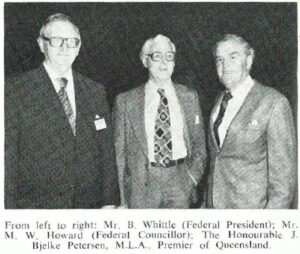

Remembering Bruce Whittle, lifetime ASFA member

Bruce Whittle (pictured, left), former President of the Institute of Actuaries of Australia and a Lifetime member of ASFA, passed away on 2 June 2019 at age 96.

Some of our members may remember Bruce from attending the annual ASFA National Conference, pictured here in an earlier Superfunds magazine. ASFA joins the industry in extending our condolences to Bruce’s family.

IOOF announces new CEO and other appointments

IOOF has announced the appointment of Renato Mota (pictured, left) as chief executive officer, effective immediately. Mota also joined the IOOF board as managing director. IOOF Chairman Allan Griffiths said, “The appointment of Renato as CEO marks a new era as we reset the business and focus on the future.”

Commenting on his appointment, Mota said: “I am excited by the opportunity to lead the next phase of IOOF’s transformation and continue to build an advice-led business, serving our clients’ and members’ interests through a deeper understanding of their needs and those of their communities.“

IOOF also announced the appointment of Andrew Bloore (pictured, right) as an independent non-executive director, to commence 2 September 2019. Bloore has been an independent non-executive director on the boards of three IOOF subsidiaries; IOOF Investment Management Limited, Australian Executor Trustees Limited and IOOF Limited since 26 November 2018.

An experienced non-executive director and entrepreneur, Bloore has designed, built and sold a number of businesses, including Smartsuper, SuperIQ and Class Super.

IOOF Chairman Allan Griffiths said, “Andrew’s appointment ensures that the board continues to develop its technology and distribution skill sets.” Shareholders will be asked to consider Bloore’s appointment at the AGM in November 2019.

A new Independent non-executive director will be appointed to the boards of IOOF Investment Management Limited and IOOF Limited to replace Bloore.

Sunsuper CEO to depart

Scott Hartley has announced his intention to resign as Sunsuper’s CEO.

Sunsuper’s chair Andrew Fraser thanked Hartley for his leadership and paid tribute to his record of achievement.

“When Scott accepted the role in late 2013, Sunsuper was a $25 billion fund with one million members. Today the fund manages more than $66 billion in retirement savings for more than 1.4 million Australians,” he said.

“We are grateful for Scott’s leadership and he deserves much recognition for Sunsuper’s success.”

“It has been an honour and a privilege to lead the awesome team at Sunsuper who have delivered industry-leading outcomes and experiences for our customers,” Hartley said.

Fraser said Hartley would stay on as CEO while the board undertook a selection process. Egon Zehnder has been appointed to lead the process.

SuperConcepts confirms two new leader positions

SuperConcepts CEO Lara Bourguignon has announced two new appointments to the leadership team.

Previously holding the national sales manager role, Annette Sheppard (pictured, left) has been appointed general manager of growth which oversees key account relationship management, sales and marketing functions.

Yasmin Omar-Meer (pictured, right) has been appointed general manager of strategy, product & price. Previously she was executive manager of marketing and a partner of More Super which was acquired by SuperConcepts in 2018.

“SuperConcepts has a strong culture of succession planning with our staff and I’m always pleased when we can reward homegrown talent and showcase the depth of talent and SMSF experience we have within the organisation,” said Bourguignon.

Aberdeen Standard Investments announces senior hires

Aberdeen Standard Investments (ASI), has announced two appointments with experienced investment specialist, Nick Schoenmaker (pictured, left), to provide investment support for its equity and multi-asset capabilities in Australia, and experienced wealth management and pensions professional Jason Nyilas (pictured, right), as Australian head of retirement & product strategy.

Schoenmaker will be based in Sydney, reporting to Don Amstad, COO distribution & head of investment specialists – Asia Pacific. In his new role he will work closely with ASI’s multi-asset team as well as global, Asian and emerging market equity fund managers.

Schoenmaker joins ASI from AMP Capital, where he had been national manager of a team of portfolio specialists across multi-asset and goals-based funds since January 2018. Prior to that he held roles at AMP Capital as portfolio specialist (multi asset), and senior manager/investment specialist (fixed income). He has also worked at CBA Private Bank as research manager and investment analyst.

