity market, funds can reduce political pressure to raid super.

Advancing super through residential property access

We are at a pivotal moment where the super industry stands to benefit enormously from efficient access to the residential property market, and to lose much if it ignores the elephant in the room that is falling home ownership and its detrimental impact on members’ future retirement.

The purpose that built superannuation into arguably the world’s greatest wealth-generation tool for middle-income earners can continue to drive the industry forward if sector participants remain mindful of the changing landscape and opportunities to advance.

This advancement need not be revolutionary to bring home ownership as an asset class and superannuation together for Australians, uniting the two most powerful drivers of a dignified retirement, and in turn shoring up the pillars of the social fabric in Australia that have enabled us to remain one of the most egalitarian nations in the world.