Brett Jollie, managing director Australia, said Schoenmaker’s wealth of experience in investment would help drive the continuing growth of ASI’s business in Australia.

Commenting on Nyilas, who has extensive global experience in retirement, wealth management and digital solutions, Jollie said he would play a central role in growing ASI’s presence in the Australian retirement income space.

Nyilas joins ASI from EY where he was most recently seconded to Malaysia to develop the retirement framework for the Employees’ Provident Fund, which is the compulsory savings and retirement fund for private sector workers in the country.

Prior to this he was a wealth management executive and partner at EY Australia, and advised on M&A, retirement, digital, registry, wrap, blockchain and other transformation areas in the wealth arms of the big five banks, and industry, public sector and retail super funds.

ESSSuper announces new appointments

ESSSuper has announced the appointment of a GM

member strategy and a GM trustee services to its executive team.

After two years as the manager commercial and performance for ESSSuper, Duncan Winton (pictured, left) has been promoted to the new GM member strategy role. For the past 20 years, he has worked across a variety of industries, for companies including ESG, ANZ Bank, Superpartners and CSC.

“I’m excited to be able to support the company in achieving clear strategic priorities as we head into a new phase of growth,” Winton said.

Ian Lancaster (pictured, right) takes up the new position of GM trustee services from 1 July 2019, as part of structural changes reflecting their strategic direction. Lancaster has over 30 years’ experience delivering governance, risk and assurance services. He joins ESSSuper from IOOF where he was the group chief risk officer from October 2017. Lancaster brings an in-depth knowledge of the current business and leading risk management practices in both the public and private sector from roles with Ernst & Young, ANZ Banking Group and the Victorian Auditor General’s Office.

“I am passionate about enabling ESSSuper to continue to drive trustee services to govern and enhance our member’s wealth and retirement outcomes,” Lancaster said.

MetLife makes key leadership appointments to drive growth

MetLife Australia has announced two leadership appointments to drive business growth.

Chesne Stafford has been appointed in the newly created role of chief customer & marketing officer. Stafford brings over 20 years’ experience in financial services and a passion for advocating for both clients and customers. Currently she is chief distribution officer, a position she has held since early 2015.

Stepping into the chief distribution officer role will be Michael Mulholland who has over 25 years’ experience in financial services in group and retail sales roles across the wealth management industry. Mulholland was most recently the executive general manager, growth, advice & marketing at Sunsuper, and also has significant retail sales experience, having been head of insurance sales at MLC.

Commenting on the additions to his leadership team, MetLife chief executive officer Richard Nunn said: “These appointments are a boost to our bench strength in customer and marketing, and sales and distribution. We plan to grow the business and to be able to do that we need the right capabilities at the most senior level. I see the need to push harder in both these areas as the way forward to making a real impact on the market and ultimately our customers.”

Both appointments are effective from 1 July, and follow Nunn taking the reins at MetLife in May 2019.

Frontier names new head of research

After an extensive executive search, Frontier Advisors has announced the appointment of Paul Newfield as director of sector research.

Newfield will join Frontier from competitor Willis Towers Watson where he has held the role of senior consultant for over eight years. Prior to that posting, Newfield spent twelve years at Mercer including a stint in their New Zealand Office, where he led Mercer’s retirement business and chaired the board of their trustee company. He is a qualified Actuary.

Frontier Advisors CEO, Andrew Polson, believes this latest, and most senior appointment in a series of new additions to the firm, will be positively received by the market.

“Paul is a well-known and highly regarded consultant in the industry and someone known to be extremely values driven, which makes him a great fit for our organisation”, said Polson.

Michael Dwyer joins TCorp board

TCorp has appointed highly respected superannuation and investment leader Michael Dwyer AO to its board of directors.

David Deverall, chief executive of TCorp said: “Michael is an outstanding addition to the TCorp board. He has vast experience in investments and superannuation and has a strong understanding of government.”

Deverall said: “Michael will also bring deep insights to the board on a range of topics, including but not limited to investment, organisation, culture and transformational change – areas that were critical to the success of his leadership at First State Super”.

Earlier in the year, TCorp board director Dr Kerry Schott retired and Dwyer takes the vacant role.

Between 2004 – 2018, Dwyer was CEO of First State Super and oversaw its transition from an organisation with $9 billion of funds under management when he started, to $90 billion when he left the organisation. He currently holds the position of chairman of Australia for UNHCR. Dwyer was named a Member of the Order of Australia in 2011 for service to the superannuation industry through leadership and executive roles, and to the community through Australia for UNHCR. He holds a Dip of Superannuation Management, Advanced Dip of Financial Services (Superannuation), and Dip of Public Administration, FASFA.

Cbus announces new deputy chief investment officer

Cbus has appointed head of public markets, Brett Chatfield, to a newly created deputy chief investment officer (DCIO) role.

As head of public markets Chatfield has overseen the successful implementation of new internal investment strategies at the $50 billion fund, as well as overseeing the fund’s external manager portfolio for public markets. His responsibilities have included equities, debt and absolute return strategies.

As DCIO Chatfield will focus on the next stage of the fund’s investment strategy evolution, including the roll out of additional internal strategies as well as supporting the CIO in continuing the fund’s focus on maximising risk-adjusted returns while driving down investment costs.

Cbus CEO David Atkin congratulated Chatfield on his appointment.

“Brett has an unwavering determination to make sure members are achieving the best possible retirement outcomes,” Atkin said.

Chatfield said: “I’m excited by the challenge helping to lead our talented and growing investment teams to deliver on the faith that members put in us.”

Local Government Super announces board appointments

Local Government Super (LGS) has amended its constitution to allow for the appointment of new independent directors.

In order to more effectively meet APRA’s requirements around superannuation governance, the LGS board agreed to appoint an independent chair and two independent directors. The change will enable LGS to bring in directors with new skills to supplement the experience of existing directors who have built up an understanding of members’ needs over many years.

The size of the board will rise from eight to nine, meaning two current directors will be replaced.

LGS Chair Bruce Miller said: “As a board, we recognise that having a strong, diverse board with the appropriate level of skill and independence is critical to ensure we deliver the best possible retirement outcomes for our members. Bringing in independent directors with new skills, capabilities and perspectives will strengthen the board’s ability to provide effective oversight to the execution of the fund strategy including ensuring that the protection of the bes

t interests of members and delivering strong member outcomes is the top priority in a challenging financial environment.

“The LGS Board is now seeking a chair and directors who will continue to put the best retirement outcomes for members at the heart of all decisions. In line with APRA’s recent guidance and expectations, these individuals will be carefully selected for their ability to bring specific expertise which adds to the board’s capability, especially in the areas of business and investment management,” Miller said.

LGS expects to have the new chair and directors in place by 31 August 2019.

The LGS Board is also recruiting an experienced chief executive officer to work with the refreshed LGS board.

Ethical investment leader steps down

Ethical wealth manager Australian Ethical Investment has announced that long-time managing director and CEO Phil Vernon will be stepping down after nine years in the role.

Vernon joined Australian Ethical in December 2009 and over the past decade has overseen substantial growth for the business as Australians increasingly consider the social, ethical and environmental impact of their investment dollar.

Vernon said: “I am proud to have been part of such a special company that has been at the forefront of responsible investing and the profit with purpose movement in this country.

“However, after nine years at the helm I feel now is the right time to hand over to fresh leadership to take Australian Ethical to the next level.

Steve Gibbs, chair of Australian Ethical, said: “On behalf of the board, I wish to extend my sincere thanks and gratitude to Phil for his significant contribution to Australian Ethical. He has led the organisation through unparalleled growth and success over the past decade.”

Vernon will work closely with management to ensure a smooth transition until his departure date of 31 August 2019. The board has started a search for his successor and Gibbs will step in as Acting CEO following Vernon’s departure.

legalsuper continues expansion of member service team

legalsuper has announced the appointment of experienced superannuation industry professional Long Nguyen (pictured, left) as client service manager in Sydney and Michael Wigney (pictured, right) as the fund’s first data analyst specialist.

legalsuper’s chief executive, Andrew Proebstl said Nguyen’s appointment is the fund’s tenth member facing appointment in less than three years and is in direct response to member and employer feedback.

Nguyen joins legalsuper from REST after more than 13 years in the financial services industry across retail investment banking and industry superannuation.

legalsuper has also appointed experienced data analyst, Michael Wigney, to a newly created role building the fund’s capacity in the growing area of data science and interpretation.

“Long’s and Michael’s appointments further advance our strategy of investing in member service and engagement to help our members achieve better retirement outcomes. legalsuper now has a total member services team of 20 across Australia,” Proebstl said.